Ethereum’s momentary bullishness is threatened by this

Ethereum’s ecosystem was witnessing tough roadblocks in the cryptocurrency market not only in terms of price but also with decentralized finance [DeFi]. Polygon network has proven to be a worthy competitor for Ethereum’s DeFi Dapps, as the users have been flocking to the former despite ETH’s reduced fees.

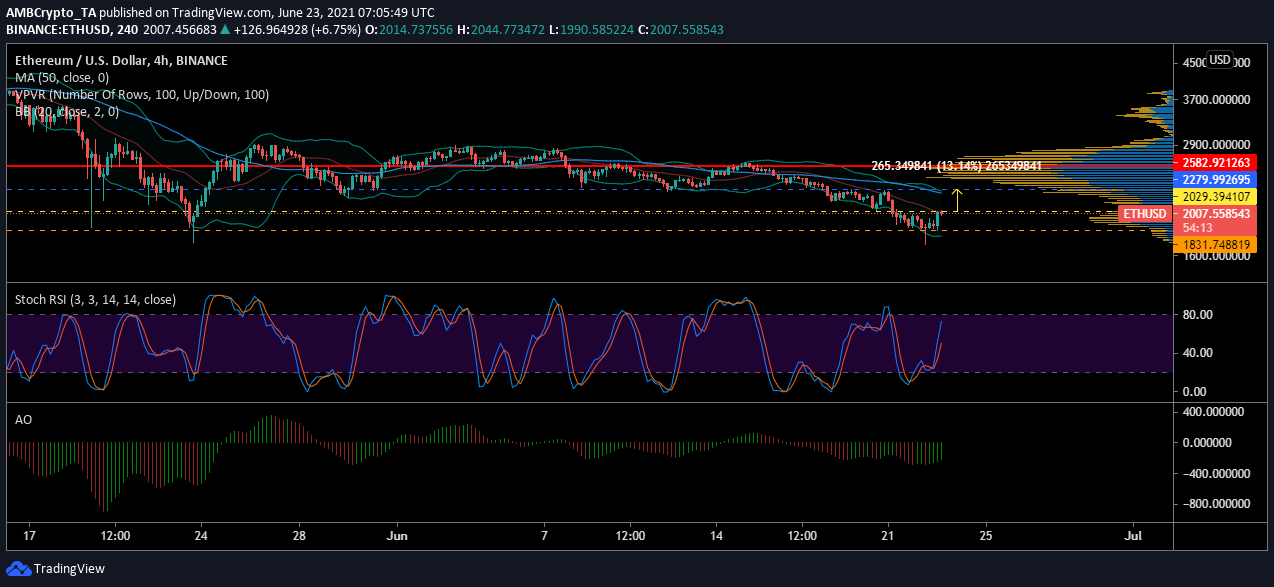

The price of the largest altcoin was also under pressure. At the time of writing, Ether was being traded at $1,997.

Ethereum four-hour chart

Source: ETHUSD on TradingView

Ethereum’s value broke down to $1,831.74 and established support here. The altcoin was close to resistance at $2,029, but the market would require a higher momentum to breach this level.

Even if ETH surpasses its local resistance, the journey upward will be difficult. Given the dominant bearishness in the market, ETH’s next strong resistance was marked at $2,279 – a 13% appreciation from $2,029. Traders’ support will prove to be crucial at this point.

Reasoning

Bollinger Bands were not vastly diverged in the 4-hour ETH market. The downtrend was evident in the market as price slipped through levels of support over the past couple of days but the recent recovery had pumped the market with brief bullishness.

This bullishness tried to push the price beyond resistance, however, a lack of support from the traders could restrict ETH under $2,029 for some time. Stochastic RSI was noting a rise in buying pressure as the indicator spiked from the oversold zone to the overbought zone. This also helped in pushing bullish momentum in the market, however, it was a weaker trend.

Conclusion

Given the dominance of the bears, ETH may move between $2,029 and $1,831. However, this was possible if no disruption was felt in the Bitcoin market. A change in BTC trend could lead ETH to also follow its path, pushing the market in the unpredictable zone.