Filecoin takes giant strides in Q1 23, will Q2 continue the momentum

– The total value of assets locked on Filecoin has more than doubled in Q1.

– FIL registered an increase of nearly 6% in its Open Interest (OI) in the last 24 hours.

The Filecoin [FIL] storage network welcomed some major developments in the first quarter of 2023 (Q1). The most prominent among them was the launch of Filecoin Virtual Machine (FVM) in March, which paved the way for the development and deployment of Ethereum [ETH]-style smart contracts.

How much are 1,10,100 FILs worth today?

Since the launch, FIL has retracted by over 8%, but a large part of it was due to the increased FUD in the broader market, exacerbated by macro-economic triggers.

With conditions easing, the token bounced back and logged weekly gains of nearly 12% until press time, per CoinMarketCap’s data.

State of Filecoin Q1 2023

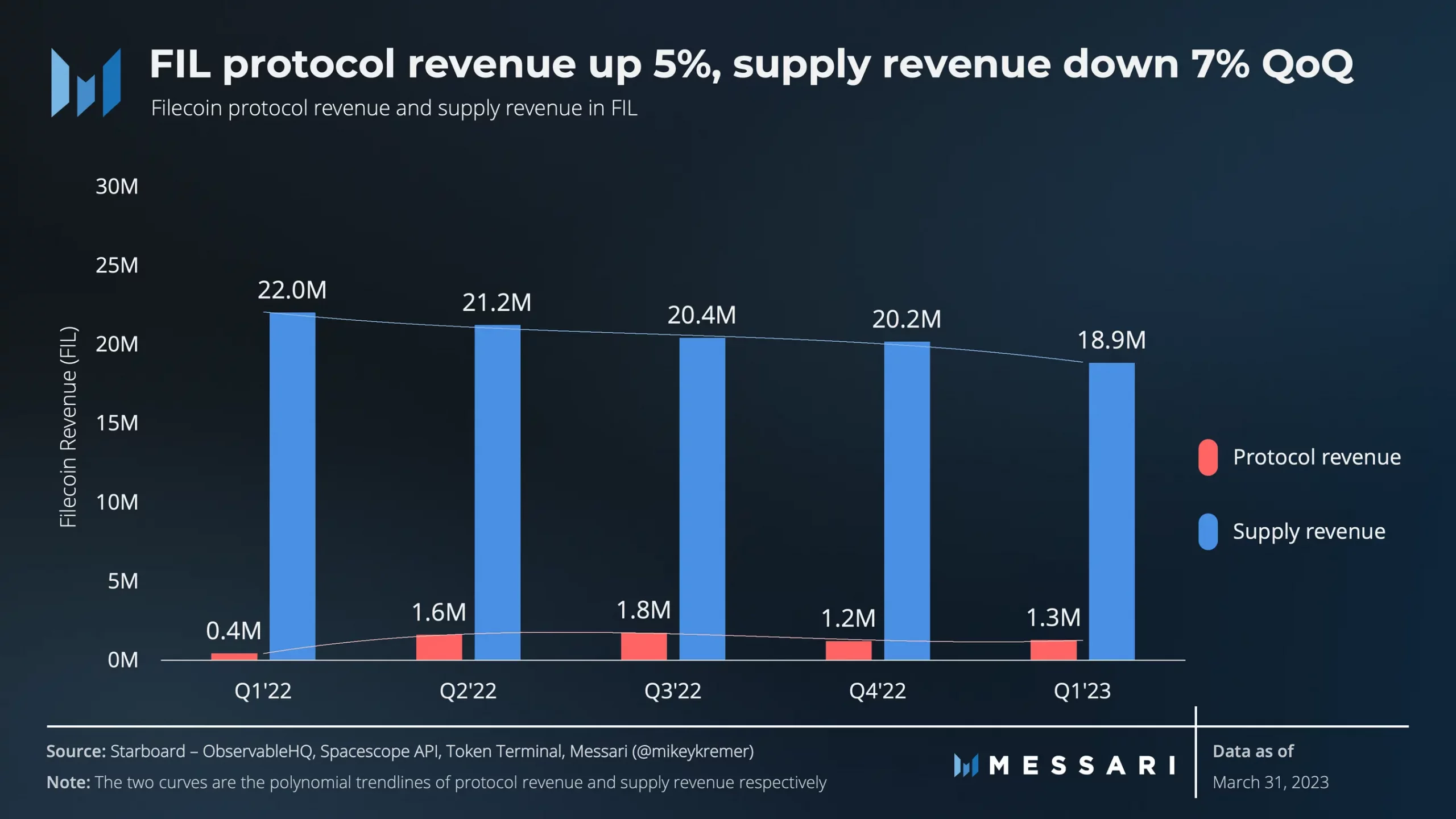

Blockchain analytics firm Messari published a report on Filecoin’s network performance in Q1. One of the biggest takeaways was the 5% growth in protocol revenue on a quarter-on-quarter (QoQ) basis. In USD terms, the revenue was $6.9 million, up 21%. Protocol revenue, or the total fees generated on the chain, represented the sum of base fees, batch fees, overestimation fees and penalty fees.

