ETHPOW faces uncertain future as DeFi TVL falls below $150,000

- ETHPOW’s TVL has fallen to an all-time low.

- Active address count on the network is less than 1% of its total address.

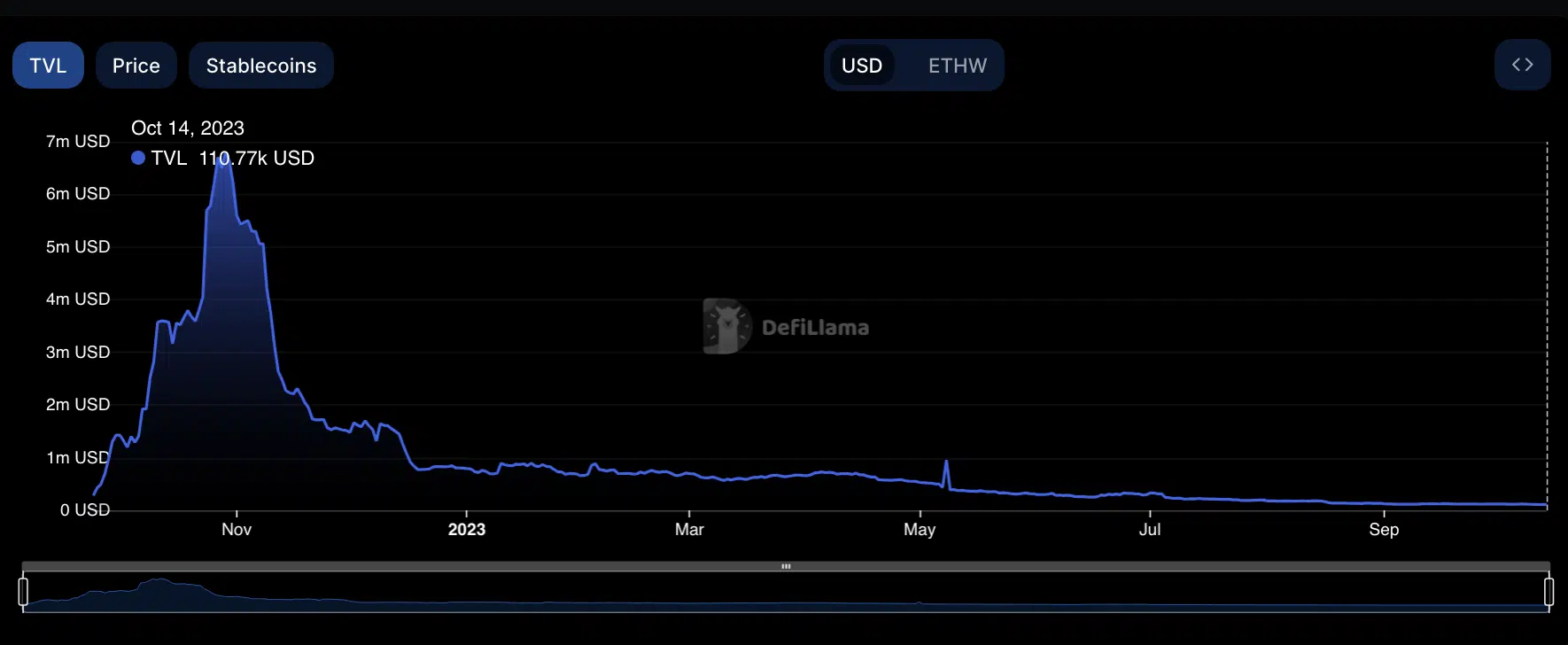

The total value locked (TVL) on the Ethereum proof-of-work (ETHPOW) network has fallen to its lowest level since its launch as focus shifts completely away from the Ethereum fork.

How much are 1,10,100 ETHWs worth today?

ETHPOW is a fork of Ethereum that went live on 15 September 2022, following the Ethereum mainnet’s transition to a proof-of-stake (PoS) consensus mechanism. Following the transition, ETHPOW continued to use a proof-of-work consensus mechanism.

However, failing to gain the projected traction, its decentralized finance (DeFi) TVL has since fallen steadily after peaking at $6.8 million on 28 October 2022.

According to DefiLlama, ETHPOW’s TVL was less than $150,000 at press time. At $110,771, the network’s TVL has plummeted by 98% in the last year.

Soon-to-be dead?

