Has the market lost its faith in stablecoins? Assessing…

- The stablecoin sector experienced a decline in market capitalization over the past 15 months.

- Despite this, there are signs of increased whale interest and potential for stablecoin recovery.

The collapse of the Silicon Valley Bank had a massive impact on the cryptocurrency market, and the stablecoin sector was hit the hardest during this period, with USDC bearing the brunt of the repercussions.

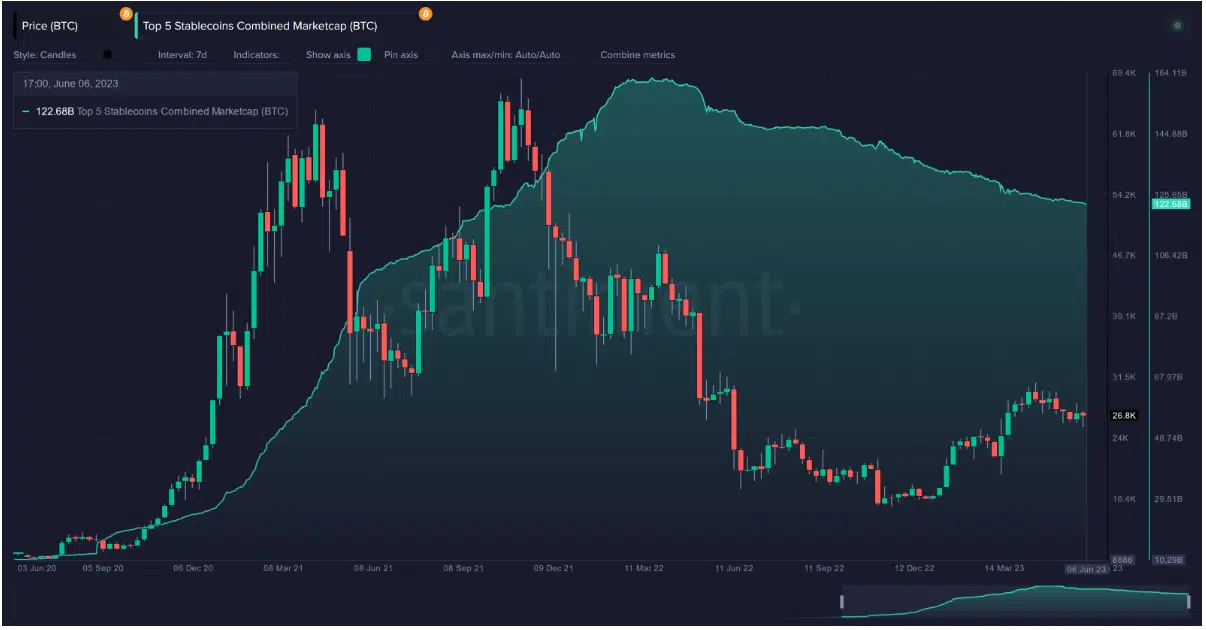

However, the effects of this incident seem to have lingering consequences as the stablecoin sector has struggled to fully recover. Santiment’s data reveals a steady decline in the overall market capitalization of stablecoins over the past 15 months, encompassing prominent stablecoins such as USDT, USDC, BUSD, DAI, and TUSD.

Whales begin to show interest

The combined market capitalization of the stablecoins reached its peak in March 2022, marking a turning point from which a downward trend emerged.

