Hector Network: Building a range of use cases in the Fantom ecosystem

Stablecoins are an important part of the crypto space that helps traders store non-volatile value and maintain a consistent purchasing power. While they are backed by the US Dollar in theory, practically the value of USD itself is depreciating. This means that its worth today is more than it will be tomorrow, putting stablecoins in a tight spot.

Hector Network offers a solution to this paradox, Hector Network is backed by an increasing pool of DAI, USDC, and FTM along with other assets. This would increase the value of its token over time when it builds liquidity.

What is Hector Network?

Hector Network is a decentralized asset-backed reserve based on the Fantom Opera Chain aiming to create value for users through the development of various use cases in their ecosystem. The platform intends to position itself as a financial center on the Fantom chain so as to make the lending/borrowing process easy for users while also acting as a bridge between chains and launching new projects.

Another major area that Hector Network is focused upon is facilitating the growth of the Fantom Opera Chain through the production of high-quality products. Keeping this in mind, they have donated FTM tokens to new users on the network to aid them in the first transactions.

$HEC is the native token of the platform and as it builds more liquidity and reserves, the backing per HEC would also increase thereby creating a price floor that steadily rises. To maintain a steady price floor, Hector Network uses the Algorithmic Reserve Currency algorithm.

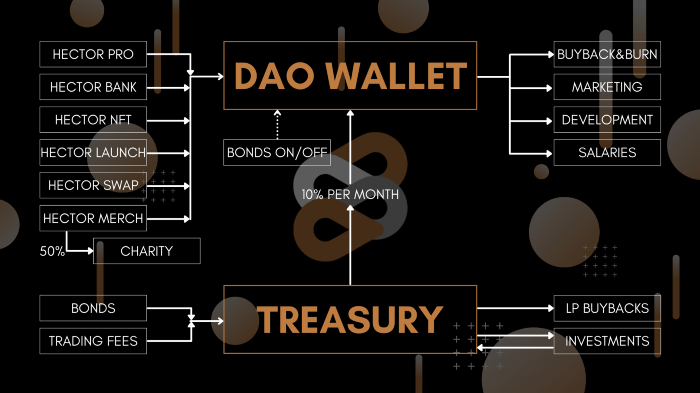

Inflows and Outflows of the Treasury

Hector’s Treasury is a multi-signature protected safe that contains all the stablecoins and volatile coins that are owned by the DAO. It has some major functions:

- Inflows: One of the major methods Hector generates profits is through bonding. The platform sells bonds of tokens such as DAI which are then vested for gradual release to the bonding party. A part of the trading fee generated on Hector Swap and Hector Bank also goes to the Treasury.

- Outflows: In times of prolonged contraction a part of the LP tokens is used to buy back and burn tokens. The components of the LP tokens are split into two parts: HEC tokens and a stablecoin like USDC or DAI. HEC tokens are then burnt and stable coins are used to buy more HEC from the market which is also burnt.

DAO wallet and Staking

While the Treasury is used for long-term storage of tokens, the DAO wallet is used for expenses such as Marketing, Buyback and burn, Salary and Development funds, etc. Profits from subprojects are also stored in the DAO wallet.

Staking is an important part of the Hector Network ecosystem. Users can stake their HEC tokens by locking it into the ecosystem and receive compounding rewards generated by bond sales. Through the process of staking, HEC tokens are locked and users are given the sHEC tokens. Unstaking is also quite simple and sHEC owned by users are burnt to give them an equal balance of HEC.

What is Hector Bank?

Hector Network platform recently launched the Hector Bank on 27th January 2022 as the first step towards becoming deflationary. Hector Bank is a decentralized borrowing and lending platform built on the Fantom Opera Chain. Lenders can use the platform to get a high APY without facing any risk of volatility of HEC prices. Borrowers on the other hand can use wsHEC as collateral to borrow stablecoins and use them in various projects without the need to unstake or unwrap the tokens.

Hector Bank isolates its pool of tokens in a range of configurations allowing for more minute control over individual token offers. This helps in risk mitigation and growth while also helping in fine-tuning the collateral factor, liquidation factor, and other such parameters.

Final word

Hector Network being a DAO incorporates its community and its feedback onto its roadmap. Token holders who have HEC, wsHEC, and sHEC get a chance to vote on important community decisions ranging from audits, listings to fund management decisions. As mentioned earlier, Hector Bank is one of the first steps the platform is taking towards a more deflationary approach. Hector Stablecoin is another addition to their ecosystem which will be live soon.

The platform will also receive the Fantom Foundation Incentives Grant from February and is working on utilizing the grant towards the development of its 2022 master plan. The platform currently has a TVL of $267 million on DeFiLlama, while the HEC token is a part of the top trending tokens on the Fantom ecosystem. Needless to say, Hector Network has a lot lined up on its 2022 roadmap for its users and token holders.

For more information on Hector Network, please check out their official website.

Disclaimer: This is a paid post and should not be treated as news/advice.