For Dogecoin, why relying on these key price metrics can be misleading

Dogecoin has seen tremendous growth this year even though much of its growth came on the back of popular endorsements from the likes of Elon Musk and countless other celebrities. What was once a project of trivial significance has now become a top-10 cryptocurrency if one were to go by market capitalization.

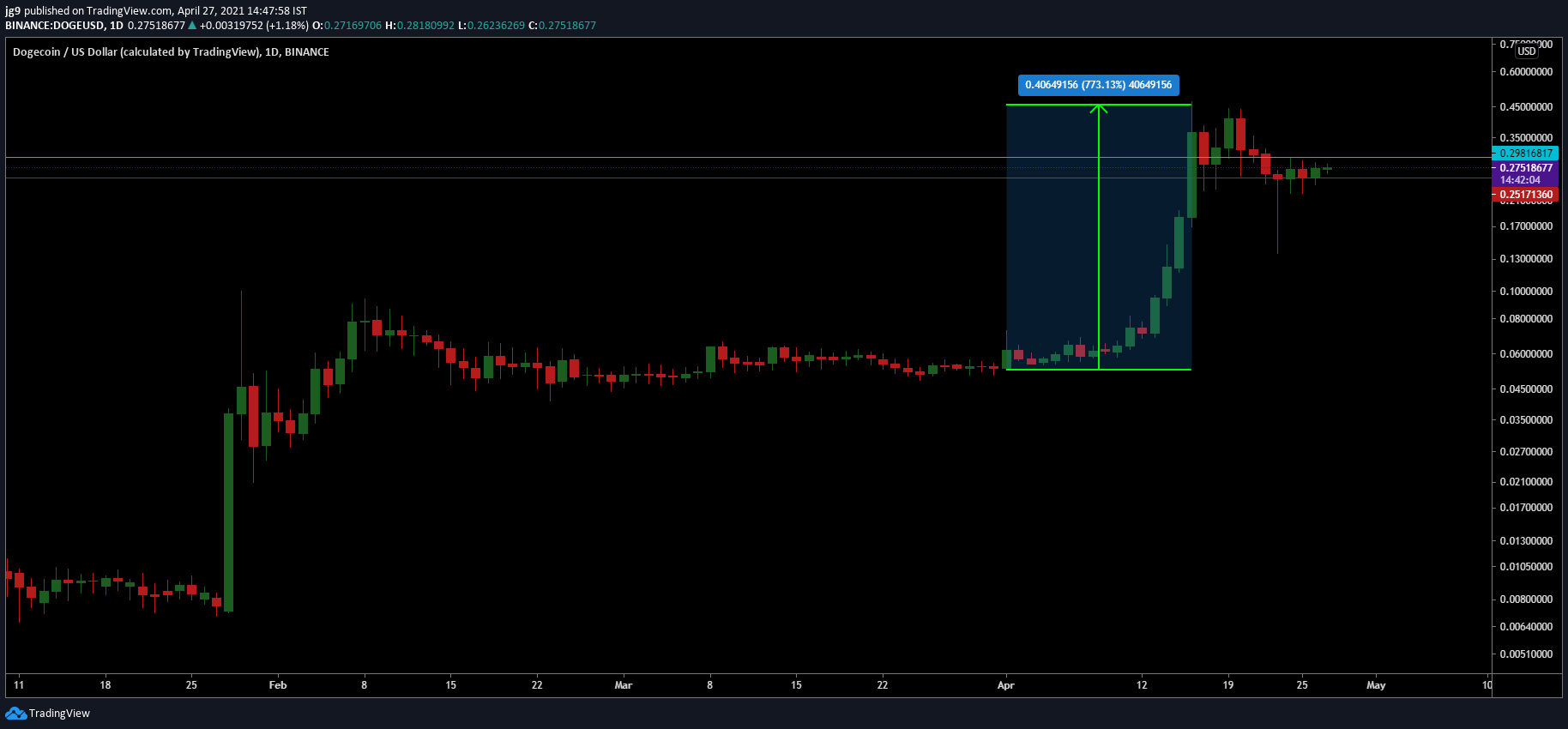

Just at the start of April, Dogecoin’s price rocketed its way up the price charts and was able to surge by an unbelievable 750 percent. However since then, while DOGE has retained much of its value, it seems to have tanked and hit a level of saturation, with the later weeks of April noting mostly sideways movement for the coin. At the time of writing, DOGE traded at $0.27 after having seen yet another minor price hike in the past 24-hours.

While Dogecoin’s recent success is quite inspiring, it also goes to show that relying on just market speculation and hype does have its limits. One of the primary critiques of DOGE is that it has no real use case or any network development that substantiates its growth on the price chart. In other words, it is quite evident that its growth has been purely on the back of speculative buyers who collectively pushed the price and after having reached a rather ‘high’ valuation, the question arises, what next?

Is Dogecoin a long-term asset like Bitcoin, the answer is hard to say. However, given the recent growth and its present price point, many traders who entered the Dogecoin market are likely to now start selling. This was highlighted by IntoTheBlock’s data with regard to the coin’s ownership metrics. According to the data, the Dogecoin market is dominated by short-term traders. There were around 165k addresses that have held on to their Dogecoin for less than a month back in December 2020.

This has now increased to a whopping 582k addresses in April with the opposite trend present with regard to its long-term holders. Having said that, the majority of DOGE is still in the hands of long-term hodler, but the recent surge in short-term participants may not help when it comes to DOGE’s immunity with regard to sell-offs.

In addition to this, the In/Out of the Money Around Price metric, highlights that around 54.16% of all addresses are out of the money as the current price is less than the average price.

In the past few months, social sentiment has been a very important factor that decided DOGE’s fate and drove buyers into the market. Interestingly, taking a look at the overall Twitter sentiment and commentary shows that while the majority of users are still bullish, negative commentary is slowly creeping up. While this is largely due to Dogecoin’s price stalling between its resistance level at $0.29, negative commentary can have a drastic effect on the coin’s current valuation in the coming months.

Google search trend data for Dogecoin showed that it peaked around 19 April and has been on a significant decline ever since. For many altcoins, while social sentiment is key and affects market perception, they also have the luxury of relying on timely developmental updates to keep investors confident in the value of the coin. In the case of Dogecoin, that isn’t the case and if sentiment turns against it, Dogecoin’s price can stall or even plummet to where it once was a year ago.