Hedera [HBAR] at a crossroads as these opposing metrics raise questions

![Hedera [HBAR] at a crossroads as these opposing metrics raise questions](https://ambcrypto.com/wp-content/uploads/2023/02/hbar-michael-1-e1676463381193.jpg)

- HBAR bulls cool down but mixed signs about price direction fog the road ahead.

- Hedera secures a strategic partnership leading to the on-boarding of another high-profile project.

Hedera [HBAR] has been one of the most bullish cryptocurrencies so far in February 2023, during which it built on its January gains. This was unlike most top digital coins, which saw significant weakness and profit-taking. But can it sustain this bullish momentum?

Read about Hedera’s [HBAR] Price Prediction 2023-24

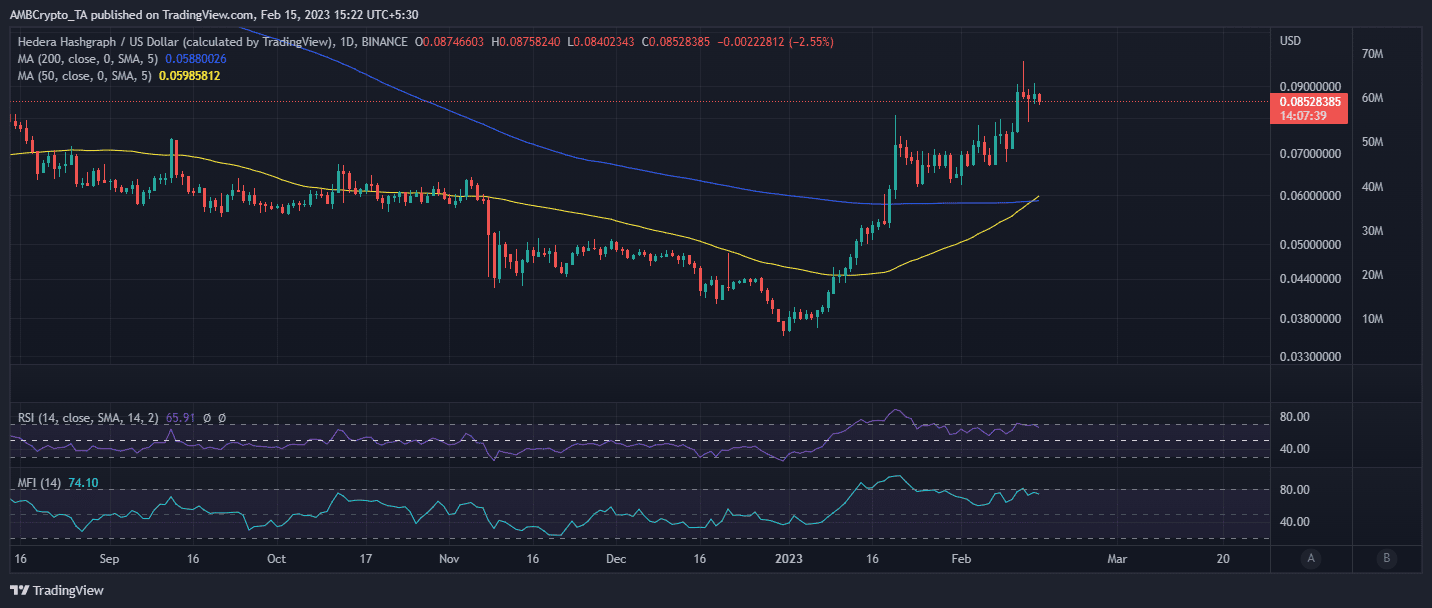

Perhaps HBAR’s price action may offer some insights into what to expect. Bullish exhaustion was evident after the cryptocurrency’s latest peak on 11 February. It has been struggling with resistance above the $0.090 price level, and the bears were attempting to take over at press time. Although expectations were high, the price action was showing mixed signs.

The 50-day moving average crossed above the 200-day moving average from below, forming a golden cross at press time. The latter is usually considered a bullish sign. On the other hand, the recent price peak was accompanied by a lower RSI level, forming a price to RSI divergence, which is usually a bearish sign.

