Footprint’s blockchain analytics make it possible to predict the next DeFi explosion

Footprint makes it easy for anyone to analyze and visualize billions of blockchain transactions—here’s why that might change crypto investing.

Blockchain technology has been a hot topic ever since the emergence of DeFi in 2017. The explosion of cryptocurrencies, and new trends like NFTs, have attracted institutions, investors, projects, investment institutions, traders, and data analysts.

All are on the hunt to explore new DeFi applications. The potential for wealth creation is evident.

But, the growth of DeFi projects and users has also led to an explosion of on-chain data. The growing value of this largely untapped spring of information is perhaps the most significant trend underlying the industry’s future.

What’s the big deal about on-chain data?

Blockchain provides many benefits for data analysis that traditional data does not. Here are three of the main features –

- A massive volume of high-quality data

Once all blockchain data is verified and approved, these records become tamper-evident.

With the rapid growth of users and businesses, the volume of data is becoming massive beyond what anyone could predict or foresee.

- Traceability and personalization

Blockchain records include all the information necessary to track their origin and live text. This includes which address initiated the transaction when it occurred, the amount of the asset transferred to the recipient address, and transaction fees.

While all on-chain data is traceable, cross-chain and cross-platform data are more complicated since they include frameworks from different developers.

- Decentralization and anonymity

Traditional institutions often can’t access comprehensive and accurate information about users because their private data is protected.

With the decentralized, anonymous property of blockchain, every transaction datum is public, taking the limits off data mining and analysis.

Challenges for Effective On-Chain Analysis

Blockchain is still a new technology. It’s fair to say that we are just beginning to understand and explore the value of the data it provides.

At this early stage, being able to collect, summarize and visualize data effectively is critical. Currently, most blockchain analytics tools focus on cryptocurrency quotes and compliance analysis.

Why?

Up to now, several roadblocks hinder creating powerful, easy-to-use analytics platforms for blockchain.

- Difficult to process data

On-chain data is multi-platform, multi-chain, and multi-project. The first step of creating meaningful insights is to consolidate this massive amount—which includes processing each data source one by one to schematize data formats, highlight key events and understand the business logic.

Naturally, the access speed to do this task is plodding.

- Hard to import incremental data

Different platforms and projects don’t always support users importing outside data for analysis. Users cannot combine data and events to discover macro trends.

- Platforms are incomplete

The range of tokens, assets, and DEXs available on platforms is limited, usually missing non-mainstream currencies, NFTs, and other highly relevant projects. Platforms also lack historical data, user behavior dimensions, and other vital events analysis capabilities.

- Lack of data applications

Many analysis tools can help users find data, but they cannot help users apply it in ways that can answer their real-world questions. Particularly, attempts at data visualization fall short.

Most of the visualizations are single view charts showing particular blockchain measures over time. These single disconnected views make it challenging to relate multiple blockchain characteristics to each other.

- Poor analysis experiences

Users generally have two options for selecting an analytics dashboard.

First, they can choose platforms that provide ready-made dashboards, severely limiting the type of data and analysis.

Second, they can select custom dashboards to import, fork, and merge data tables. The problem lies in the fact that these tools are not beginner-friendly at all. They require coding and knowledge of SQL.

In other words, the threshold of operation is high. A custom analysis is essentially impossible for the many DeFi investors and enthusiasts who do not have these technical skills.

- Difficult to track address data

Tracking the address behavior of centralized exchange wallets is not easy, especially when dealing with multi-wallet addresses.

As a result, current platforms cannot integrate multi-chain data for the same wallet and cannot track wallet behavior over time. This gives their visual charts a static quality which fails to capture transactions and movement as they happen in reality.

- Few tagging applications

Tags make parsing through different tables, metrics, and dimensions efficient. However, there is a notable lack of tags based on behavior categories, business connotations, analysis scenarios, and other useful categories in the current data platform offerings.

Most platforms do not support custom tags—something that is a prerequisite in other industries dealing with data. Those that do support custom tags still lack tagging rules, which are guidelines for users to give definitions to the tags.

Footprint makes blockchain analytics possible for anyone

Many blockchain-focused data analytics platforms have stepped in to make blockchain data accessible.

As the demand for blockchain analytics grows, these tools are becoming more effective and powerful, each serving the needs of different kinds of investors and businesses.

Footprint is one such platform. Built by a team of internet serial entrepreneurs, it is a one-stop analytics platform that helps you visualize your blockchain data exploration results with an effortless, easy-to-use, and user-friendly interface.

Footprint offers the following solutions for data analytics users.

