Ethereum’s current inertia: Will this be the case for long?

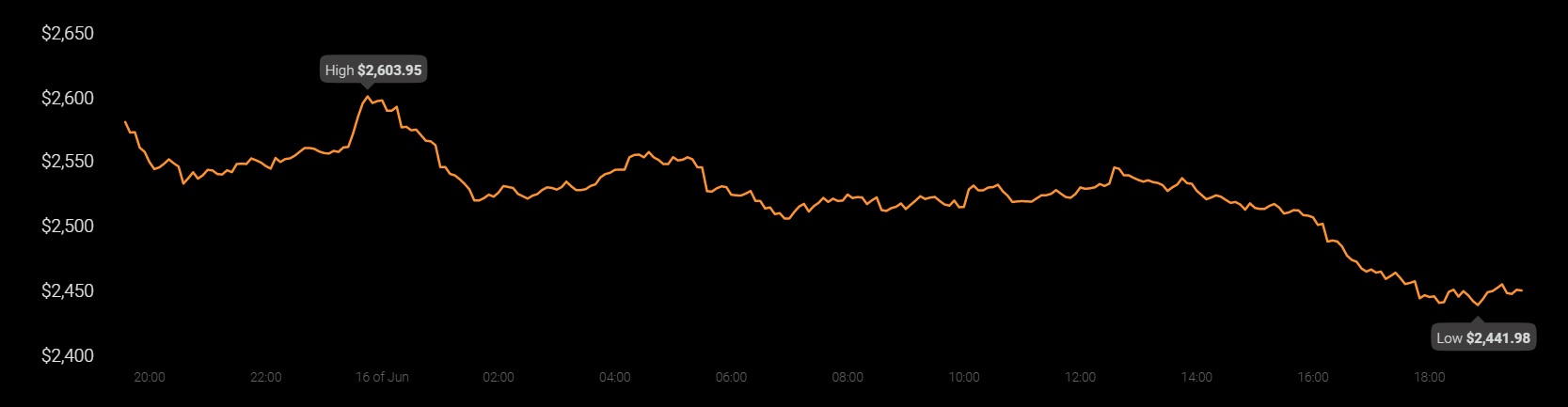

Ethereum, at the time of writing, was over 40% off its ATH of $4,356 on the back of the depreciation event that struck the wider crypto-market in mid-May. While steady, sustained, and steep recovery has been hard to come by, of late, the world’s largest altcoin has been somewhat dependant on the price action of Bitcoin. The same wasn’t as prominent back when ETH was surging past one ATH after the other a few months ago.

Source: Coinstats

And yet, many in the community remain optimistic about ETH’s price fortunes. Popular trader and analyst Lark Davis is one of them, with the YouTuber recently highlighting a few reasons why he thinks the altcoin might climb as high as $10,000 on the price charts.

According to Davis, Ethereum 2.0, the transition to PoS, and other events such as the upcoming EIP-1559 protocol upgrade will all contribute to the long-term health and price potential of the altcoin,

The aforementioned factors, Davis believes, will help Ethereum ward off criticism about its potential environmental impact, especially at a time when the likes of Bitcoin have come under attack for the same reasons. Inclusions of EIPs like 559 will also fuel Ethereum’s march towards becoming a deflationary asset, with its reduced supply fueling greater scarcity and the evolution of ETH as “ultrasound money.”

With network sharding and scalability on the priority list of Ethereum’s plans,

“… continuing to drive forward the narrative that Ethereum is an innovational cryptocurrency that is continuing to adapt to the new realities of technology.”

Finally, the popularity and demand associated with the presence of DeFi apps with the “deepest liquidity” on Ethereum are also contributing to the bullishness of ETH. These are the reasons, he concluded, why the “big money crowd” is contemplating switching to or moving some of their holdings into Ethereum.

Now, all that is well and good. After all, these are talking points the community has been harking about for months. What do on-chain metrics say though? Do they share this degree of bullish optimism?

On the contrary, according to a recent report by Santiment, Ethereum’s on-chain sentiment can be best characterized as one of “inertia.”

Consider this – Average fees on Ethereum’s network fell to a 6-month low recently. Now, the fees falling to such a level should ordinarily spur a lot more activity on the blockchain and a lot more interaction with the network. That hasn’t been the case this time, however, with the number of daily ETH addresses continuing to fall despite the “fee discount.”

