Ethereum’s mining difficulty, hashrate hit new all-time highs

Soon after Ethereum’s price went past the crucial $1400-level a few days back, it fell down the charts. However, despite the scale of price corrections, the cryptocurrency was continuing to trade close to its ATH with a trading price of $1,255, at press time.

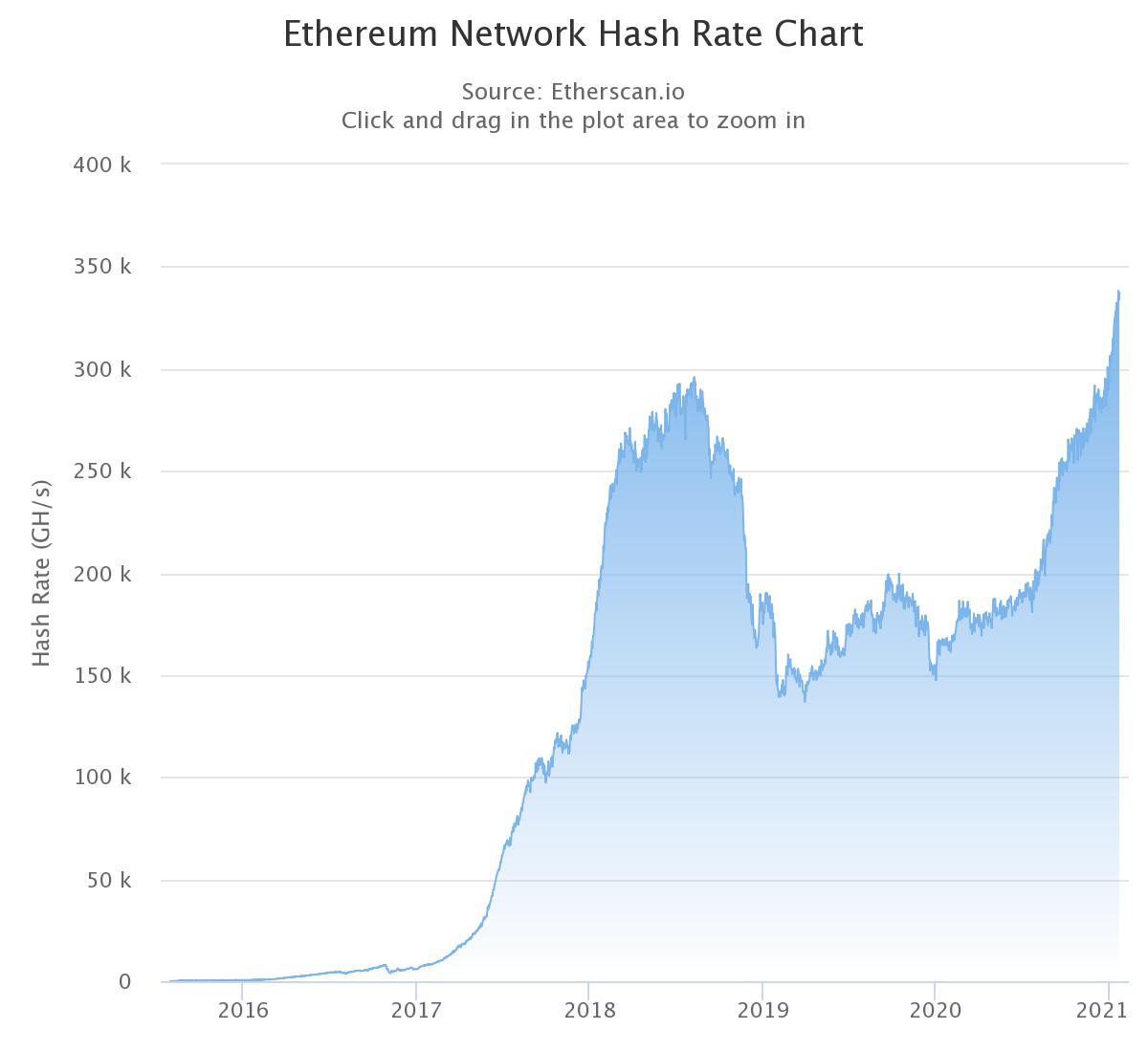

Over the past few days, two of Ethereum’s key metrics also registered all-time highs. The world’s second-largest cryptocurrency saw its network difficulty and hash rate hit new levels.