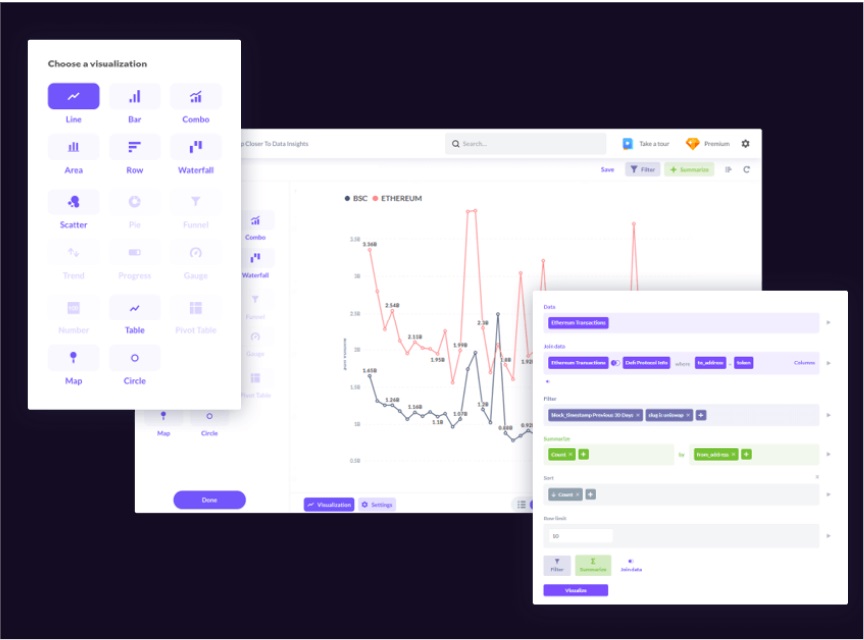

No coding or technical skills required

Footprint solves the problem of exploring blockchain data and gives users an effortless drag-and-drop experience. There is no need for SQL queries or coding to analyze blockchain data—anyone can discover and present actionable DeFi insights with the sleek interface.

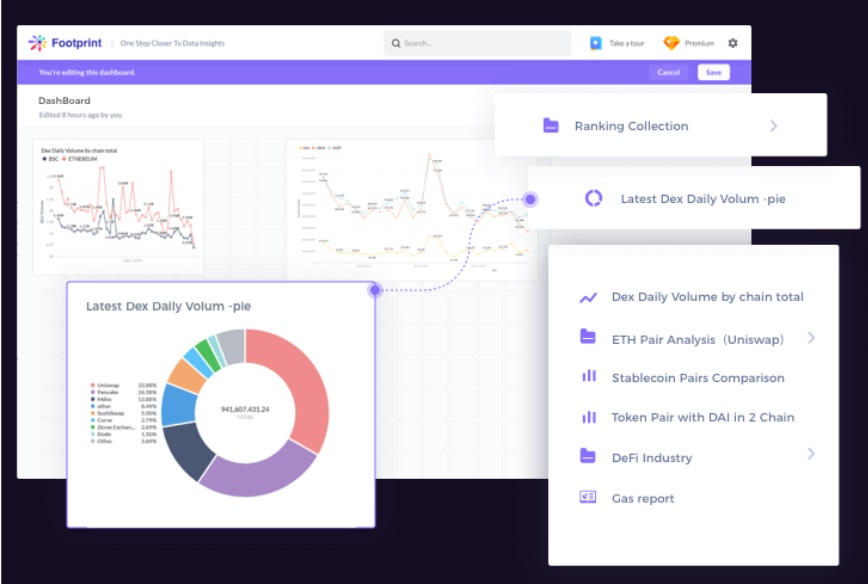

Fork queries with one click

Footprint provides rich data analytics templates that support forks with any open analytics table on the platform with one click, helping users easily create and manage personalized dashboards. Users can also share data tables and dashboards with partners or on social media.

Supports cross-chain data

Subscribers get a platform that provides cross-chain and multi-project type data, supporting users to draw and analyze data charts by chain and project type.

Advanced wallet labeling

The Footprint database has generated tags by category for the DeFi platform. And now it supports users to tag reports and dashboards, so users can quickly search for the report templates they need based on the tags.

Underlying the usability of the platform are advanced wallet labeling capabilities. It tracks and labels every individual wallet address exchange, meaning users can see which addresses are accumulating or selling off specific tokens, plus their portfolio profits. This enables both hyper-targeted research and uncovering macro DeFi market trends. With token metrics for usage, engagement, and liquidity, users can make informed decisions before and after investing.

Community-powered by DAO

To push the possibilities of decentralization while building a supportive community, Footprint’s DAO brings together active, diverse, and engaged members to inspire and support one another through forums. The decentralized organizational structure of the Footprint community allows its users to share insights and actively drive development.

Where will blockchain analytics take you?

Cryptocurrency transactions involving multiple chains, projects, and wallets are an enormous challenge for developers and data analysts because of the data volume and complexity.

For data analysis platforms, collecting and organizing standardized data structures takes a lot of time and effort and requires constant investment in long-term maintenance. Because of the complexity of the data, most of the analytics tools on the market only realize the overall statistics or part of the chain’s data, and there are almost no platforms that can provide microscopic data granularity that can be tracked to individual behaviors like Footprint.

With the development of the multi-chain ecosystem, data analysis will usher in development opportunities like never before.

As an early innovator in accessible analytics tools, Footprint will likely support the growing interest in DeFi with its pleasant, simple interface experience and powerful data capabilities.

To learn more about Footprint, join the Discord community: https://discord.gg/3HYaR6USM7 or check the below website: https://www.footprint.network/.

Disclaimer: This is a paid post and should not be considered as investment advice