Exploring XRP’s sell-off: As whales start to exit, should you do the same?

- Whales lost interest in XRP as prices dipped.

- Development activity also fell significantly.

Ripple [XRP] has been in the headlines for all the wrong reasons in the last few weeks. Ranging from battles with regulatory bodies to scathing reviews by analysts, XRP was not having a good time.

Whales move away

To add insult to injury, whales had started to make moves in the XRP market, and it’s raising questions about the future trajectory of the cryptocurrency.

Recent blockchain data highlighted a significant transfer of 24,118,600 XRP, equivalent to approximately $12.46 million, from Bitvavo to an unknown wallet.

Such large-scale movements by whales often signal a lack of confidence in the asset’s short-term prospects, adding to the bearish sentiment surrounding XRP.

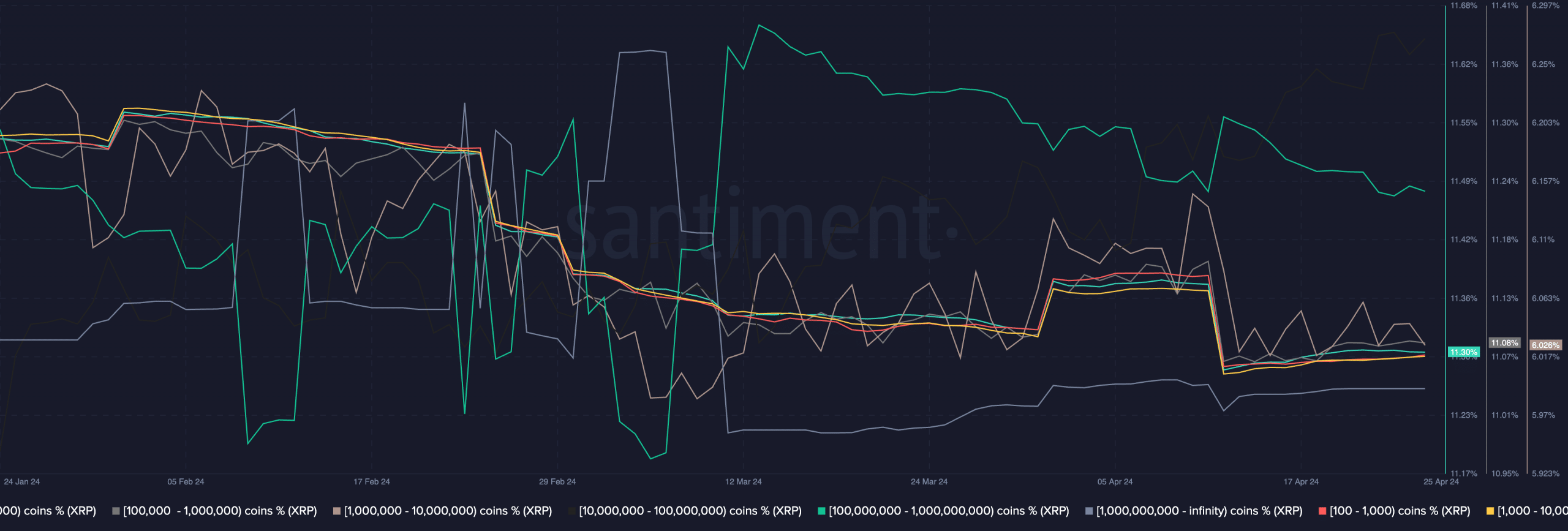

Adding to the concerns, insights from Santiment’s data reveal that addresses holding between 100 and 100,000 XRP coins have begun to exhibit signs of disinterest.

This trend among larger addresses suggests waning confidence among institutional or high-net-worth investors, which could further dampen XRP’s appeal in the market.

Looking at the data

Reflecting these negative sentiments, the price of XRP has experienced a significant decline, trading at $0.5198 at the time of writing, marking a 16.02% decrease in value over the past month.

This downward movement was part of a larger bearish trend that had begun since May.