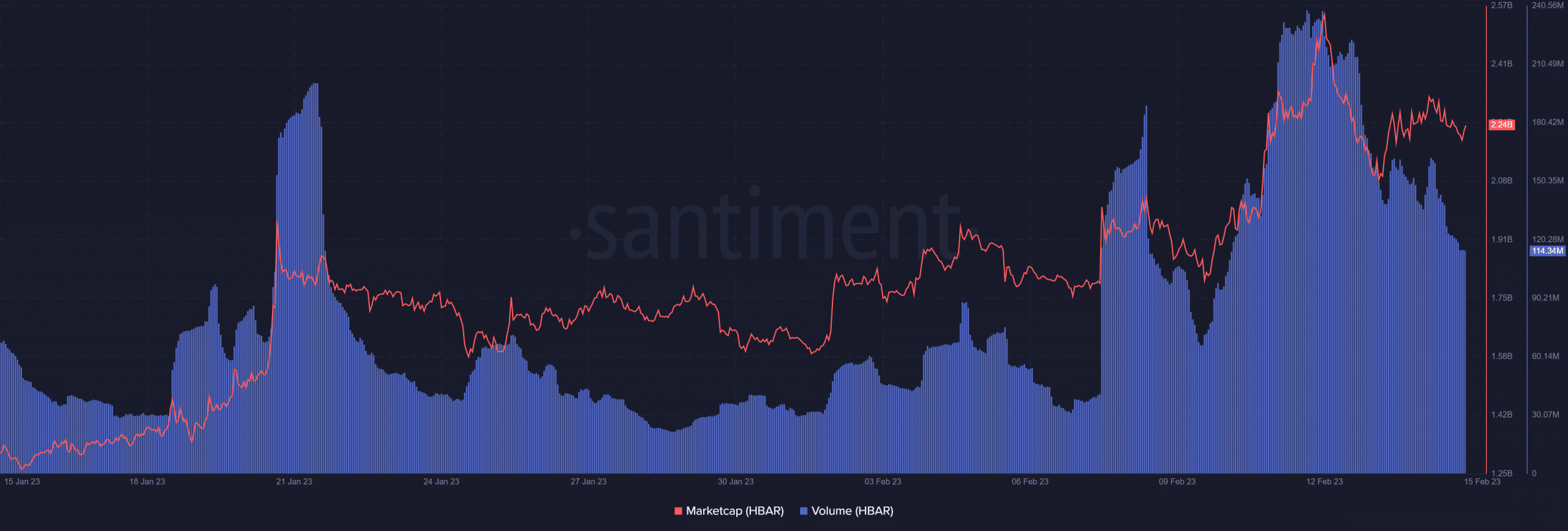

HBAR also retested overbought territory, and sell pressure is likely to manifest under such conditions – especially if the price was previously heavily bullish. This is because investors that are deep in money may want to secure profits. Significant outflows of roughly $310 million have already taken place in the last three days.

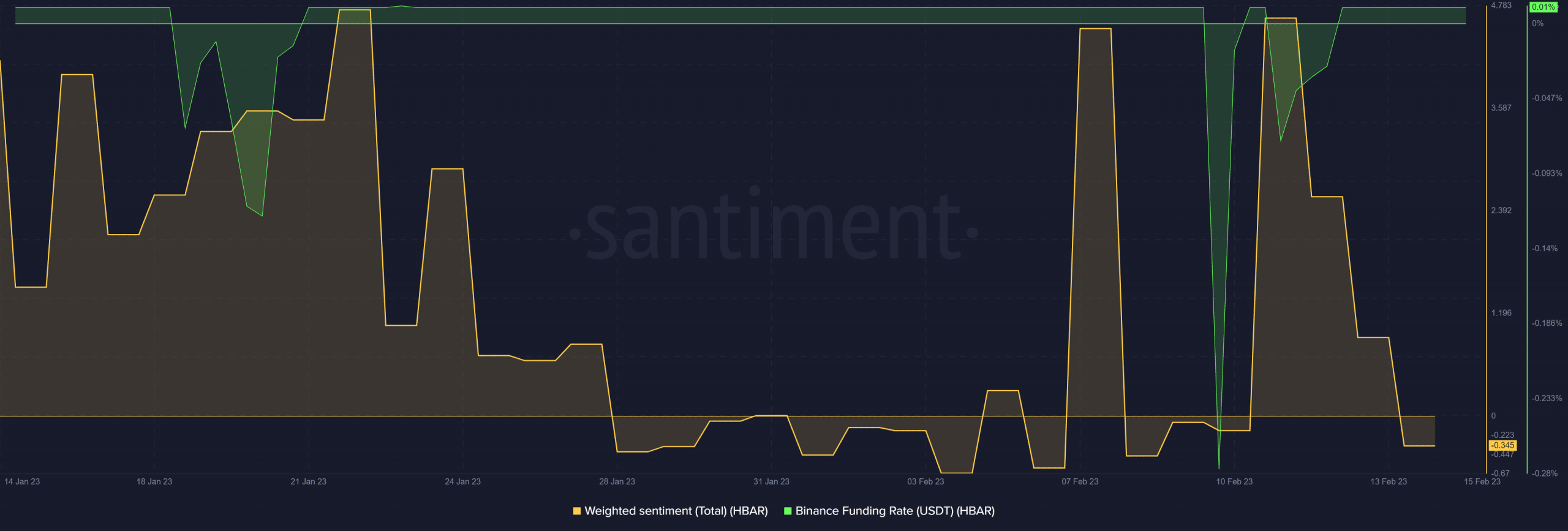

HBAR’s volume also tanked substantially during the same period, confirming that the bullish sentiment is no longer in control. This reflected the weighted sentiment which dropped in the last three days in favor of the bears.

Source: Santiment

Despite the bearish sentiment, HBAR’s Binance funding rate maintained consistency during the same period. This suggested that there was still a healthy demand in the derivatives market.

Is your portfolio green? Check out the Hedera Profit Calculator

What should HBAR investors expect?

Both the price and metrics analysis pointed towards contrasting signs. While the metrics and the price-RSI divergence highlighted a potentially bearish outcome for the next few days, the golden cross suggested otherwise. But this is not the only bullish sign. The HBAR Foundation just announced a strategic partnership between Hedera and the Virtual Power Exchange (VPE).

We’re excited to announce that the Virtual Power Exchange (VPE), a joint venture between @Securrency and @BOSSControls, has selected @Hedera #ReFi to create a first of its kind digital energy exchange platform for retail market participants ? pic.twitter.com/Psnz4LrvgG

— HBAR Foundation (@HBAR_foundation) February 14, 2023

The partnership will allow Hedera to host the first digital exchange platform. This came amid the call for healthier environmental practices, allowing for new industries to be formed around such issues. But is this enough to curtail profit-taking? That remains to be seen, but it adds to the list of Hedera’s latest achievements that contribute to network growth.