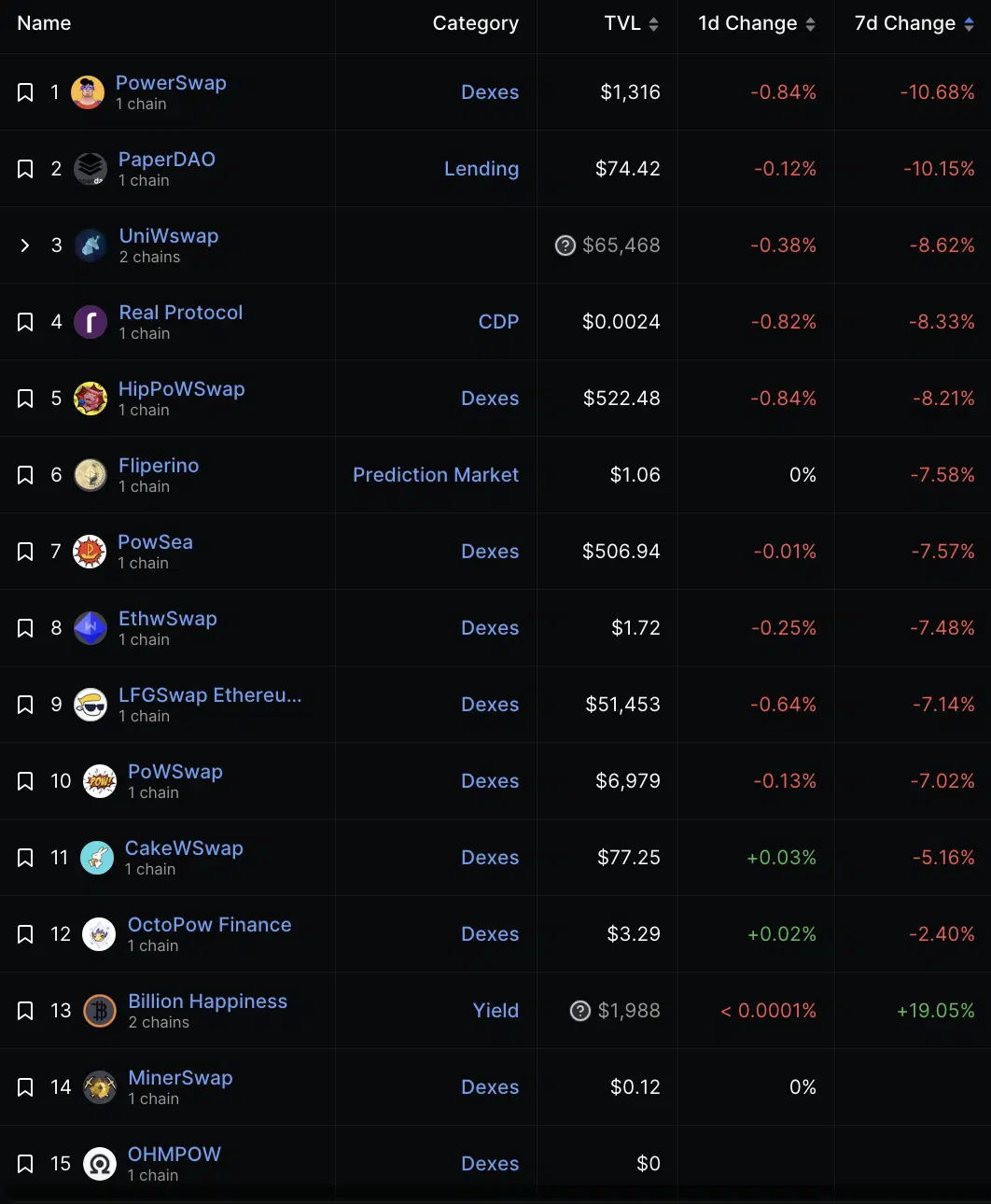

In terms of ranking, as of this writing, the DeFi protocol with the highest TVL on ETHPOW was UniWswap, with a TVL of $66,646. As of October 2022, the project’s TVL sat above $5 million.

In the last week alone, 14 out of the 15 protocols housed within the chain logged TVL dips, with one declining as low as 10%.

Regarding mining on the network, data from 2Miners.com revealed a sustained decline in ETHPOW’s hashrate. At 9.32 TH/s at press time, the chain’s hashrate has dropped by 45% since the year began and by 86% since its launch date.

As expected, the drop in mining activity on EthereumPOW also culminated in a similar downward adjustment in the chain’s mining difficulty. At press time, the network difficulty was 125.87 T, an 84% decline in network difficulty since the first block was mined on the network in September 2022.

An extended decline in a network’s hash rate and network difficulty could make the network less secure, centralized, and profitable. This could make it less attractive to users and developers, which could lead to a decline in the network’s overall value.

Read EthereumPOW’s [ETHW] Price Prediction 2023-24

User activity on ETHPOW

According to data from OKLink, ETHPoW saw an influx of new addresses in the last 24 hours. Information from the on-chain data provider showed that 99,000 new addresses were created on the blockchain during that period, bringing the total number of addresses on the chain to 374.71 million.

However, at press time, only 0.053% of this total address count was active on the chain. As for its ETHW coin, it traded at $1.21 at the time of writing, having logged an 83% decline in value in last year, according to data from CoinMarketCap.