Ethereum’s Dencun killing L2 fees by 92%: Will Optimism, ARB pump now?

- Ethereum’s Dencun upgrade went live on the 13th of March.

- There has since been a notable decline in transaction fees on L2 networks.

Leading layer 2 networks (L2s) have witnessed a significant drop in transaction fees in the past 24 hours.

This is a result of the successful deployment of the Dencun upgrade and the activation of EIP-4844 on the Ethereum [ETH] mainnet.

The Dencun hard fork, which is the biggest upgrade to the Ethereum network since the Merge in September 2022, went live at 1:55 pm UTC on the 13th of March.

As reported previously, the Dencun upgrade aims to enhance Ethereum’s scalability and, notably, to decrease the transaction fees of L2 solution providers.

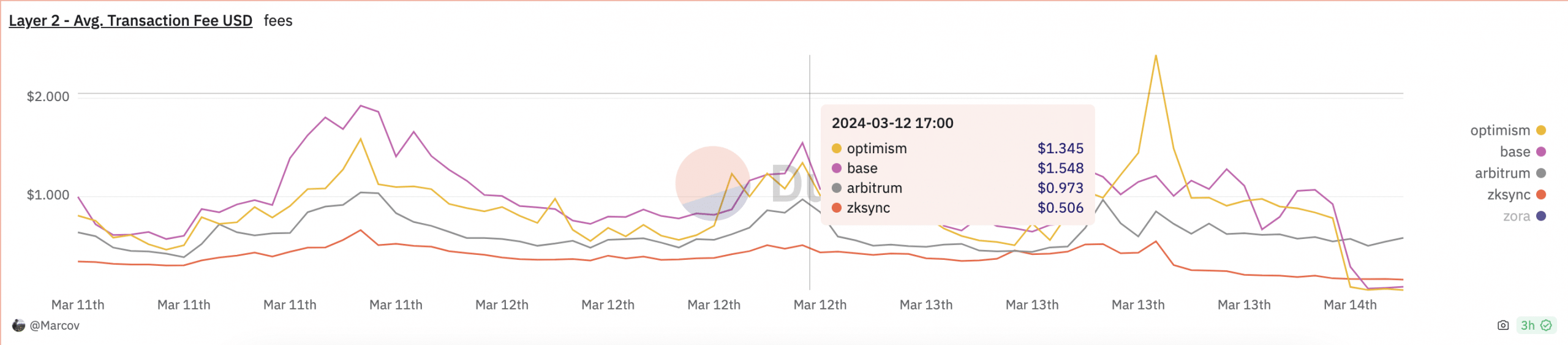

The average transaction fees on L2s like Optimism [OP], Arbitrum [ARB], Base, and zkSync have dropped significantly by 92%, 23%, 94%, and 33%, respectively, since the implementation of the Dencun hard fork.

AMBCrypto sourced this data via a Dune Analytics dashboard compiled by Marcov.

ETH remains in good hands

ETH exchanged hands at $3,988 at press time, per CoinMarketCap’s data.

Its statistically positive correlation with Bitcoin [BTC], whose value has climbed by over 10% in the last week, caused the altcoin to witness a 5% price uptick during the same period.

A 2% increase in its supply on cryptocurrency exchanges over the past week indicated a rise in profit-taking activity.

