BNB’s price took a hit, but THIS metric soared instead

- BNB’s price has risen by 19% in the last seven days.

- Due to the general market decline in the past 24 hours, BNB’s futures open interest witnessed a slump.

Binance Coin [BNB] has defied the current market slump, surging by almost 20% in the past week. According to CoinMarketCap’s data, this has made it the crypto asset with the highest growth among the top four cryptocurrencies by capitalization.

Demand for BNB lingers

At press time, a BNB coin sold for $550. Due to its positive correlation with Bitcoin [BTC], BNB’s price dropped by 5% in the past 24 hours following the decline in the former’s value.

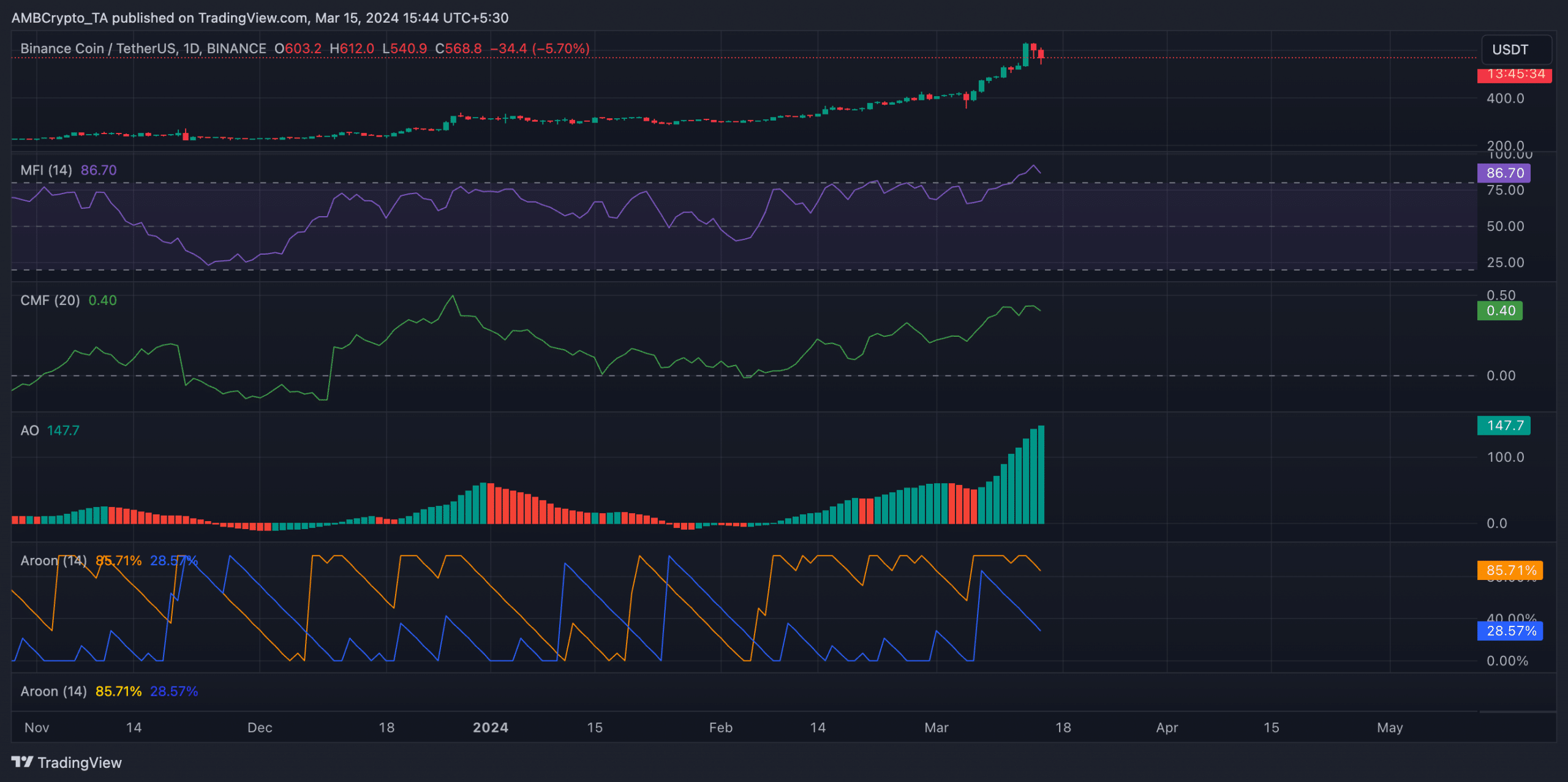

However, AMBCrypto found that amid the general market downturn, demand for BNB persisted. Its key momentum indicators, as assessed on a single-day chart, trended upward.

