Here’s the caveat to Bitcoin Cash, Ethereum Classic’s price actions

On the back of recent gains, most altcoins started moving north too. In fact, before minor corrections set in, these alts saw pretty decent rallies, with Bitcoin Cash and Ethereum Classic among them. However, what really matters is whether they can sustain these rallies or not. For the likes of BCH and ETC, this is a very critical question.

What does the price say?

Both Bitcoin Cash and Ethereum Classic were up more than 40% since 20 July, at the time of writing. While both altcoins followed Bitcoin’s footsteps, their individual price trajectories were slightly different. ETC started presenting a more consolidated price range and lower volatility only since 27 July. While ETC has had more than five red candlesticks on the 12-hour chart since, BCH has had only two.

Now, the general market perception today is one of confidence about Ethereum Classic due to its ecosystem-centric developments. However, the same sentiment hasn’t been shared by its trade volumes. While there were high candlesticks for ETC highlighting more trade, when compared to last month, BCH had more significant trade volumes.

BCH’s trade volume (in green) on 26 July was the highest since 24 May.

Further, on the 12-hour chart, while ETC never entered the overbought zone during this rally, BCH was overbought at the time of writing. Its Relative Strength Index had a reading of 71.

A disclaimer for Bitcoin Cash

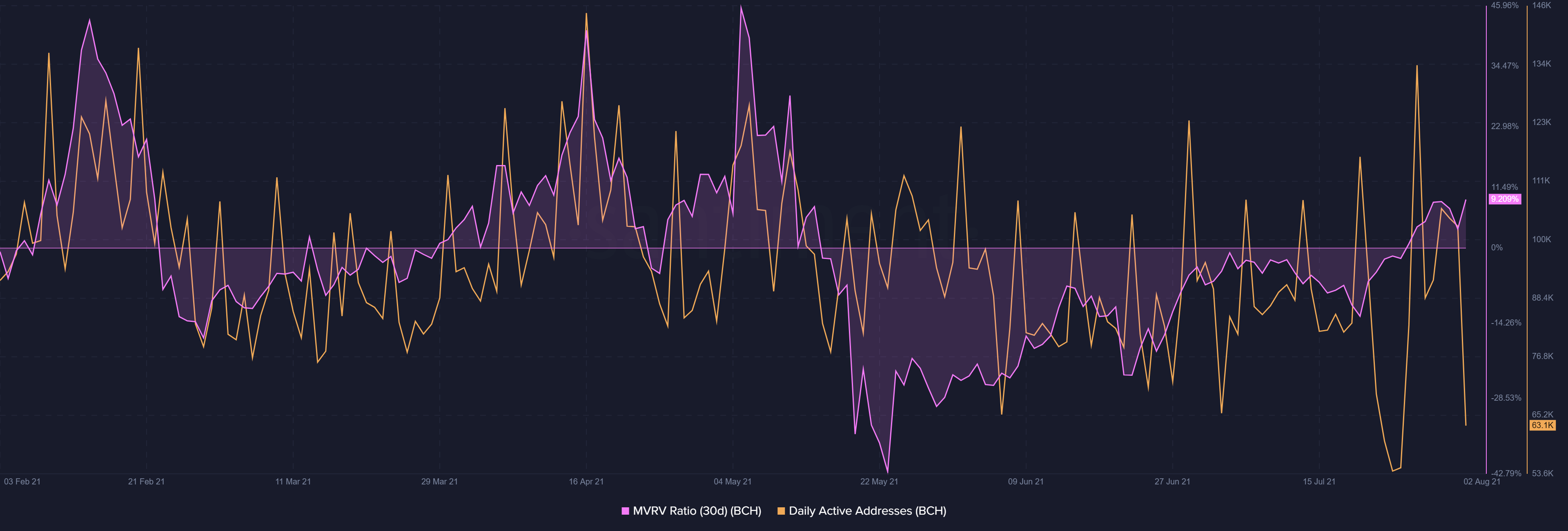

On Bitcoin Cash’s four-year anniversary on 1 August, price-wise, the alt seemed to be doing pretty good. Corresponding to that, the MVRV Intraday (30day) for BCH saw a spike – Its highest value since 12 May. All through the end of May till almost July-end, the MVRV for the asset was negative. This leap finally meant that BCH holders were making some money after a long while.

