Here’s how Bitcoin’s hashprice may affect BTC soon

- The Bitcoin hashprice has decreased, indicating a possible rebound for the coin.

- BTC was not trading near its premium, and a buying opportunity seems to have appeared.

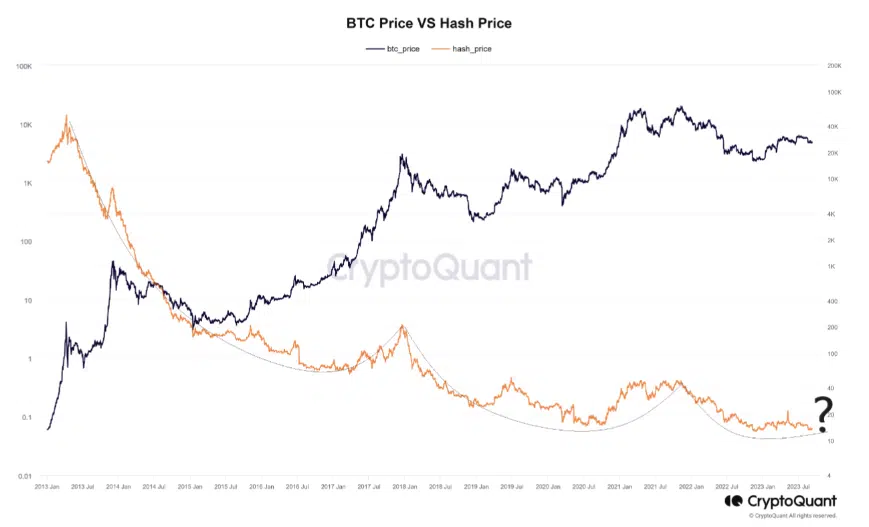

Quantified as the amount a miner can expect to earn from block subsidy and transaction fees, the Bitcoin [BTC] hashprice has historically influenced the coin price. While BTC’s price has increased significantly since its inception, the hashrate has subsequently decreased.

Is your portfolio green? Check the BTC Profit Calculator

This relationship led on-chain analyst Woominkyu to check out the current situation between the BTC and the hashprice. Woominkyu, in his CryptoQuant publication, noted that the decrease in hashprice, could be connected to the energy costs and a hike in competition in the mining industry.

BTC: Ready to bounce back?

The analyst, while referring to history, noted that a signifcant decrease in Bitcoin hashrate lays the ground for price rebound. At press time, the metric had significantly reduced. Therefore, he concluded that.

“Given the current circumstances, a resurgence in Bitcoin and hash price would not be out of the ordinary, and could be expected in the near future.”

For a while, miners have been cashing in on their BTC holdings. At the same time, they’ve enjoyed an increase in fees generated via transactions on the network. These events have affected the BTC price negatively.

However, the market cap to Thermocap ratio suggests that BTC is currently cheap. The metric is simply calculated as the division between the market cap and the Thermocap. Its function is to assess if the asset’s price is currently trading at a premium when compared with the total security spent by miners.

If the ratio rises into the red region, it implies that Bitcoin is trading at a premium. Whenever the ratio falls into the red area, it implies that the coin is undervalued. At the time of writing, the market cap to Thermocap ratio was 0.00000051, close to the green region.

Secure the king for the long term

Another metric that connects mining state and the Bitcoin price is the hash ribbon. This metric indicates when the worst of miner capitulation is over. This happens when the 30-day Moving Average (MA) is above the 60-day MA.

Read Bitcoin’s [BTC] Price Prediction 2023-2023

When the 60-day MA is above the 30-day MA, it implies an increase in miner capitulation. As of this writing, the Bitcoin hash ribbon has moved from the light red to the dark red area. This meant that BTC, at $25,671, could be a good buying opportunity for those intending to hold for the long term.

However, investors may need to be careful about assuming that the rebound may occur soon. As it stands, BTC may continue to hover between $25,000 and $26,000. Also, another decline below the said threshold could happen before a recovery.