ETH staking service providers’ dominance is concerning, here’s why

- 70% of Ethereum staked is controlled by staking services, which has raised concerns about decentralization.

- Revenue generated by Ethereum has increased despite a decline in trading activity.

According to data provided by glassnode, it was observed that 70.86% of all Ethereum staked on the beacon chain was being staked by staking services such as Lido, Coinbase, Kraken, and Binance.

This concentration of staking services on the beacon chain has the potential to impact the overall decentralization of the Ethereum network. At press time, Lido made up 29.3% of the overall staked ETH, followed by Coinbase (12.8%), Kraken (7.6%), and Binance (6.3%).

This suggests that a relatively small number of entities hold a significant portion of the staked ETH and that the network is less decentralized than it could be.

Realistic or not, here’s ETH’s market cap in BTC’s terms

Despite this, the number of validators on the Ethereum network continued to grow.

Ethereum gets validation

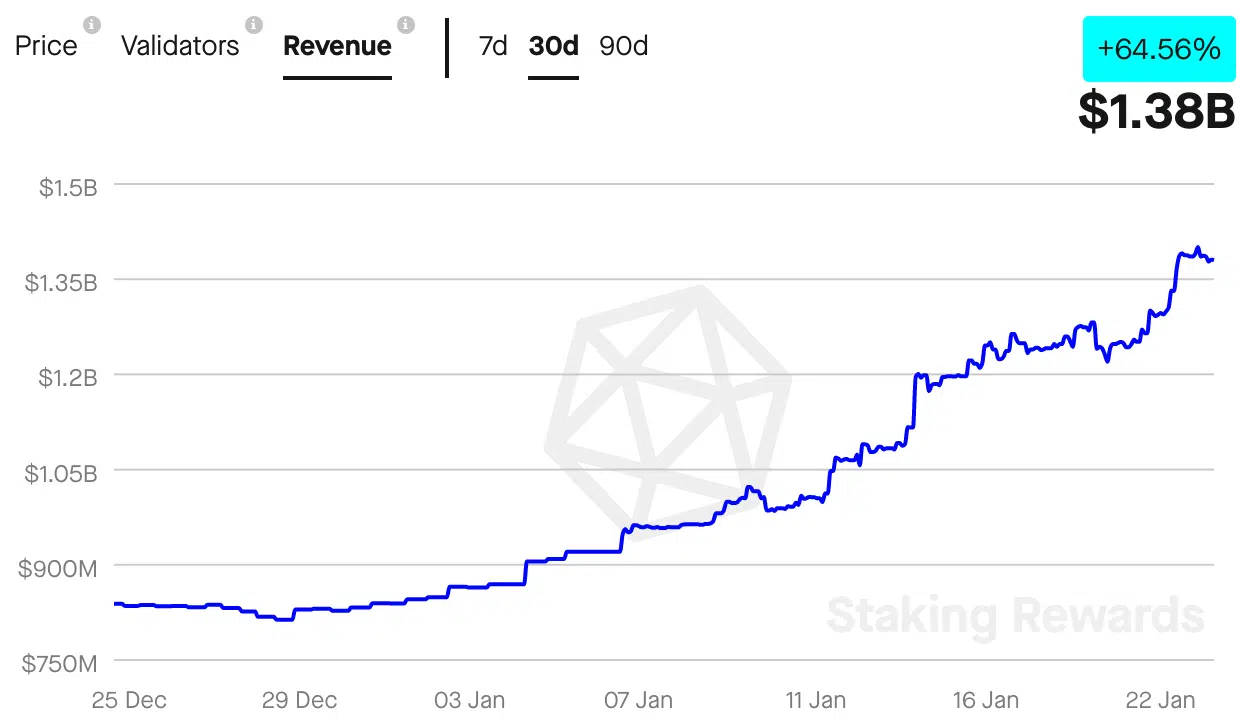

Based on data provided by Staking Rewards, the number of validators on the Ethereum network grew by 2.53% over the last month. Along with that, the revenue generated by the stakers grew as well.

