Hedera [HBAR] looks ripe for an unprecedented recovery thanks to its…

Hedera’s native crypto, HBAR looked like it was set for a bullish recovery in the first week of May after dipping into oversold territory. This was before the market unexpectedly took a turn for the worse, resulting in more downside but it is once again looking bullish.

HBAR received a roughly 42% discount in the last seven days as the crypto market suffered one of its worst crashes in recent history. The cryptocurrency crashed from its $0.155 weekly high to its latest low at $0.073.

It has since recovered to $0.1028 at the time of writing, after bouncing from its long-term descending trend line. The token was up by 31.84% over the last 24 hours.

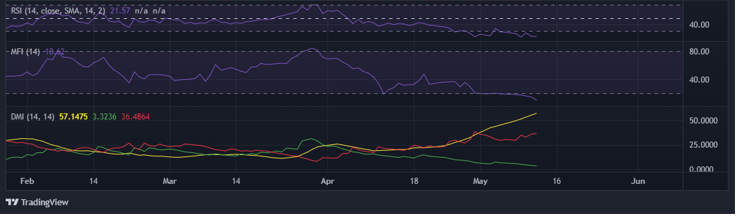

The bounce-back might be a sign that HBAR bulls are finally ready for some action. This outlook is further supported by HBAR’s deeply oversold price as the RSI points out. At press time, RSI rested at the 31-mark. On the other hand, the Money Flow looked ripe for accumulation.

HBAR’s ADX on 12 May was at 57.14, reflecting the strong trend but the –DI registered some sideways performance in the last few days. This might be a sign of bearish trend exhaustion considering HBAR’s heavy selloff.

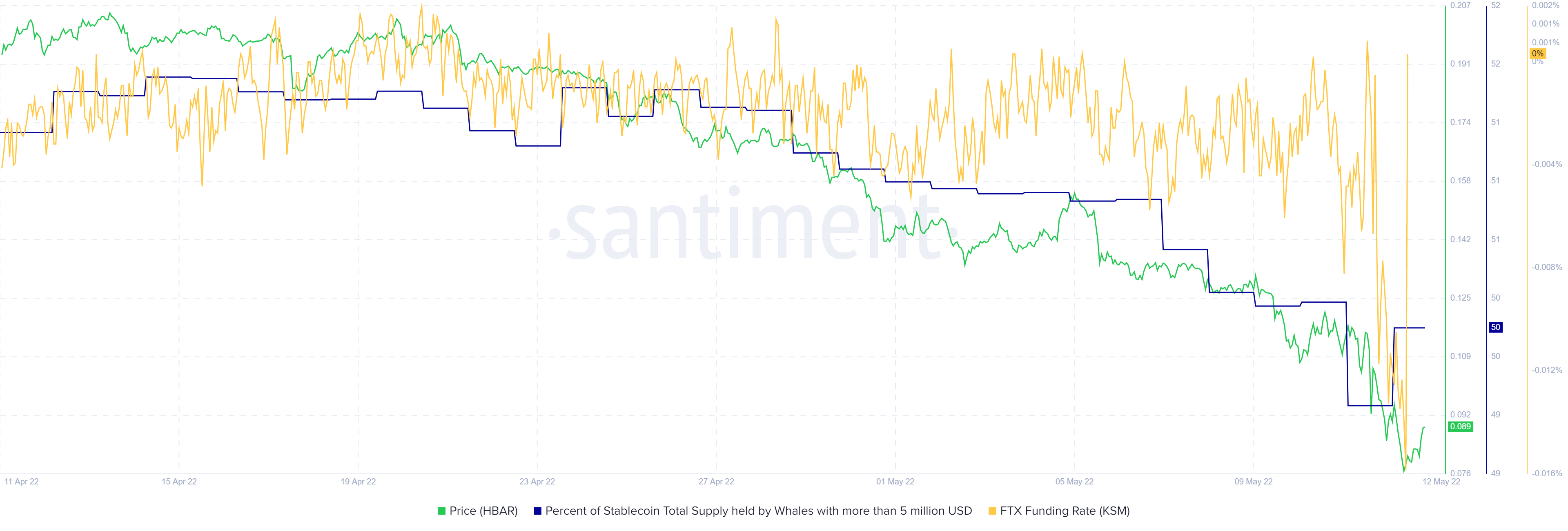

HBAR’s on-chain activity may also be in line with the expectations of bullish recovery. For example, the total supply held by whales metric registered a noteworthy increase in whale holdings in the last 24 hours.

The FTX derivatives funding rate achieved a rapid recovery during the same period. This was after previously dipping to its lowest monthly levels.

Extended selloff?

Recovering interest in the derivatives market may mirror activity on the spot market. It also aligns with the uptick in supply held by whales and helps to formulate the view that it is ready for a bullish reversal. However, the latest events in the market have shown that there is always the risk of more downside.

HBAR can still extend its bearish performance if it fails to secure enough buying volume. Such an outcome might occur if the current sentiments prevail. The market is heavily correlated and this means altcoins such as HBAR will continue mimicking BTC’s price action. In other words, HBAR’s recovery is heavily hinged on whether Bitcoin will give way to the bulls.