Grayscale AUM hits $30 billion

Bitcoin’s price has been appreciating since January 2021 however the rally has now hit a brief halt. The BTC price has been progressing sideways with few drops under $30k. However, there has been a rise in momentum over the past few days due to Elon Musk’s support and BTC has now been trading at $37k. Interestingly, while there has been a price consolidation institutions are filling their bags with as many Bitcoins as possible.

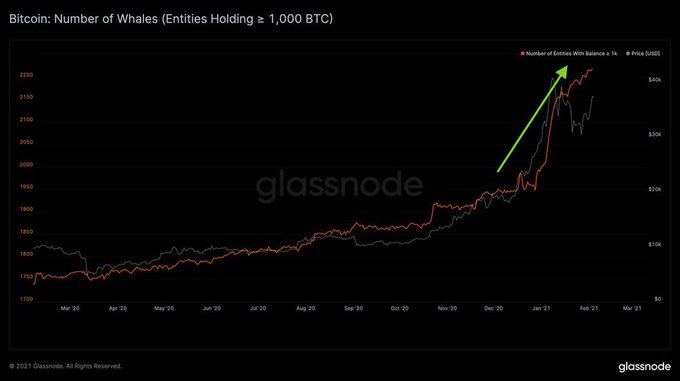

A sign of this was visible when the whale addresses in the Bitcoin market began to rise. According to Bloqport, 200 new Bitcoin whale addresses were created since the beginning of 2021. The addresses had approximately 1,000 BTC each, making it a large chunk for an individual to hold.

Source: Twitter

As the addresses increase, the number of Bitcoins leaving exchanges has also increased. In the past few weeks, nearly $3 billion worth of BTC left Coinbase. This was an indication that investors were unwilling to trade the digital asset and would probably hodl for now. This has been a practice observed among institutional buyers and could be an indication for more institutional money entering the crypto market.

Meanwhile, the world’s largest digital asset manager Grayscale has announced its crypto net assets under management surpassing $30 billion. The company houses two important products- Grayscale Bitcoin Trust [GBTC] and the Grayscale Ethereum [ETHE] which makes up 95% of its crypto holdings.

Grayscale tweeted:

02/04/21 UPDATE: Net Assets Under Management, Holdings per Share, and Market Price per Share for our Investment Products.

Total AUM: $30.1 billion$BTC $BCH $ETH $ETC $ZEN $LTC $XLM $ZEC pic.twitter.com/EJusspgOnK

— Grayscale (@Grayscale) February 4, 2021

However, even though many focused on filling their Bitcoin bags, Grayscale was adding more Ethereum. The company has been adding more Ethereum ever since it reopened its Ethereum Trust [ETHE] and according to data it bought over 12,684 ETH on 4 February.

Grayscale adds a further 12,684 $ETH over the past 24 hours. Over the past 7 days, Grayscale has added 83,678 $ETH in total, worth $137 million.

Chart: @bybt_com pic.twitter.com/u8w0eP5YK0

— Bloqport (@Bloqport) February 4, 2021

Whereas earlier, the company added 47,000 ETH worth $76.7 million in 24 hours. It was clear that Grayscale investors were supporting the performance of the largest altcoin.

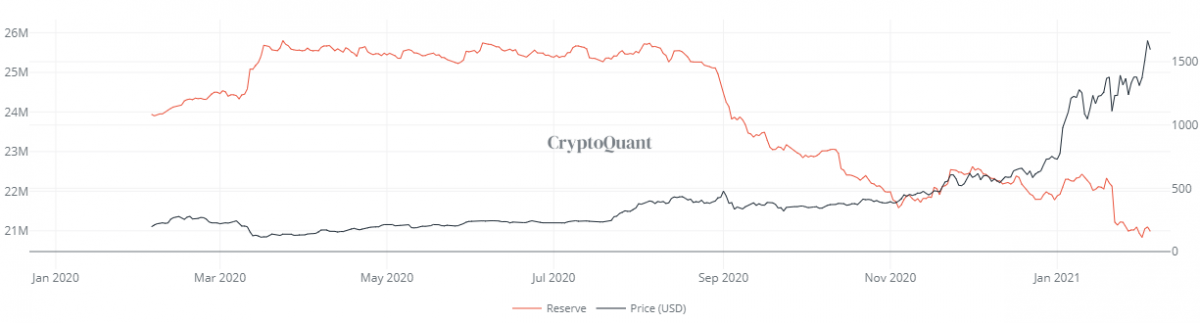

However, like Bitcoin, Ethereum was also being held in private wallets and not on exchanges. Data suggested that Ethereum on exchanges has been rapidly falling, while the price witnessed an upward trend.

Source: CryptoQuant

The ETH on exchanges has hit a low of 21 million. This data, however, highlighted the investors’ behavior to hold the digital asset than to trade it, with a chunk also using ETH in staking pools.