This implied that an increasing number of people are becoming interested in staking their ETH and earning rewards for validating transactions on the network.

Large ETH addresses flee

Although validators showed interest in ETH, it was observed that large addresses shied away from holding Ethereum, despite growing prices. According to glassnode’s data, the number of addresses holding 10k+ coins reached a 1-month low of 1,199 at press time. This suggested that large holders of ETH were not as confident in the long-term prospects of the token as they once were.

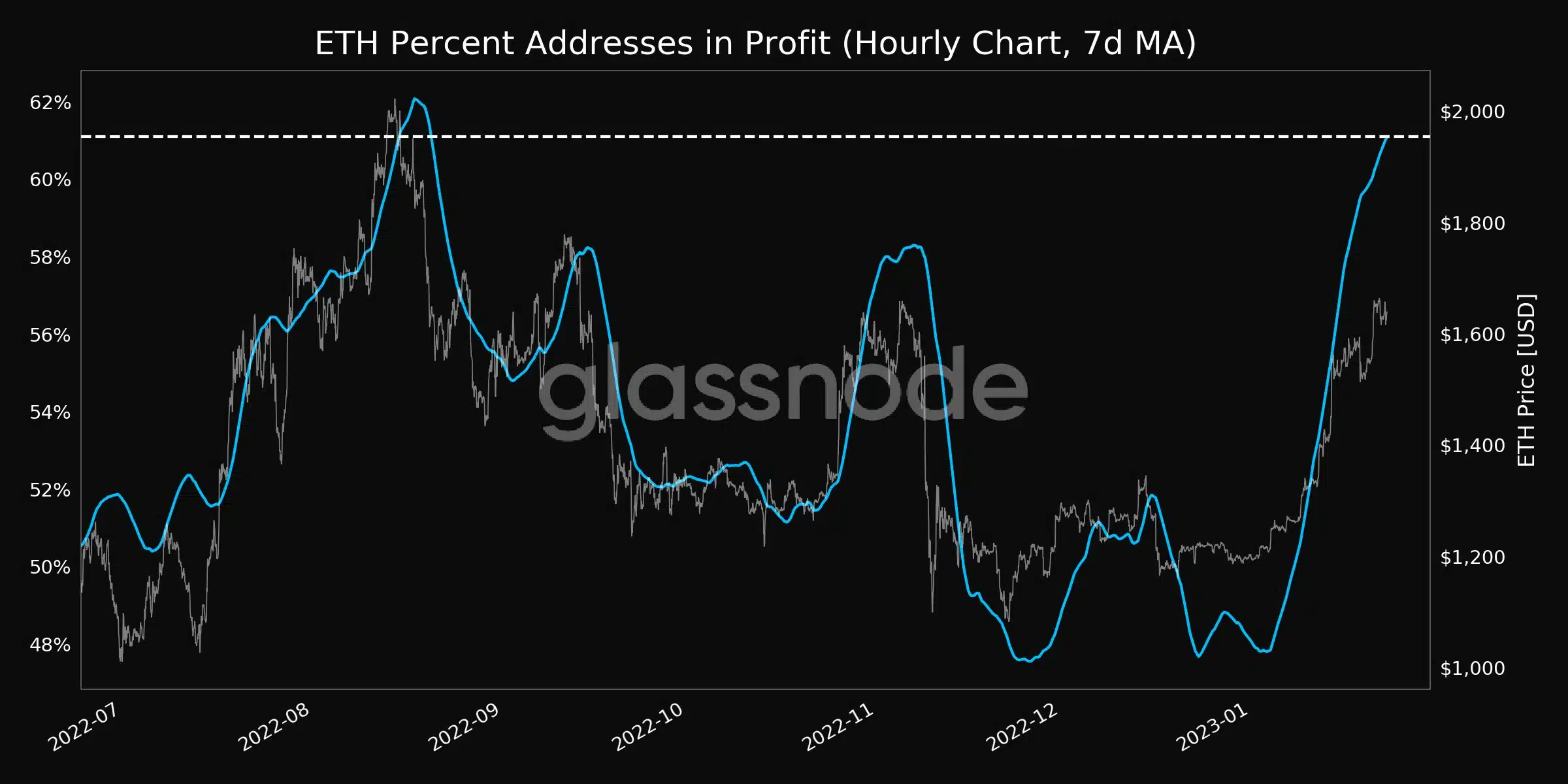

