Here’s how Pepe traders can profit as volatility dies down

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- PEPE offered a buying opportunity after another retest of a significant support level.

- It lacked a trend on the higher timeframes but could still register sizeable gains in July or early August.

Pepe [PEPE] saw a higher time frame downtrend from May to mid-June. Around the period of 19-22 June PEPE saw gains that measured close to 95%, breaking it out of the previous slump. This swift bullish victory was followed by a range formation.

Read Pepe’s [PEPE] Price Prediction 2023-24

This could be healthy in the long term as it allows investors to dollar cost average into positions. For short-term traders, there was some volatility over the past month and they can expect gains after the retest of the support level.

The range formation and the month-long support highlighted the levels traders can keep an eye on

Since 21 June PEPE has traded within a range (yellow) that extended from $0.00000136 to $0.00000185. Within this range, the support level at $0.00000148 (dotted orange) has been significant as well.

At the time of writing, PEPE was trading just above this support level. Yet, the market structure was bearish as the price formed a series of lower highs and lower lows after the rejection from the range highs at $0.00000188.

The Directional Movement Index showed there was no strong trend in progress over the past few days. The CMF was at -0.04 but was lower last week, which showed capital flow out of the PEPE market. The RSI was also below the neutral 50 mark.

How much are 1, 10, or 100 PEPE worth today?

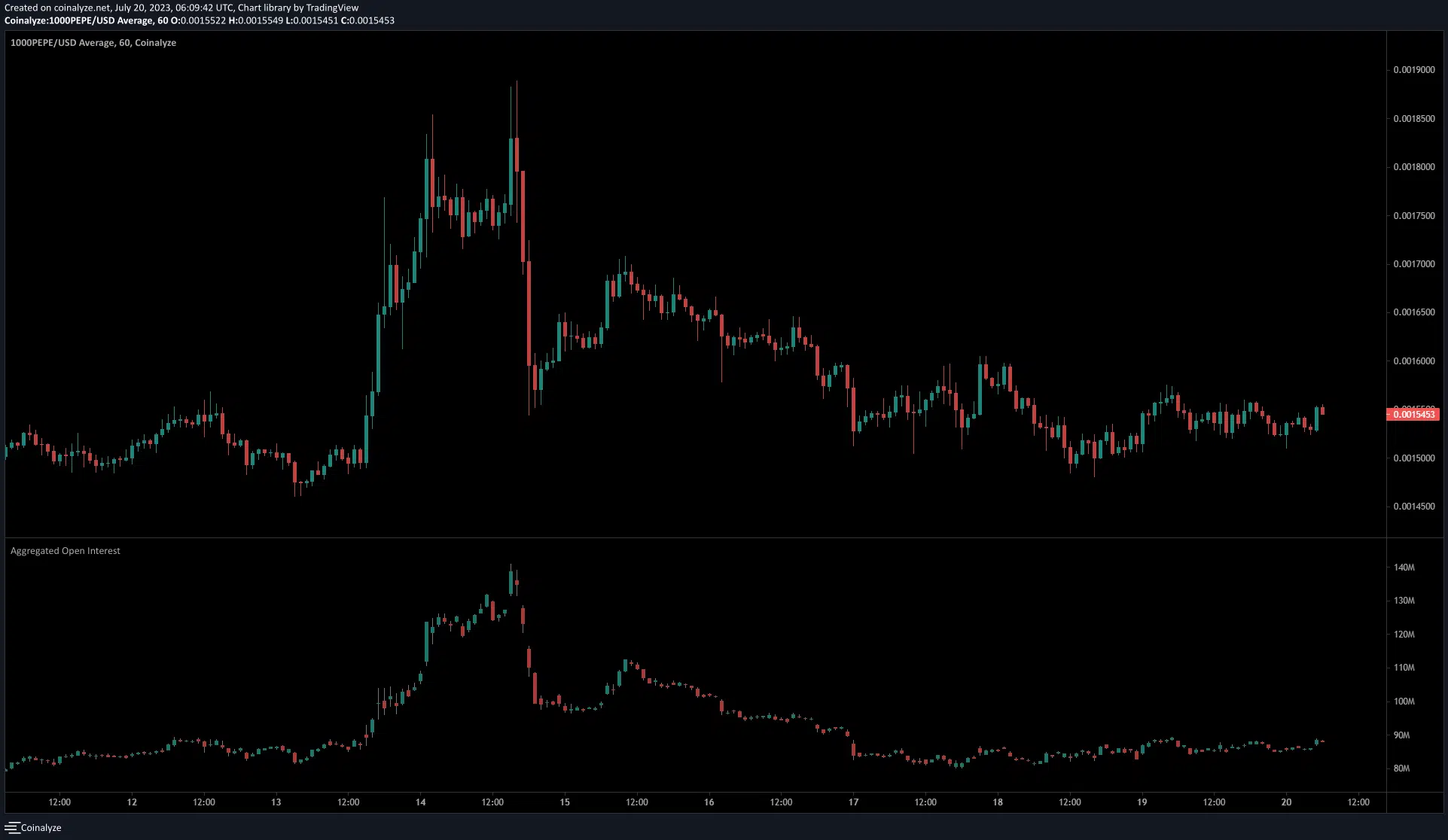

The Open Interest showed bullish belief was slowly solidifying

Source: Coinalyze

Since 17 July, the Open Interest chart has formed higher lows on the chart and slowly trended higher. During this time the price action did not see a trend but stayed just above the support level at $0.00000148.

This was indicative of speculators slowly shifting bullish, but PEPE has not registered much gain yet. The price action and volume indicators showed that buyers were not strong yet, but the support level has been defended and PEPE prices could be pushed higher over the next week.