Everything you need to know about the growing institutional interest in Bitcoin

Investments in Bitcoin have been growing at a considerably of late. The increasing involvement of institutions is reaching new highs.

Bitcoin for institutions

Since 2020, the market has seen multiple trend changes, including the effects of Covid-19, November 2020’s bull market, April’s all-time high, and then the May crash, followed by the August rally. Another trend that came up was the increase in institutional capital during the 2020 to 2021 market cycle.

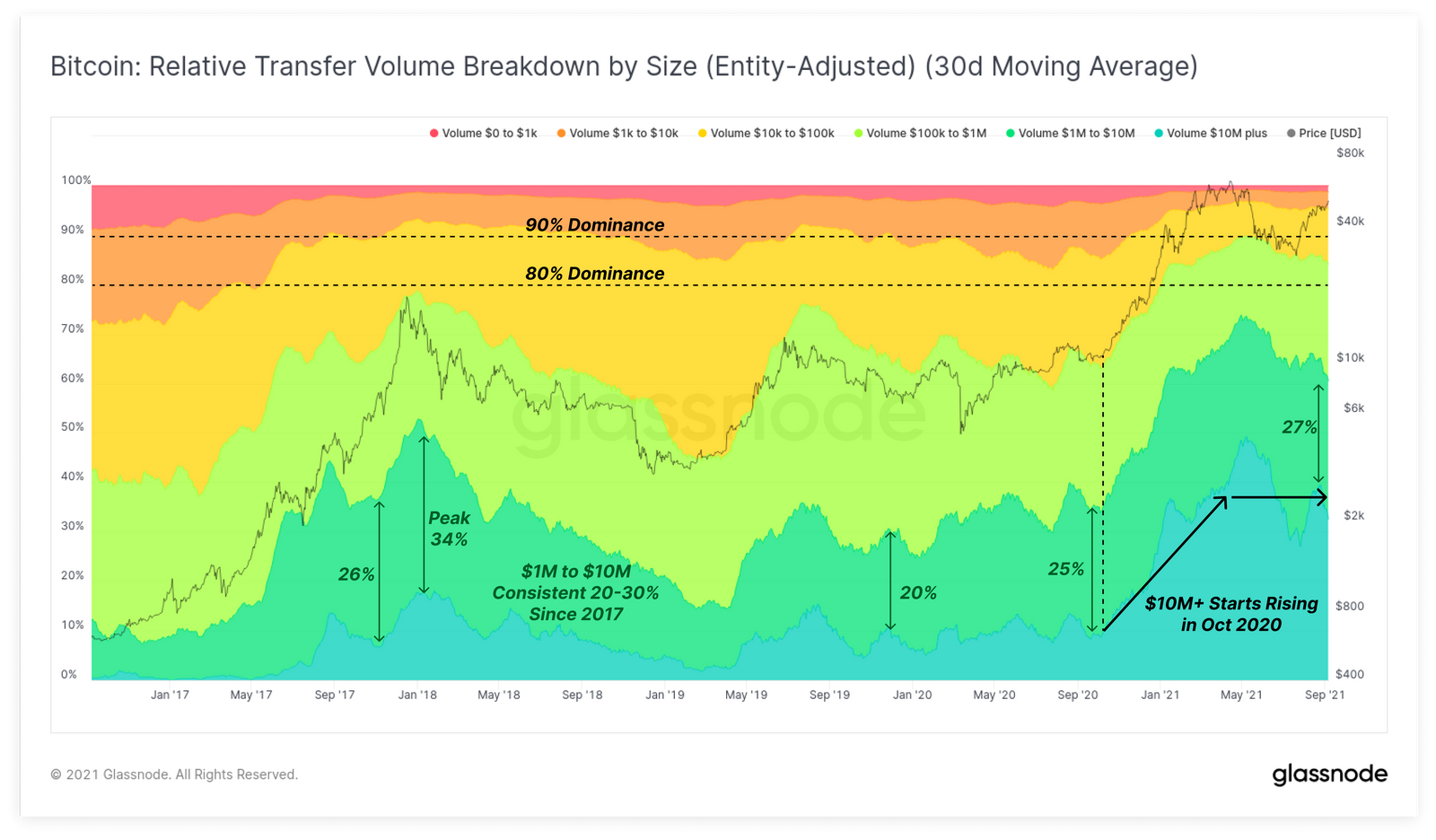

On-chain metrics have indicated that recently there has been a significant change in the different transaction volumes observed. At the moment, the $100k cohorts are holding dominance over the market. Back in 2014, volumes above $100k were 40% in 2017, they have since increased to 85% – 86%.

Bitcoin transfer volumes by size | Source: Glassnode

On the other hand, volumes under $100k were close to 60% in 2017, they have since come down to 10-20% today. Here’s an interesting observation. The $1 million to $10 million cohorts, which were at 26% in late 2017, have remained constant in the 4 years since. The fluctuations have remained around the 10% zone, keeping volumes at 27% presently.

