Former SEC attorney chimes in on the Bitcoin ETF conversation

- John Reed Stark suggested that SEC will not look favorably upon Bitcoin ETFs.

- Analysts think that the ruling may get postponed even further.

Multiple large financial institutions have recently showcased interest in applying for Bitcoin [BTC] ETF. Firms such as Blackrock, Wisdom Tree and Valkyrie have all been vying for approval from the SEC. This interest from the institutions caused a wave of optimism in the crypto sector. However, over time, the optimism has started to dwindle.

Read Bitcoin’s Price Prediction 2023-2024

Future looking bleak

Former SEC attorney John Reed Stark suggested that the SEC will probably remain firm against Bitcoin spot market ETFs, despite notable filings from Wall Street giants. The non-profit organization Better Markets, aligning with the SEC, reinforces its stance against spot ETFs due to concerns about market manipulation and concentration in Bitcoin markets.

Better Markets highlighted concerns regarding spot bitcoin markets. According to them, these markets show inflated volumes due to manipulation and high concentration. They depend on a limited group to maintain the Bitcoin network.

They also stated that such vulnerabilities make a spot bitcoin-based ETF susceptible to manipulation. This in turn puts investors and the public interest at risk. They also believe that relying on surveillance from other markets is insufficient.

The SEC has consistently denied Bitcoin ETF applications since 2013, citing these concerns. While ETFs in Bitcoin futures markets have been permitted, applications for spot ETFs have been blocked. BlackRock, the world’s largest asset manager, recently applied for a spot ETF, followed by other major Wall Street players.

Stark, on social media platform X, predicted potential shifts in SEC crypto regulation after the 2024 presidential election. He anticipates that if a Republican candidate wins, a GOP-led administration could adopt a more favorable approach to crypto, possibly facilitating spot ETF approvals.

He also forecasted that enforcement actions pursued by the SEC might slow significantly under a Republican-majority leadership within the agency.

Is your portfolio green? Check out the Bitcoin Profit Calculator

The Bitwise Bitcoin ETP Trust and spot bitcoin ETF applications from BlackRock, VanEck, WisdomTree, and Invesco are awaiting a decision from the U.S. SEC by September 1. Bloomberg analysts suggest that the SEC will likely delay all rulings. This postponement would further extend the waiting period for these applications.

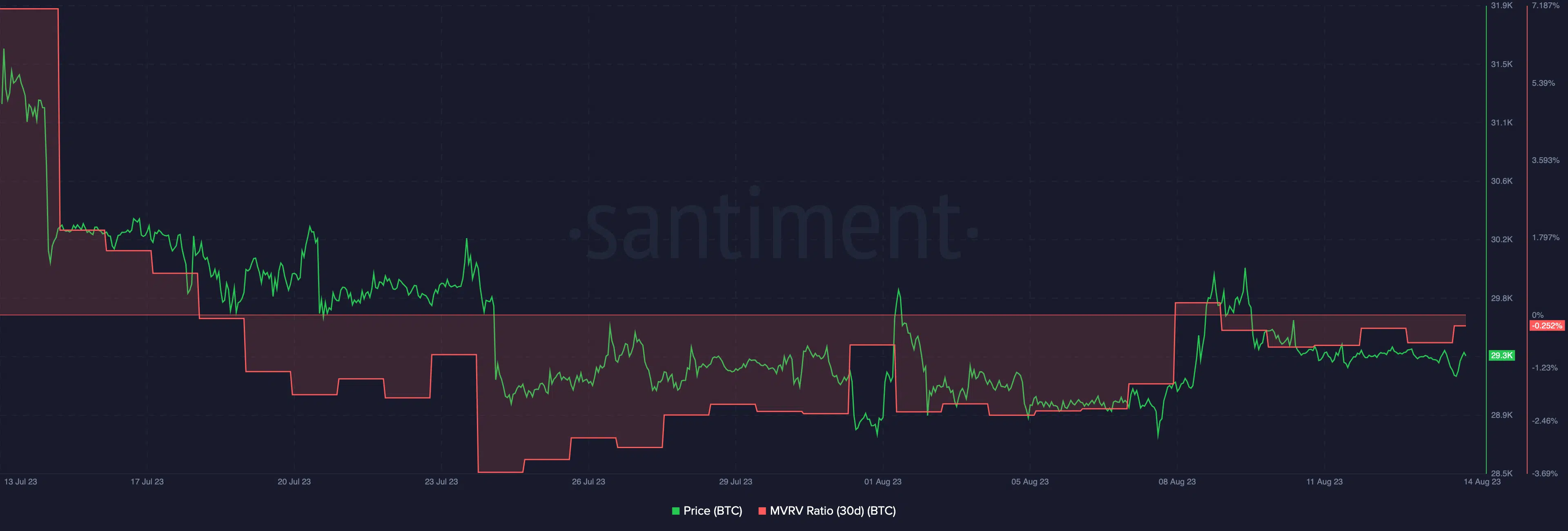

At press time, BTC was trading at $29,300 and its MVRV ratio had fallen as well. A negative MVRV ratio implied that most addresses holding BTC were not profitable at press time.