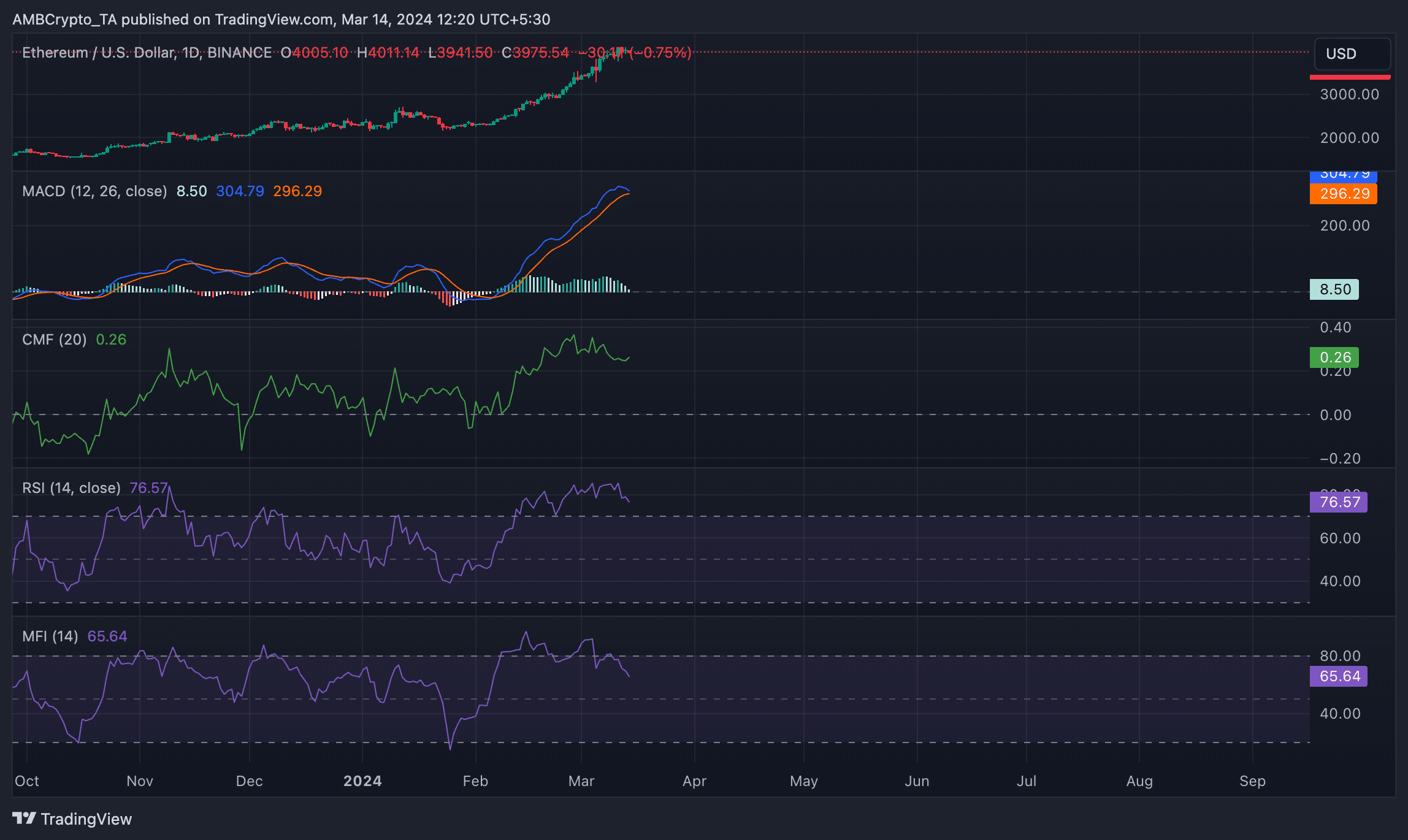

However, a look at its performance on a daily chart revealed that market sentiment remains markedly bullish.

For example, reading from ETH’s Moving Average Convergence Divergence (MACD) indicator which tracks market trends, showed the MACD line (blue) significantly above the trend (orange) and zero lines.

When these lines are positioned in this manner, it indicates strong bullish momentum in the market.

It suggests that the short-term moving average is above the long-term moving average, and there is potential for continued price growth.

Read Ethereum’s [ETH] Price Prediction 2024-25

Further, the altcoin’s Chaikin Money Flow (CMF) was 0.26 as of this writing. In an uptrend and above zero, ETH’s CMF showed that liquidity inflow into the market remained high.

Regarding the demand for the leading altcoin, its Relative Strength Index (RSI) and Money Flow (MFI) were 76.57 and 65.54 at press time. These values showed that coin accumulation exceeded sell-offs.