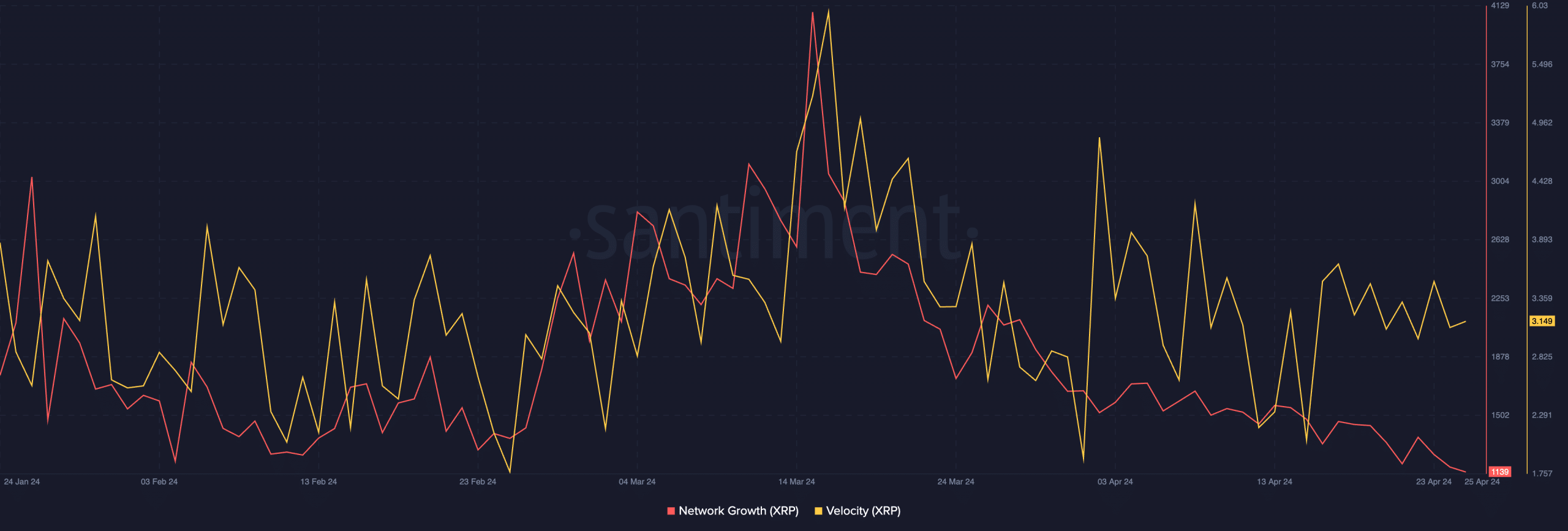

Further analysis of XRP’s on chain metrics revealed a decline in both network growth and velocity.

A decrease in network growth indicated a slowdown in the acquisition of new users or adoption, while reduced velocity suggested a decrease in the frequency of transactions, potentially indicating a loss of trading interest among investors.

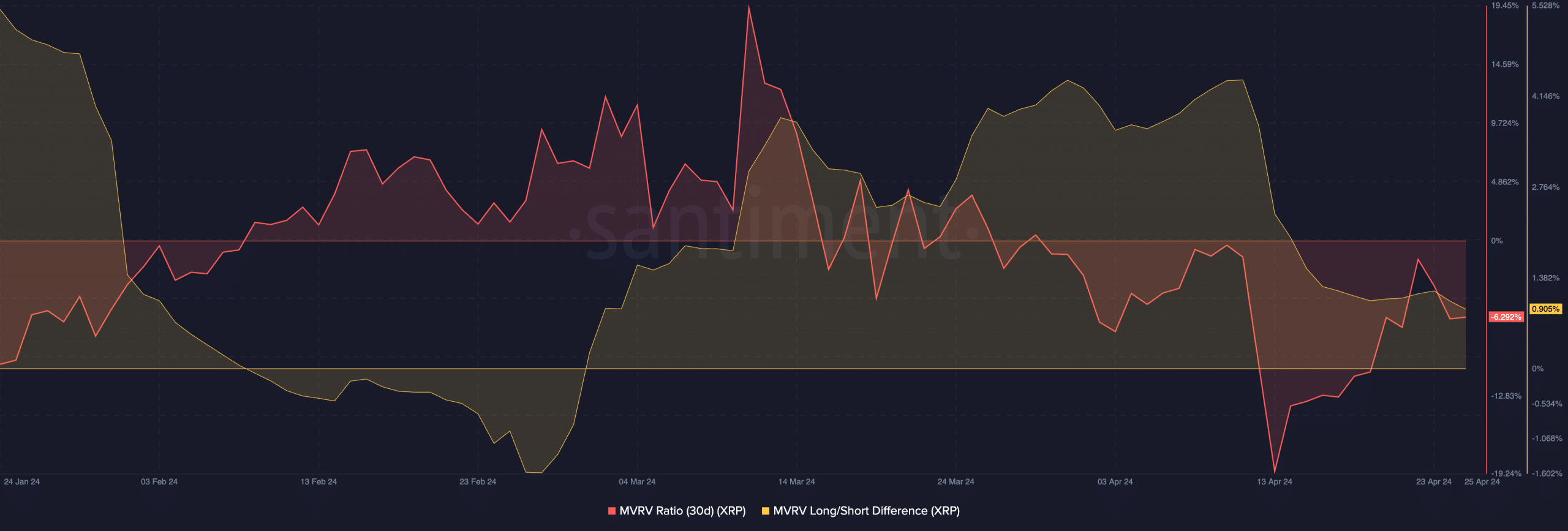

Moreover, metrics such as the MVRV ratio paint a concerning picture for XRP holders.

The declining MVRV ratio implied that a significant portion of XRP addresses were holding XRP at a loss at press time, compared to their initial investment.

Additionally, there was high long/short difference observed for XRP. This indicated a surge in long-term holders, which is positive as these holders don’t sell because of short term market movements.

Only time will tell whether the faith of long term holders will be enough for XRP to retain its current levels.

Realistic or not, here’s XRP’s market cap in BTC’s terms

On the development front, indicators like code commits and the number of active developers working on XRP-related projects have also seen a downturn.

This reduction in developer activity could signal a lack of innovation or progress within the XRP ecosystem, further eroding investor confidence and market sentiment.

![Bitcoin [BTC]](https://ambcrypto.com/wp-content/uploads/2025/06/Erastus-2025-06-25T110829.705-1-400x240.png)