One of the reasons for the same could be the growing number of Ethereum addresses in profit. At the time of writing, more than 60% of addresses holding Ethereum were in profit.

If this number continues to grow, it could incentivize addresses to sell their holdings for a profit which could impact ETH’s price negatively.

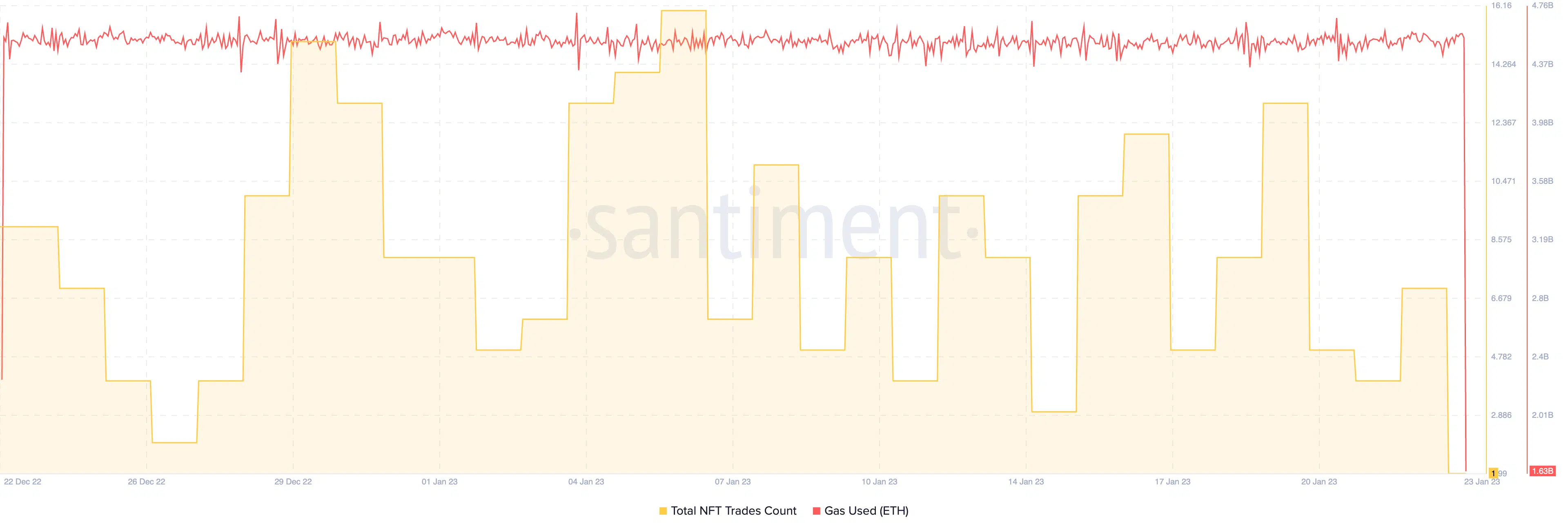

Another cause of concern for Ethereum would be the decline in the number of Ethereum trades. Based on Santiment’s data, the number of trades on the Ethereum network declined materially.

How many are 1,10,100 ETH worth today

This also impacted the overall gas spent on the network, which decreased sharply over the past few days.

