Ethereum’s EIP-1559 ‘does NOT deliver’

Ethereum Improvement Proposal (EIP) 1559 has been a subject that has garnered opposing points of view from different people from the community ever since it was proposed. The aforementioned protocol is set to be incorporated in the hard fork after Berlin in July.

While many in the community firmly believe that the update would change user bids for transactions, the other section, mainly comprising of miners, oppose the proposal owing to the projected drop in their revenue. However, the latest buzz this time was created by MyCrypto’s founder and CEO Taylor Monahan after she outrightly stated,

“EIP-1559 does NOT deliver.”

Here, it should be noted that EIPs were initially conceived to improve Ethereum’s transaction fee mechanism. As soon as it was proposed, the 1559 protocol was one among the few EIPs that “gained traction” and additional users got engrossed in the proposal. However, according to Monahan, the said traction was “unfortunately” garnered due to the “not-so-subtle promises” of the reduction in the gas fees and the subsequent hike in Ethereum’s price. She argued,

“The early promises of overpayment reduction, market efficiency, fee stability, and even reduced TX [transaction] fees seem to be…..not actually a thing.”

Colin Wu, the popular blockchain reporter from China, had previously stated that the deployment of the EIP-1559 protocol would be imperative if the transaction fee hitch isn’t resolved. However, the MyCrypto exec claimed that it is essential to be “mindful” of how the protocol would operate in reality, than in theory. Technology solution builder, Least Authority, had recently analyzed the same and observed,

“Deciding upon a gas price is non-trivial. Normal (human) senders choose this according to prevailing market price for a given speed of execution. Contracts may not have enough information.”

Monahan, however, rebutted the aforementioned claim and stated that people usually paid any “random” amount that the pricing APIs recommended, and that, according to her, was “the prevailing market price.”

She went on to add,

And since EIP-1559 seems to ignore much of this….

NOTHING IS GOING TO CHANGE IN TERMS OF WHAT YOU PAY FOR YOUR TRANSACTION.

NOTHING IS GOING TO CHANGE IN TERMS OF REDUCING COMPLEXITY FOR THE USER.

WHEN ETH PRICE GOES UP YOUR TXS ARE GUNNA BE GO WAAAAY UP.

??????♀️

— Taylor Monahan (@tayvano_) May 27, 2021

Elucidating the basis on which Ethereum managers like Geth, Etherscan, EthGasStation, MetaMask, and MyCrypto arrive at the projected gas fees rate, she said,

“They look at the current transactions that are being mined and show the user a range of costs with their roughly associated time til mined values so the users can roughly indicate where their personal cost vs time lines intersect.”

The exec went on to assert that the information wallets/ui’s/apis/people use to determine the transaction cost would eventually not change and neither would the transaction cost decrease for the users. The upgrade that is being pushed out in the middle of the bull run, according to her, would only create “instability” and “uncertainty” in the minds of market participants.

Highlighting the ultimate priority of EIP-1559, she concluded,

“There’s one goal that made its way into EIP-1559 and didn’t get lost with all the others promises. It still remains today: Don’t give the fees to miners. Burn the fees. Low inflation! *Negative* inflation!”

On the other hand, one of Paradigm’s research partners, Gorgious Konstantopolous, claimed that the burn mechanism is required to make the system secure against miner attacks. Additionally, he stated, “ETH inflation based on usage is a useful side effect.”

What’s more, Tim Beiko, one of Ethereum’s all core developers, pointed out that the base fee would still get burnt in legacy transactions.

“If there are more legacy transactions than block space, and the effect on them is higher than the native 1559 ones, then they [miners] should prioritize those.”

Source: Twitter

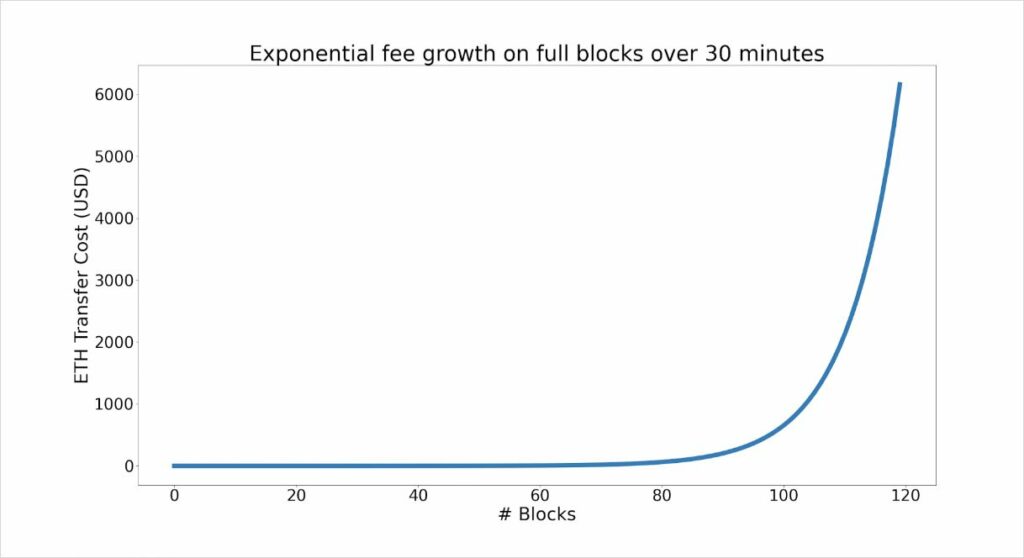

Konstantopolous further contended that the base fee would be low initially, but would exponentially grow to dominate the tips within a few blocks. He argued,

“In EIP 1559, the BASE FEE grows exponentially. This means that 100% full blocks quickly become very expensive (doubles every 6 blocks). This acts as a downwards force against rising demand.”

The 1559 protocol, undoubtedly, has a rosy side and another parallel not-so-rosy side. However, only time can tell which side will overweigh the other and whether or not EIP-1559 will deliver.