Here are the summer 2021 projections for Ethereum and DeFi tokens

The spring of 2021 has been largely driven by Bitcoin’s rangebound price action, ETH rallying towards a target price of $3,000, and DeFi’s rally.

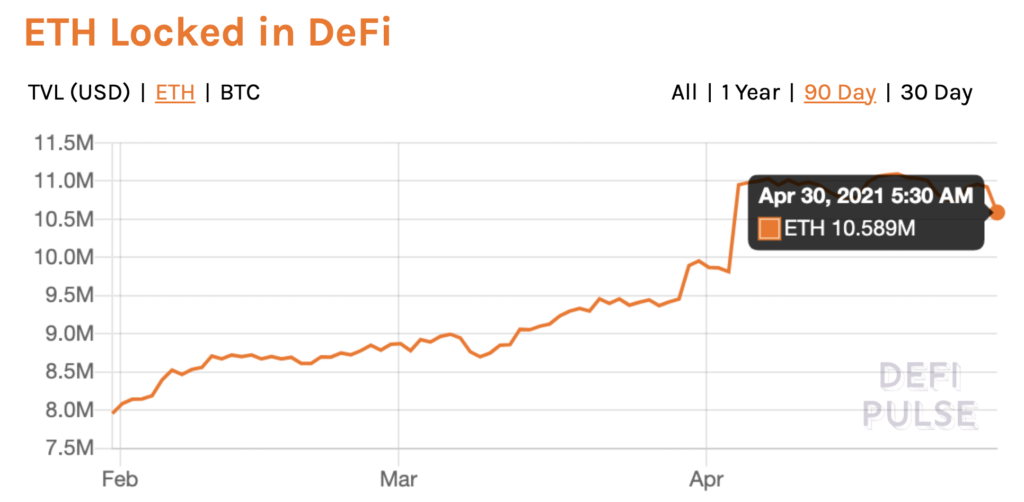

Since April 2021, over 950k Ethereum have been moved from top centralized exchanges. At the same time, the percentage of Ethereum in circulation now locked in DeFi protocols has risen from 8.5% to nearly 10%. This could signal the beginning of a supply scarcity, one that may manifest in the summer of 2021.

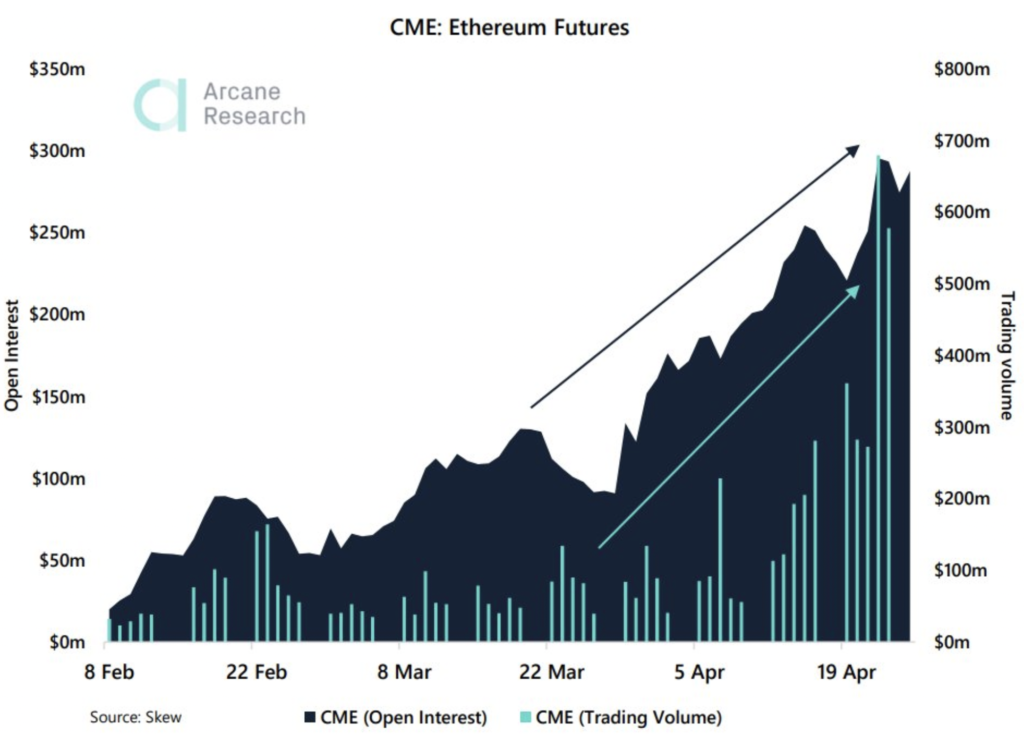

CME ETH Futures || Source: Twitter

While hedge funds are taking time to warm up to ETH, there has been a hike in interest in DeFi projects. ETH loans make up a high percentage of the loan book of institutions, however, the investment flows have shifted from ETH to DeFi and back again this season.

Additionally, it is exciting that Ethereum’s innovative ideas and scaling solutions are being built with speed, especially since DeFi projects have high demand and a high number of unique users. In fact, quite a few DeFi projects were created to boost trades and solve scaling issues on the ETH network, helping traders to long ETH.

ETH locked in DeFi || Source: DeFiPulse

Projects like Polygon’s MATIC that is a layer 2 solution have contributed to the increasing TVL on account of the increasing market capitalization and the price rally. Due to Polygon’s collaboration with ETH, there are top DeFi projects like AAVE and CRV that are building on the ETH network. This doesn’t pose a challenge since ETH has users and demand owing to its technical development and updates.

What’s more, DeFi teams have expanded from ETH to other EVM-compatible chains like Polygon and there are projects starting on BSC before moving to ETH, instead of the other way around.

Based on how the market’s L1, L2 ecosystems have been doing, top projects like SOL, MATIC, FTM, and AVAX have all led the rally in the Spring of 2021. The trend reversal in DeFi is covered for by the scaling up of the ETH network. Traders are generating consistent demand across exchanges and buying dips until ETH’s volatility is high enough to support a price rally to the $3,000-level.

Finally, L2 solutions have protected whales and institutions from high fees and this has supported ETH’s increasing market capitalization. At the time of writing, ETH’s market capitalization was north of $330 billion and the price continued to remain below the $3,000-level, despite the volatility this spring. Traders are anticipating that this may change over the summer of 2021.