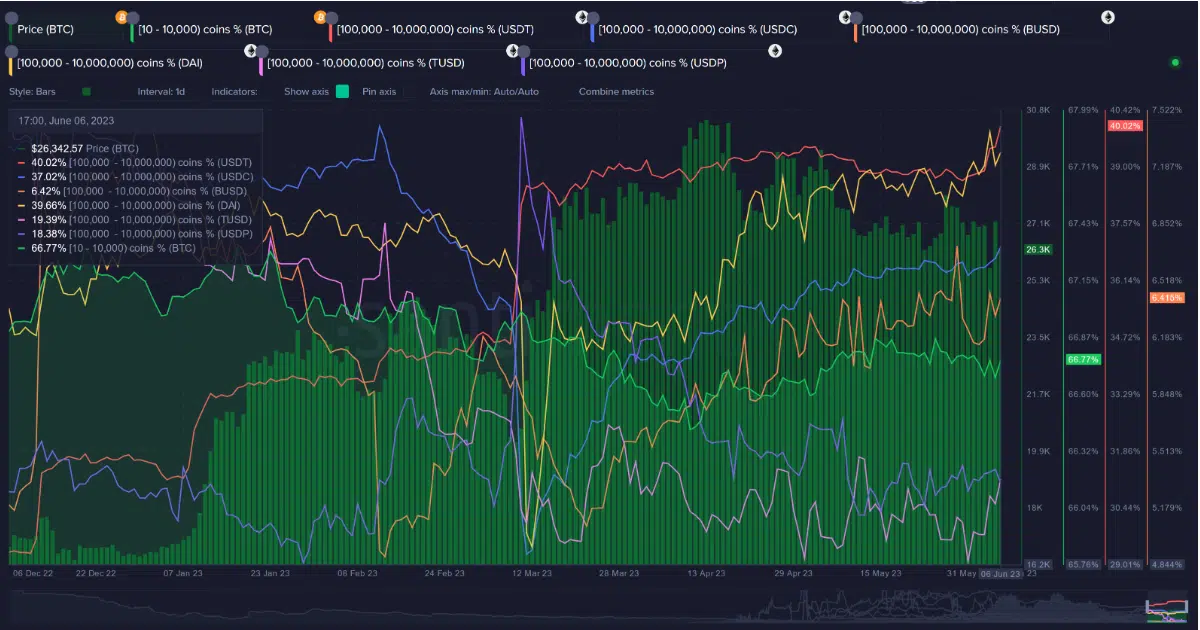

Despite this decline, there has been a notable increase in whale interest in stablecoins. Large holders of Tether, USDC, and DAI have significantly boosted their holdings, with the current amounts being the highest since November 2021, February 2023, and December 2020, respectively.

These staggering numbers indicate that major investors have not completely exited the crypto market; instead, they have opted to hold a significant portion of their assets in stablecoins while waiting for opportune moments to re-enter the market.

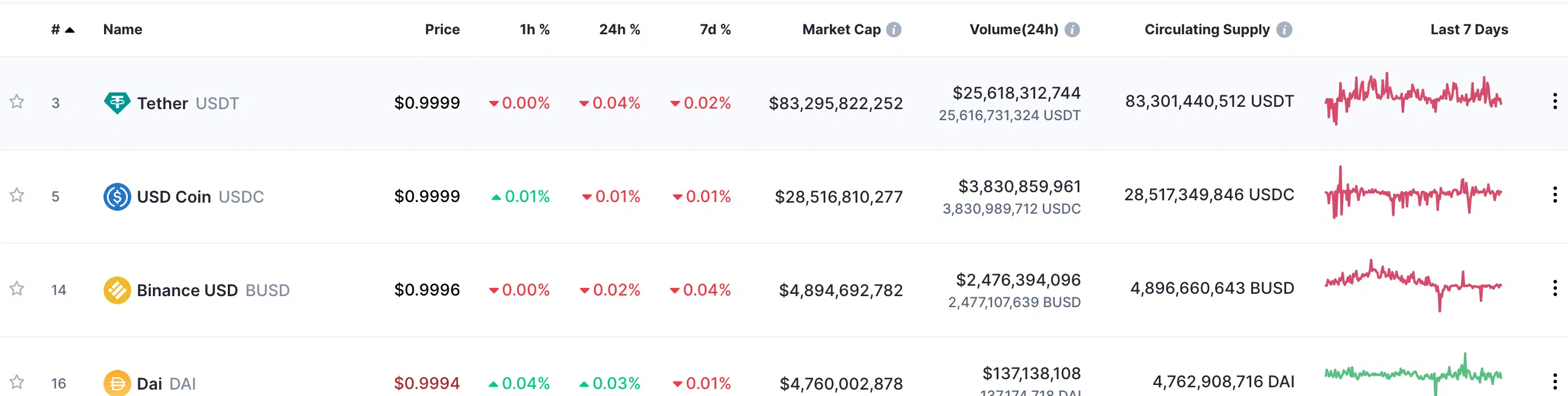

While stablecoin interest has experienced an overall decline, USDT continues to maintain its dominant position in the sector.