Source: Glassnode

Ethereum network’s mining difficulty has been steadily rising for a while now, with the same now hitting 4410T, as per data provided by Glassnode. In fact, the rate of its hike has gained even more momentum since 05 January 2020.

Interestingly, as 2021 kicked off, the coin was able to finally go past levels last seen during the bull run of 2017-18. This has a lot of significance for Ethereum and the fact that with the increase of the network’s difficulty the hash rate for the coin has also grown is a positive sign for the robustness of the network and the price action of Ethereum in the coming months.

Source: Etherscan

According to Etherscan, the coin’s average hash rate, akin to the network difficulty, hit a new high of 338,213.5899 GH/s recently, with the same holding on without any significant dips on the charts. The fact that these two metrics have performed so well despite the massive changes Ethereum underwent in the past few months is a positive sign for traders who have invested in the coin.

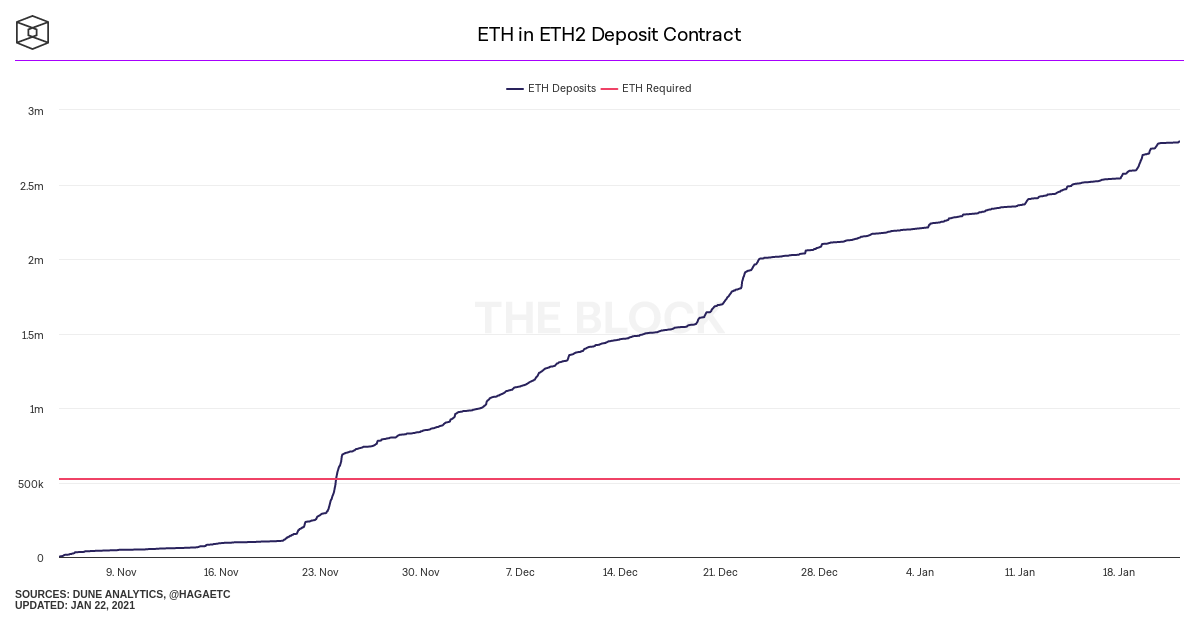

That’s not all either. Despite the much-delayed launch of ETH 2.0, at press time, there were about 2.79 million ETH staked in the ETH 2.0 deposit contract, according to the coin’s network data.