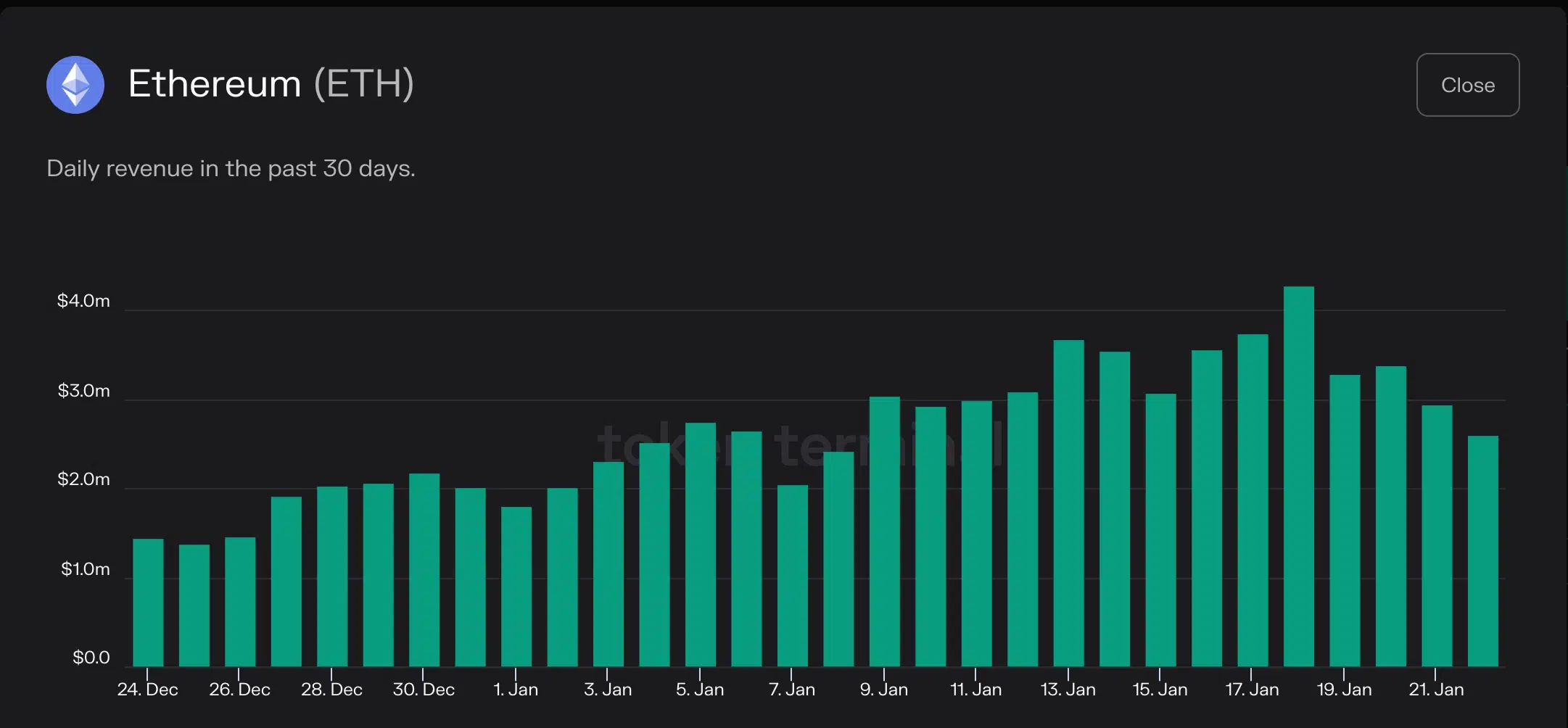

Furthermore, according to token terminals data, the revenue generated by Ethereum increased by 39.6% over the last month. During press time the cumulative revenue accumulated by Ethereum was $79.3 million.

However, it is yet to be determined how all these factors could come together and impact Ethereum’s price.