FLOKI, BONK’s volatile week: Will the bear runs continue?

- Market sentiment remained bearish on both BONK and FLOKI.

- Most indicators and metrics hinted at continued price declines.

Bonk [BONK] and Floki Inu [FLOKI], two of the most popular meme coins, had a tough week as their values declined in double digits.

However, as the market trend changed, their southward momentum also declined. Does this mean that investors could expect their charts to turn green in the upcoming week?

BONK and FLOKI bears stand strong

According to CoinMarketCap, BONK’s price dropped by more than 17% in the last seven days. FLOKI’s fate was also similar, as its value dipped by over 13% during the same time.

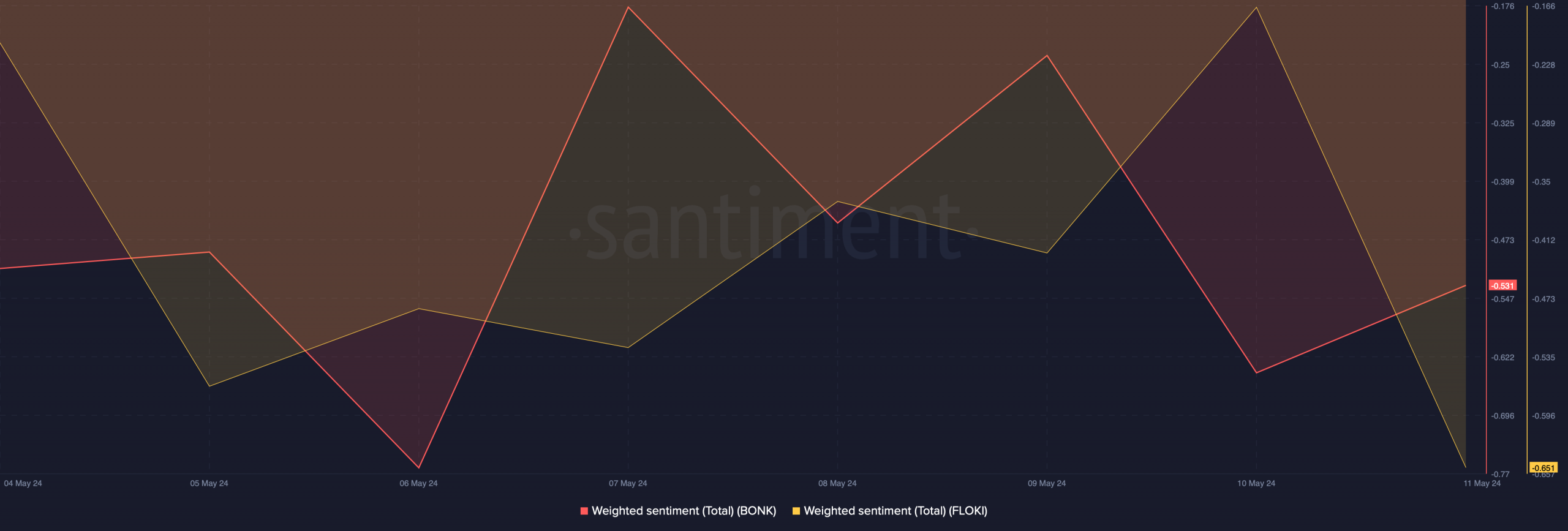

The declining price action took a heavy toll on these meme coins’ market sentiments. AMBCrypto’s analysis of Santiment’s data, both meme coins’ Weighted Sentiments remained drastically low.

This signified that bearish sentiment around BONK and FLOKI was dominant in the market.

However, the bearish trend seemed to have been coming to an end as the degree of price decline dropped. While BONK’s price dropped only by 1.8% in the last 24 hours, FLOKI’s price dipped by 1.5%.

This might be an indication of a trend reversal. At press time, FLOKI was trading at $0.0001685, while BONK had a value of $0.00002264.

Is a trend reversal possible?