According to CoinMarketCap’s data, USDT’s market cap stands at $25 billion, significantly higher than USDC’s $3.8 billion and BUSD’s $2.4 billion.

However, BUSD faces potential negative implications due to ongoing SEC lawsuits involving Binance. Should the outcomes of these lawsuits be unfavorable for Binance, many BUSD holders may seek alternative stablecoins for their investments.

Can USDC regain its footing?

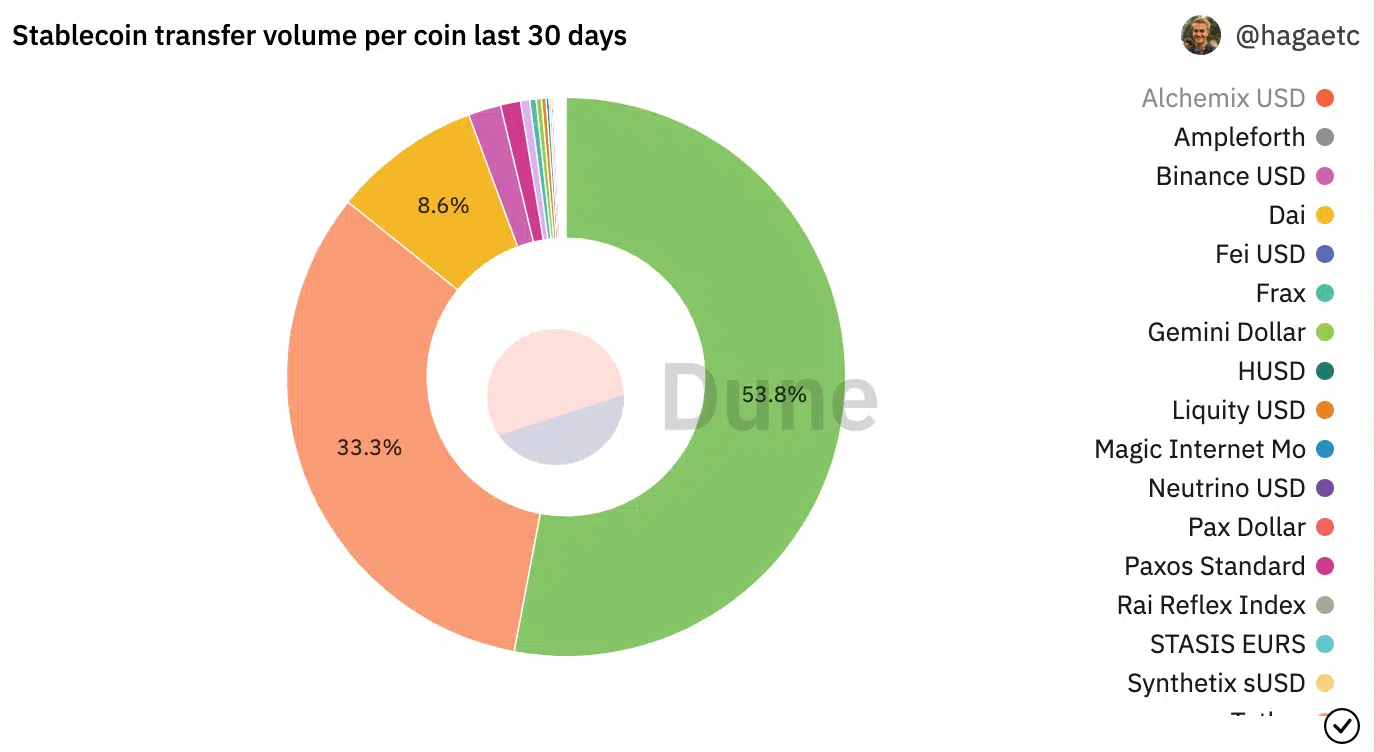

USDC, on the other hand, witnessed a significant drop in market capitalization. However, it still accounts for a considerable 53.8% of stablecoin volume, as per data from Dune Analytics.

Despite its decline, USDC might make a comeback with its strategic efforts to expand into various territories. Circle, the issuer of USDC, obtained a Major Payment Institution license from Singapore on 7 June.

This license empowers Circle Singapore to offer digital payment token services, cross-border money transfer services, and domestic money transfer services in Singapore. This expansion into new markets can help USDC regain momentum and attract renewed interest.