The fact that despite a $10k drop in valuation for Bitcoin, in comparison to its ATH, Ethereum has sustained its price level above $1000 shows that these strong network fundamentals are backing the coin’s price on the charts.

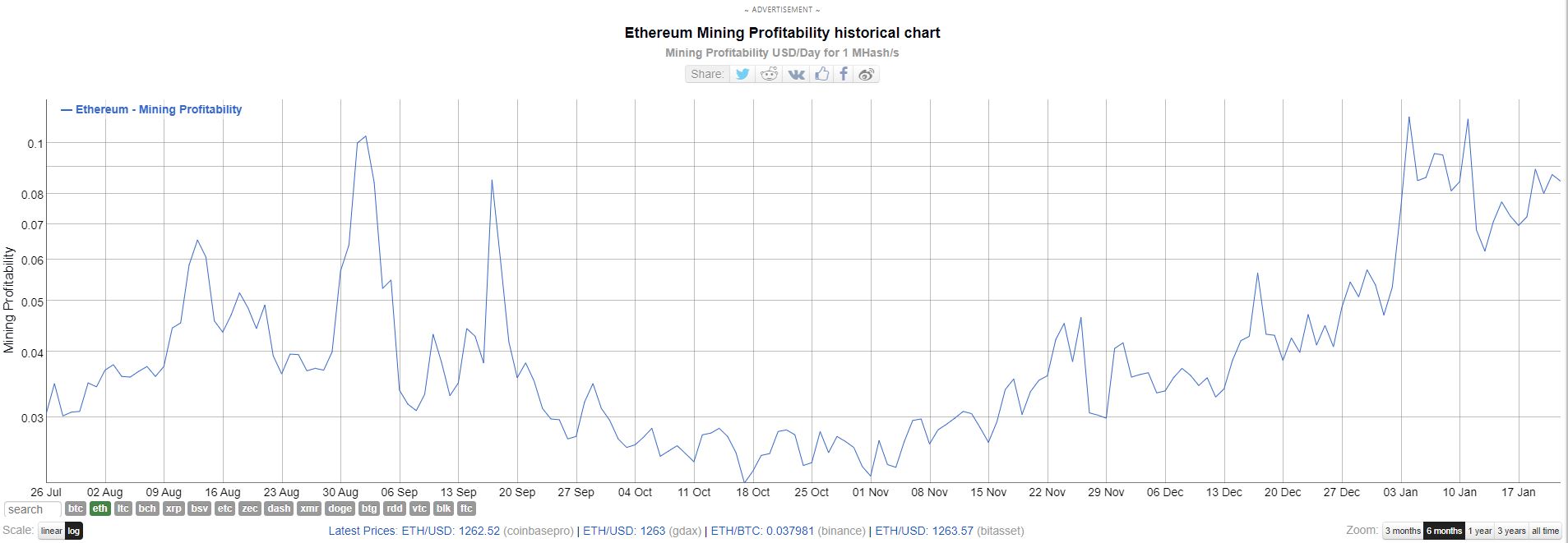

The surge in these two metrics suggests that more people are willing to mine Ethereum and one of the key reasons why this is the case is because of the fact that mining ETH still remains a profitable venture. To a certain degree, one could argue that the key reason behind the surge in Ethereum’s mining difficulty and hash rate is increasing miner revenue.

According to data provided by BitInfoCharts, Ethereum miners continue to remain quite profitable. The data shows that since October 2020, miner profitability has been on the rise. At press time, Ethereum’s mining profitability was around 0.085, having steadily increased from a low point of 0.0225 in the past few months.

Source: BitInfoCharts

Strong network fundamentals, coupled with the backing of Ethereum’s miners who are hodling the coin, show that the coin is likely to maintain its current position. While Ethereum continues to enjoy a high correlation with Bitcoin and its price action, a massive correction for Ethereum might not be on the cards in the short-term.