For example, the coin’s Money Flow Index (MFI) was 84.48. This showed that spot market participants favored accumulation over distribution

Likewise, its Chaikin Money Flow (CMF) rested above the zero line, returning a value of 0.40 at press time. A CMF value above 0 suggests capital inflow and is a sign of market strength.

Confirming the bullish trend in the BNB market, its Awesome Oscillator (AOI) returned green histogram bars that faced upwards. When an asset’s AO is set up in this manner, it suggests that buying pressure is increasing, potentially signaling a bullish trend in the market. Traders often interpret this as a signal to consider buying or holding onto positions.

Further, BNB’s Aroon Up Line (orange) was 85.71%. This indicator is used to identify trend strength and potential trend reversal points in a crypto asset’s price movement.

Therefore, when an asset’s Aroon Up Line is close to 100, the uptrend is strong and the most recent high was reached relatively recently.

Futures market takes a hit

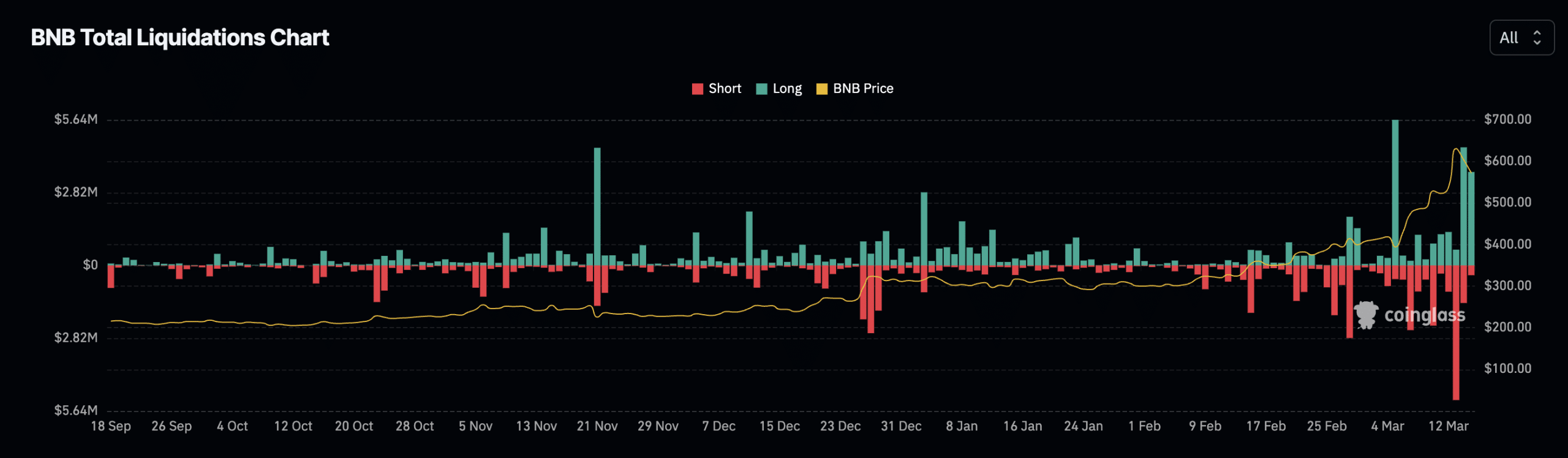

The 5% decline in BNB’s value in the past 24 hours caused it to record its second-highest single-day long liquidations since the year began.

Read Binance Coin’s [BNB] Price Prediction 2024-25

According to Coinglass’ data, the general decline observed in the crypto market on 14th March caused BNB to witness long liquidations totaling $5 million. Its year-to-date high in long liquidations was $6 million, which it recorded on 5th March.

The price dip also resulted in a brief pullback in the coin’s futures open interest. At press time, it was $682 million, having declined by 6% in the past 24 hours.