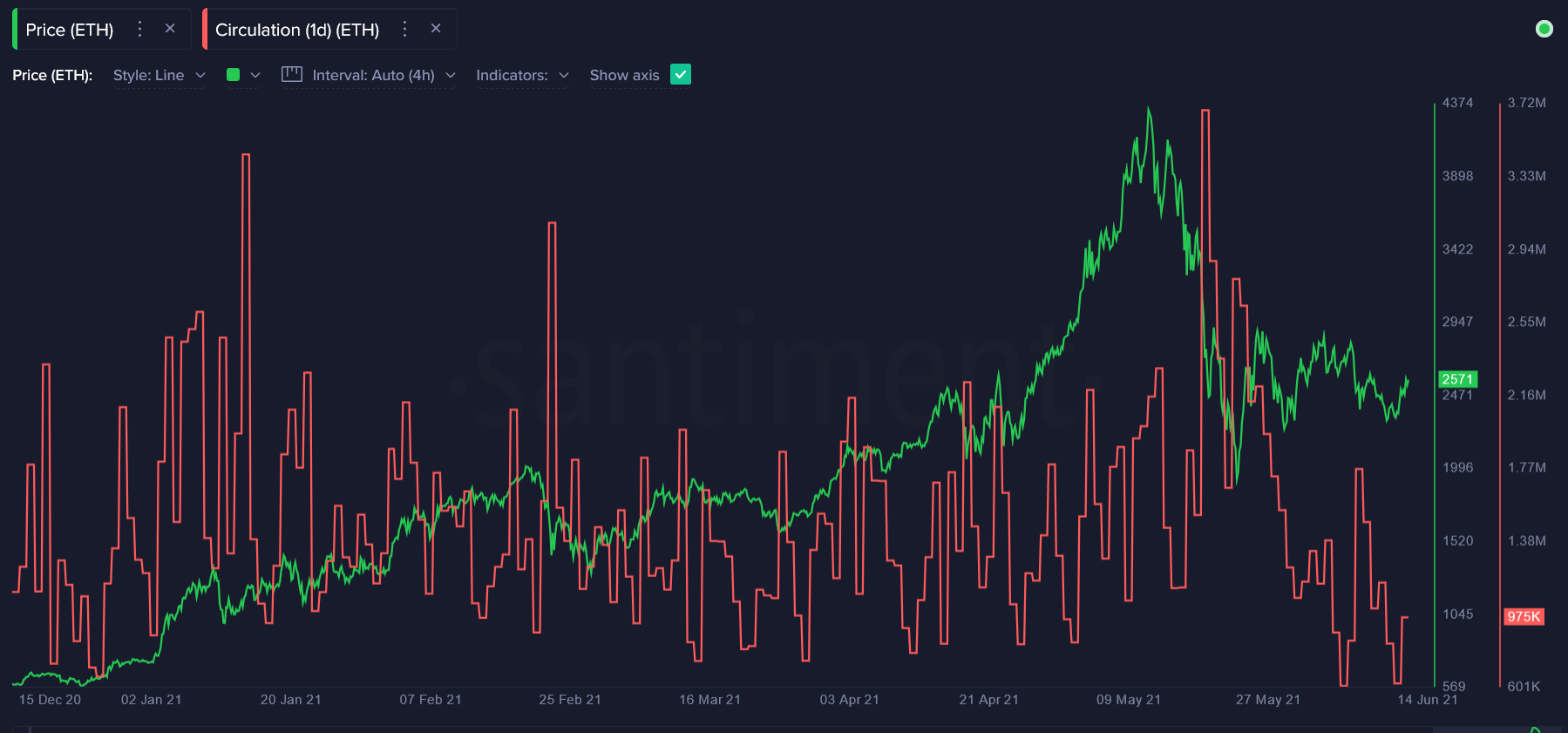

Source: Santiment

What’s more, perhaps the best illustration of the aforementioned inertia is,

“…. the amount of unique ETH moving on the network daily, which recently dropped to a 6-month low of 607k.”

Source: Santiment

What do these findings suggest? Well, they mean that while there is cause for optimism for Ethereum, most of the factors/talking points the community is so keen to talk about are all long-term factors. ETH, at this moment, is too early in its cycle to price in some of these developments and planned updates.

Ergo, in light of the current, “fearful” market, it is understandable that both on-chain data and market movements for ETH are inert, even if community sentiment isn’t. Will this be the case for long, however? Unlikely seems to be the verdict. After all, despite everything, Ethereum’s fundamentals remain fairly robust. In this market, you can always count on fundamentals to rescue an asset eventually.