Has the Bitcoin FOMO helped it surpass Visa in terms of market cap?

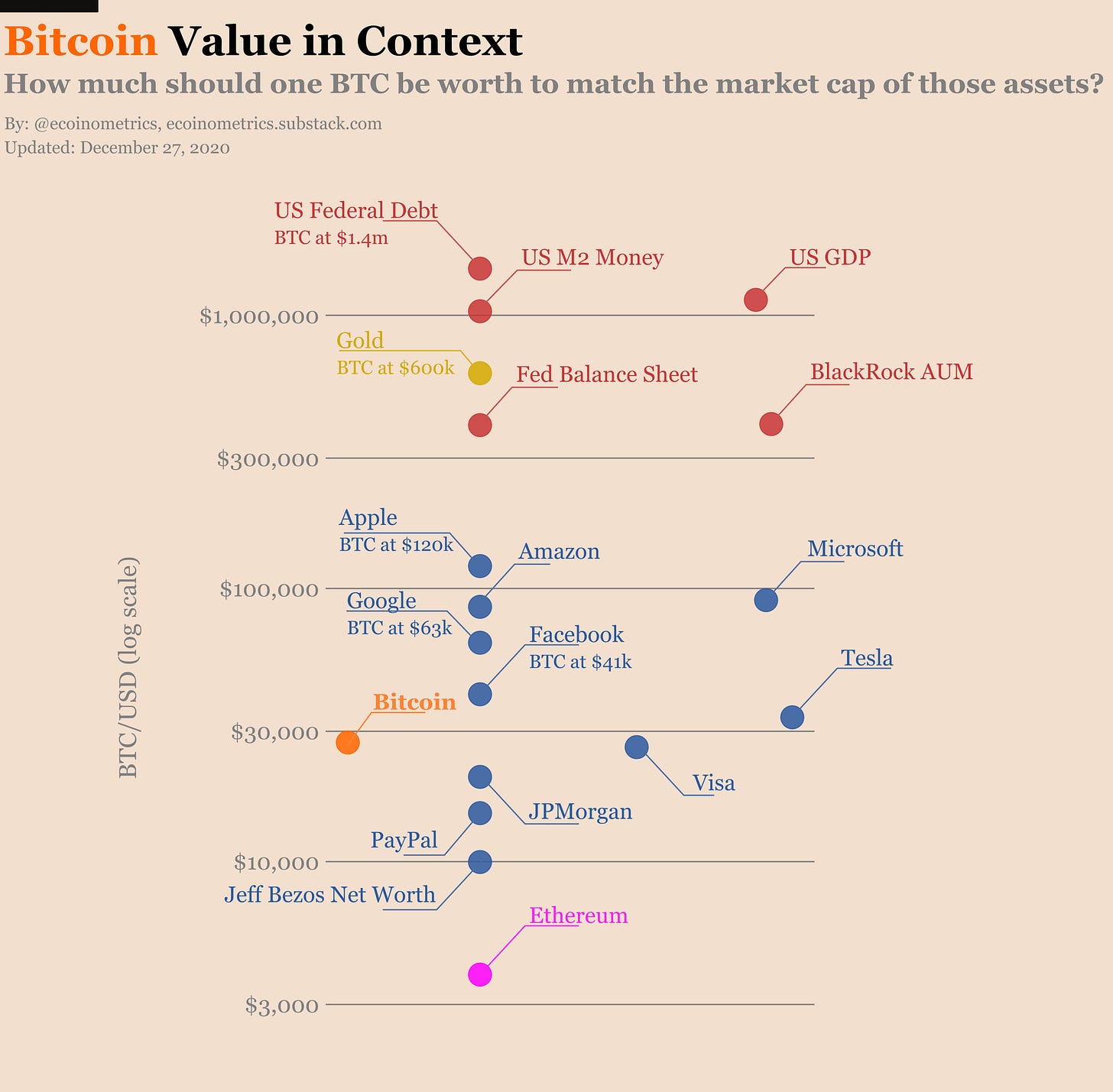

Bitcoin has broken past all expectations as it marked a new all-time high at $28k. This new ATH was nearly $10k higher than its 2017 price point and has resulted in its value to surpass Visa in terms of market capitalization. The chart below explains the progress of the digital asset, along with the second-largest cryptocurrency in the market, Ethereum.

Source: Ecoinometrics

The above chart noted that as the price of BTC approaches $30k, the coin may surpass Tesla’s market capitalization. However, among the other tech giants, Bitcoin’s next target in terms of value will be Facebook, Google, and Apple.

For BTC to surpass Facebook’s value, it will have to reach a value of $41k. Given the price momentum observed in the market, this target may not be completely unachievable. The reason for such a rise in momentum can be associated with the growing institutional interest in the market.

Over the course of the last couple of months, Paypal, Grayscale, MicroStrategy, and Square are all including Bitcoin in their investment portfolios. According to Bitcoin Treasuries, more than 1.1 million BTCs of over $30 billion worth of crypto assets have been held by various companies.

Source: Bitcoin Treasuries

According to the above chart, MicroStrategy now held over 70k BTC, followed by Galaxy Digital Holdings with 16.651 BTC and Square with 4,709 BTC. There are 29 firms holding Bitcoin in place of traditional reserves like stocks and cash. This growing interest has caused a scarcity shock, and thus also created a FOMO driven buying spree.

The FOMO-driven interest will add more to the momentum and surge in price, making it more possible for the digital asset to surpass the social media giants. However, since the price surge has been sudden a price correction might be en route, but that will not deter holders’ interest as the narrative of the store of value continues to remain intact.