However, a fall in daily active addresses for BCH meant that there were fewer participants in the market. A sharp decline in the same was seen too. Furthermore, velocity for the altcoin also highlighted a downtick which meant that a single BCH token was being used less in daily transactions now than a few days back.

This downtick in velocity also meant that adoption has been going down. Even though BCH looks neutral on the charts, it’ll be best to wait before making any moves.

Coasting on the strength of its network?

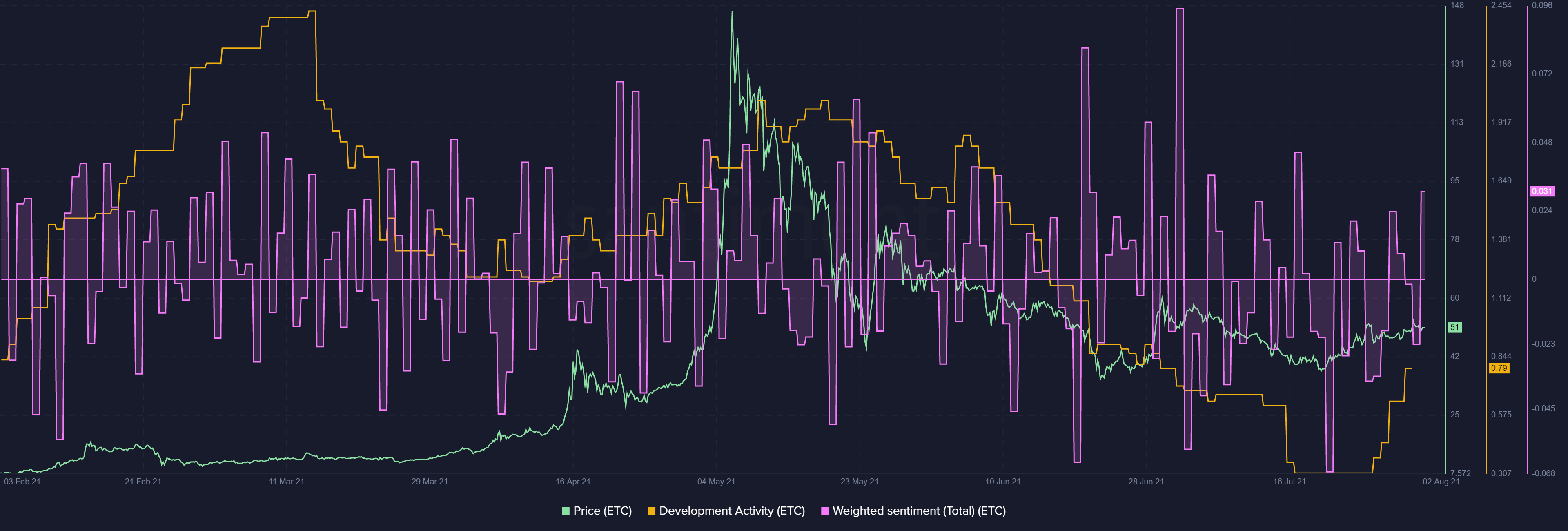

Ethereum Classic was one of the few star gainers of Q2, as highlighted by this article. However, during the latest rally, ETC couldn’t register gains as high as the ones seen by other alts, including Bitcoin Cash. Nevertheless, network-wise, ETC seemed to be in a good place.

Ethereum Classic saw sustained growth in its development activity towards the end of July. At the time of writing, the development activity was the highest since 30 June. Also, ETC presented a good social image with its weighted sentiment reading the highest since 17 July.