On the other hand, the supply-side revenue, or the fees which go to the storage miners, dipped 7% from Q4 22.

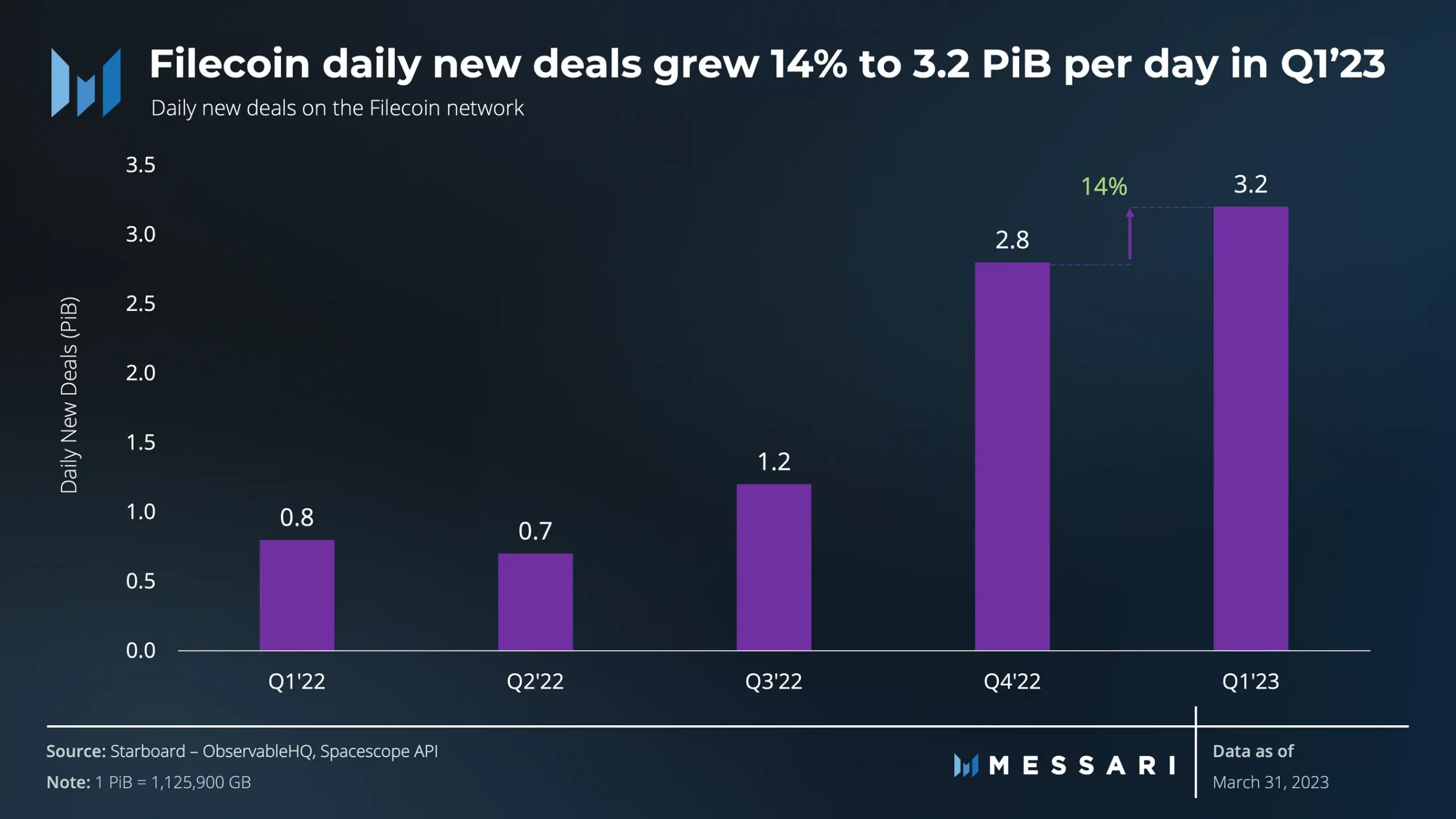

Messari underlined that growth in protocol revenue was powered by an increase in new storage deals. A storage deal is like a contract where users in need of data storage pay fees to storage providers to store data for a specified duration.

Moreover, the Filecoin Plus (Fil+) program, which offered rewards for storage providers for participating in the deal, was a major factor in the 14% growth in daily new deals in Q1 23.

Additionally, the report highlighted how the launch of FVM spurred trading activity on the network. As of 31 March, over 440 unique contracts have been deployed, generating nearly 44,000 transactions.

FIL ready for bullish pivot?

The total value of assets locked (TVL) on Filecoin more than doubled in Q1, as revealed by data from DeFiLlama. The TVL reached its all-time high of $3.15 million on 21 February. However, market uncertainty during March stemmed its momentum.

Read Filecoin’s [FIL] Price Prediction 2023-24

On the derivatives side, FIL registered an increase of nearly 6% in its Open Interest (OI) in the last 24 hours, according to Coinglass. On a weekly basis, the OI jumped 25% to $170 million. A surge in price followed by a surge in OI is generally considered a bullish signal and confirms the uptrend.