The $10 million + category has also risen to 30% dominance. This reflects a notable growth in large-size capital allocation and trading activity. This comes from the recent movement by the likes of MicroStrategy and Tesla, which over the last year and a half have acquired over 147k BTC, controlling about 0.7% of the supply worth $7.72 billion.

MicroStrategy and Tesla’s holdings | Source: BuyBitcoin – AMBCrypto

Is it only institutions though?

Not necessarily. Traders dealing in these volumes should not be considered as a confirmation for institutions. 19 BTC can be traded by several high spenders other than institutions.

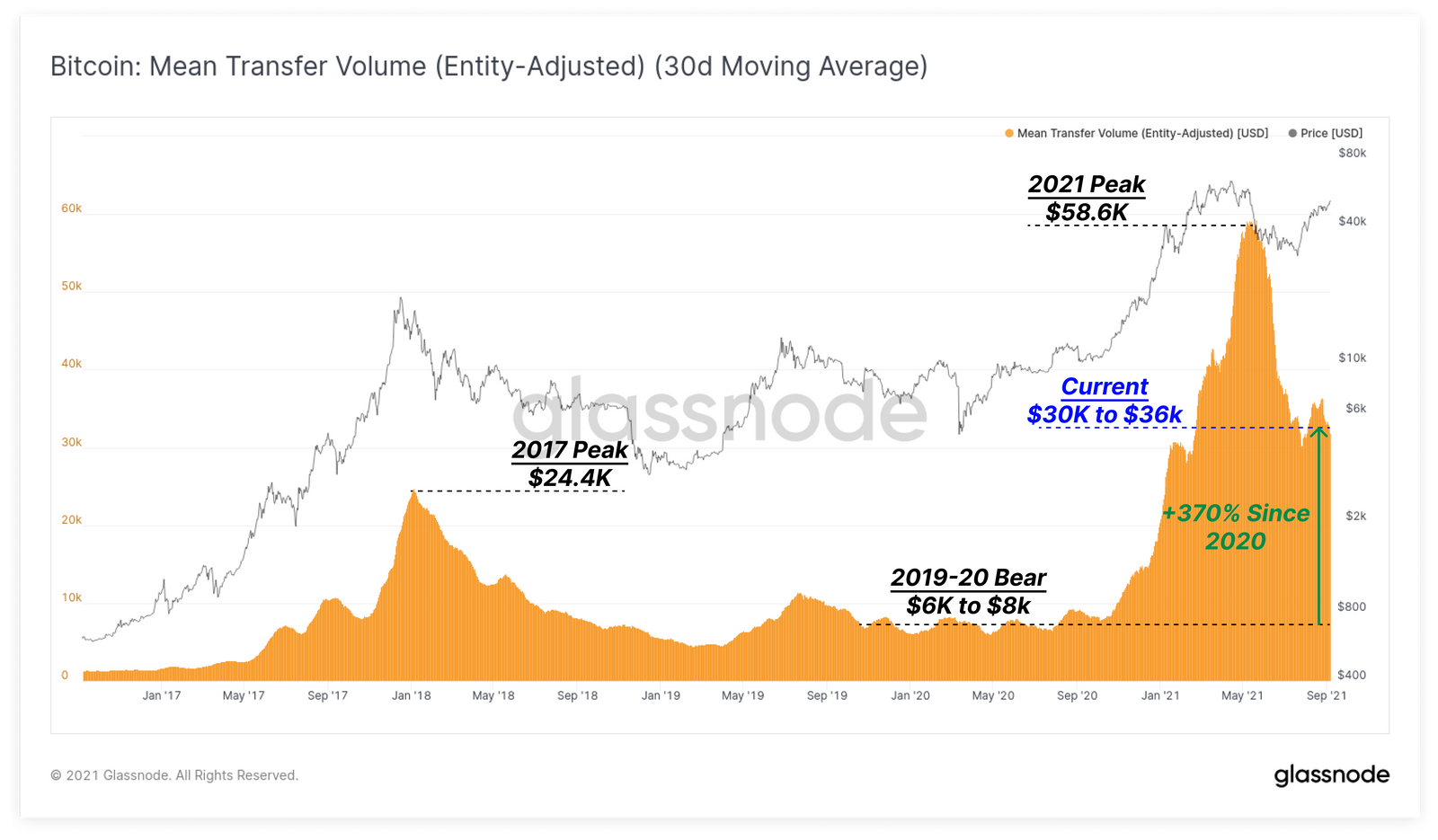

However, the confirmation for institutions’ growing interest can be seen in the transaction sizes as well. Average transaction size has grown by 370% in the last 2 years, reflecting continued institutional-sized interest. In 2019-20 the transaction size ranged from $6k to $8k, however, in the 2020-21 bull market, the same average size rose to $58.6k in May. However, this has come down since, resting at $30-36k.

Bitcoin average transaction size | Source: Glassnode