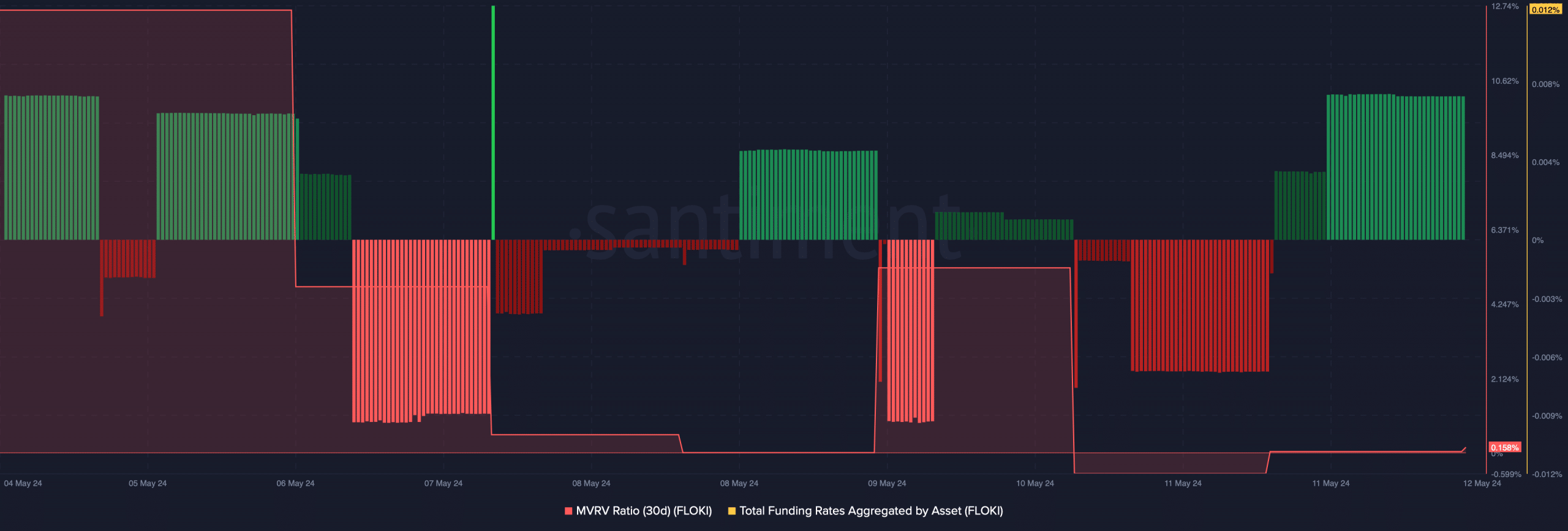

To see whether that’s the case, AMBCryto checked their metrics. We found that FLOKI’s MVRV ratio dropped sharply last week, meaning that fewer investors were in profit.

Its Funding Rate increased on the 12th of May. Generally, prices tend to move the other way than the Funding Rate, suggesting that FLOKI’s price might continue to fall.

Coinglass’ data revealed that, like FLOKI, BONK’s Funding Rate also registered an increase in the past few hours.

We then analyzed both meme coins’ daily charts to better understand what to expect. Beginning with FLOKI, we found that the meme coin might just be testing the upper trendline support of its bullish flag pattern.

Its Money Flow Index (MFI) also registered a slight uptick, hinting at a price increase. However, the Chaikin Money Flow (CMF) remained in the bears’ favor.

If the southward price action continues, then FLOKI’s price might touch $0.000156 support, from where it might rebound.

BONK’s market indicators also looked pretty bearish. Its CMF was also considerably lower than the neutral mark.

Unlike FLOKI, BONK’s MFI registered a downtick, suggesting that the chances of a continued price decline were high. Additionally, the MACD also displayed a bearish crossover.

Read Bonk’s [BONK] Price Prediction 2024-25

AMBCrypto then checked BONK’s liquidation heat map to look for possible support zones. As per our analysis, BONK has strong support near $0.000022.

If it manages to turn bullish from there, then its price could move up towards $0.000029. But a plummet under that could push BONK’s price down to $0.000018 in the coming week.