So, are ETC and BCH looking strong

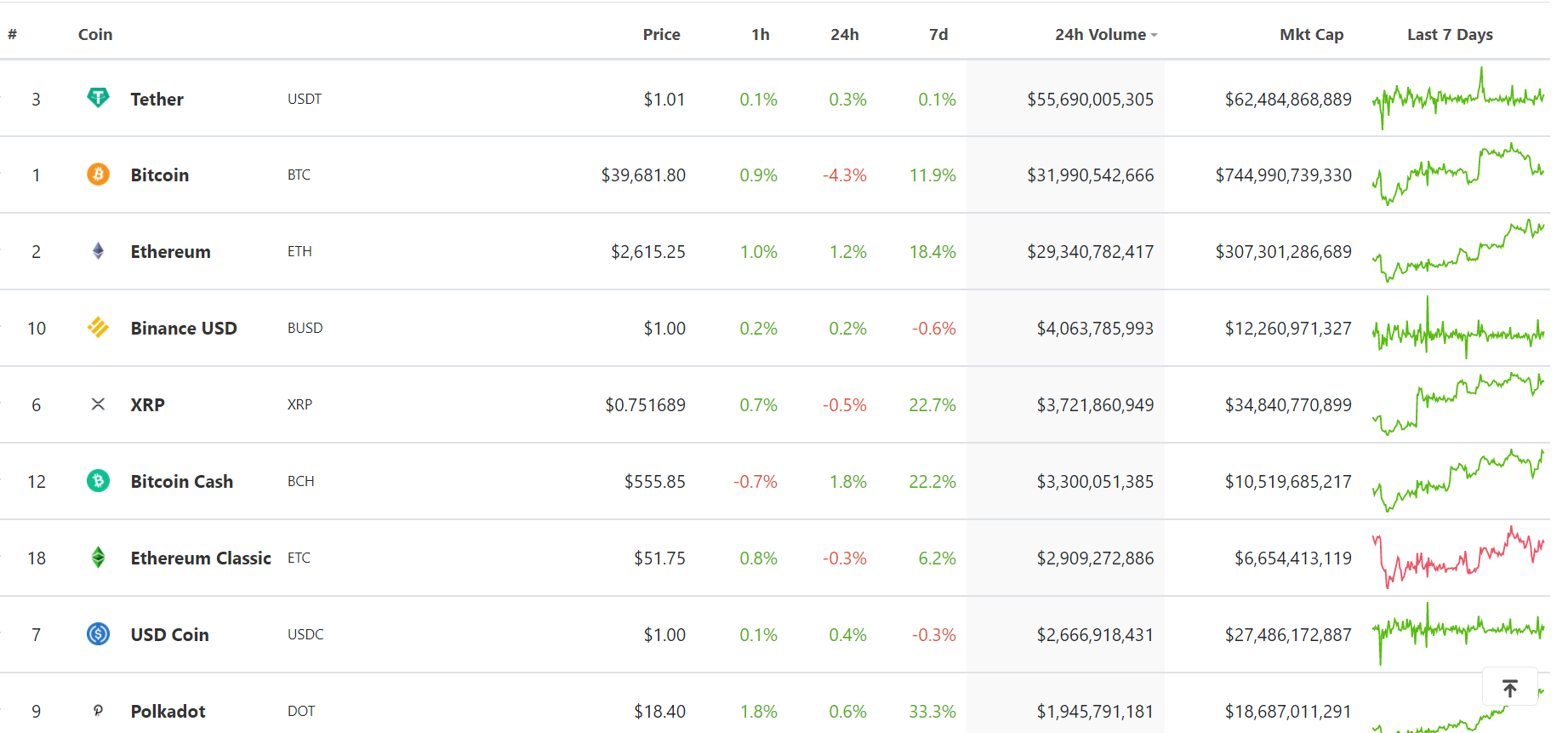

While BCH looked stronger in terms of price gains, ETC seemed to have stronger network activity. Nonetheless, one thing that both cryptos had was high 24-hour trade volumes, at the time of writing.

In fact, both BCH and ETC had higher volumes than cryptos ranked high such as Cardano, Polkadot, and Binance Coin.

![Uniswap [UNI] price prediction - Traders, expect THIS after altcoin's 14% hike!](https://ambcrypto.com/wp-content/uploads/2024/12/UNI-1-400x240.webp)