Everything you need to know about the next key support for Bitcoin

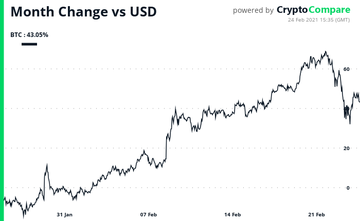

Bitcoin is currently trading at $50406 and despite the massive drop from the ATH at $58330, the current price level is over 40% higher than a year ago. This increase in Bitcoin’s price comes at a time when institutional buying that started below the $20000 level has increased several times over. MicroStrategy’s first investment in Bitcoin came in the August of 2020, from the cash from its balance sheet and now Bitcoin is MicroStrategy’s reserve asset.

With 90531 Bitcoin, MicroStrategy holds a high share of the Bitcoin in circulation. Of the supply that was active in the past 2 years, MicroStrategy’s Bitcoins were moved to cold storage and were pulled out of the supply, reducing liquidity and creating a shortage. Other institutions like Grayscale have worked on creating shortages, fueling price rallies at different price points in the current market cycle.

As the average cost of an institution’s Bitcoin purchase goes up, it is expected that the $52000 level will be guarded against a further drop in price. The same was true when institutions lined up to purchase above BTC at the $30000 level. The price went through corrections, however, $30000 was guarded as support and an important psychological hurdle for Bitcoin’s price. The drop in price above this level was triggered by selling pressure on spot exchanges, from an increased inflow. Though the asset is currently struggling to remain above $50000, it is important to note that the price is recovering, as it did after dropping to the $40000 level.

Source: Twitter

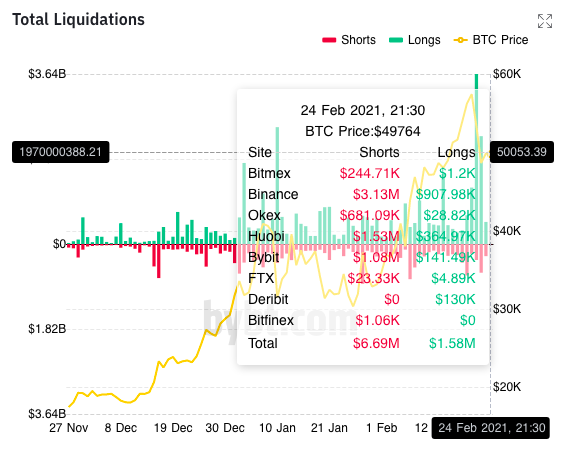

It may be alarming that GrayScale Bitcoin Premium has dipped below 0, hitting the negative range -0.67%, however with a steady increase in Bitcoin’s price, back to $58000 level the premium may bounce back to positive. Currently trading around $50000 based on data from CoinMarketCap, Bitcoin is expected to recover. The liquidations on derivatives exchanges indicate that 200% more shorts are liquidated than longs.

Source: bybt

Increased liquidation of shorts across derivatives exchanges is a bullish sign for retail traders as the price may recover from the drop below $50000. With high volatility and relatively high network momentum, spot exchanges have more trade activity than the 7-day average. This may help Bitcoin’s price as it navigates its way through this market cycle and make price levels around $50-$52k sustainable in the future.

![Bitcoin [BTC]](https://ambcrypto.com/wp-content/uploads/2025/06/1000001598-400x240.webp)