Here’s the whole story behind Bitcoin’s funding rate

Bitcoin touched yet another milestone this week, with the cryptocurrency going past the price level of $50,000 and later, $52,000. In fact, right now, the narrative of “It is closer to $100,000 than $0” is taking precedence over any other.

The bullish momentum accompanying BTC’s price movements have permeated different parts of the digital asset industry, with the same highlighted by the derivatives ecosystem too.

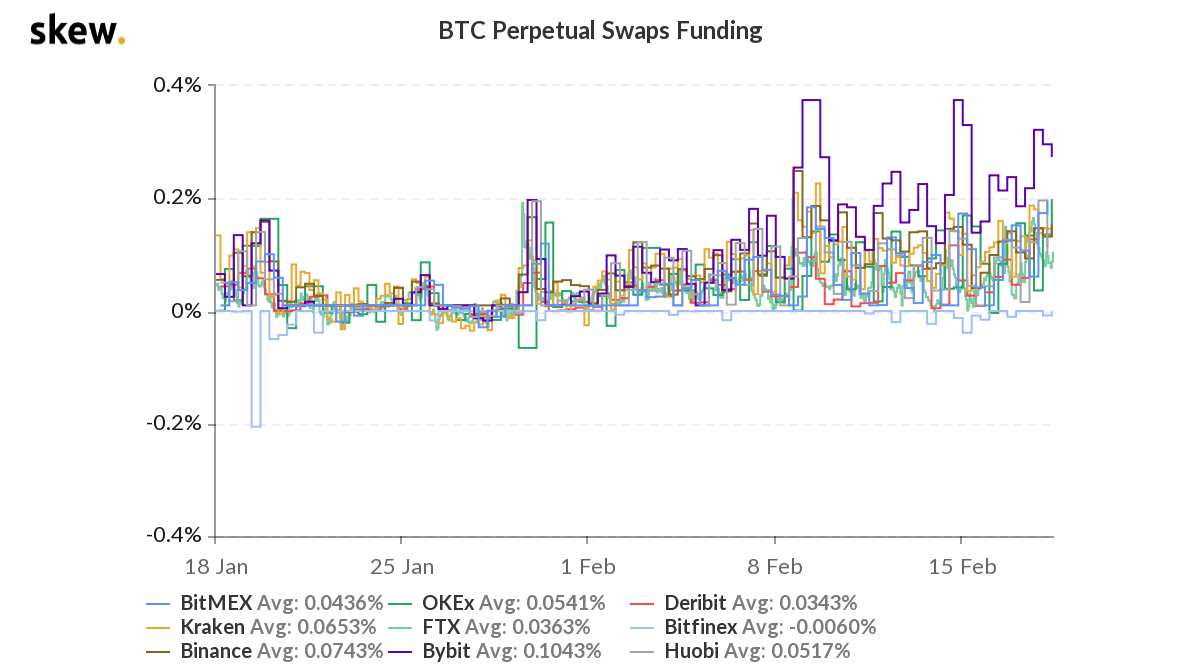

Funding Rate is soaring high across exchanges

According to Skew, the BTC Funding rate across some derivatives exchanges has soared to its highest level since May-June 2019 lately. While the funding rate, on average, is still higher than the rate seen over that period, it is much closer in comparison.

A hike in funding rate usually indicates that the number of longs is much higher than the number of shorts. A higher number of longs entails that the collective market is more bullish than before for another leg of price discovery on the charts.

Bitcoin: Realized Volatility rises, but Implied Volatility drops?

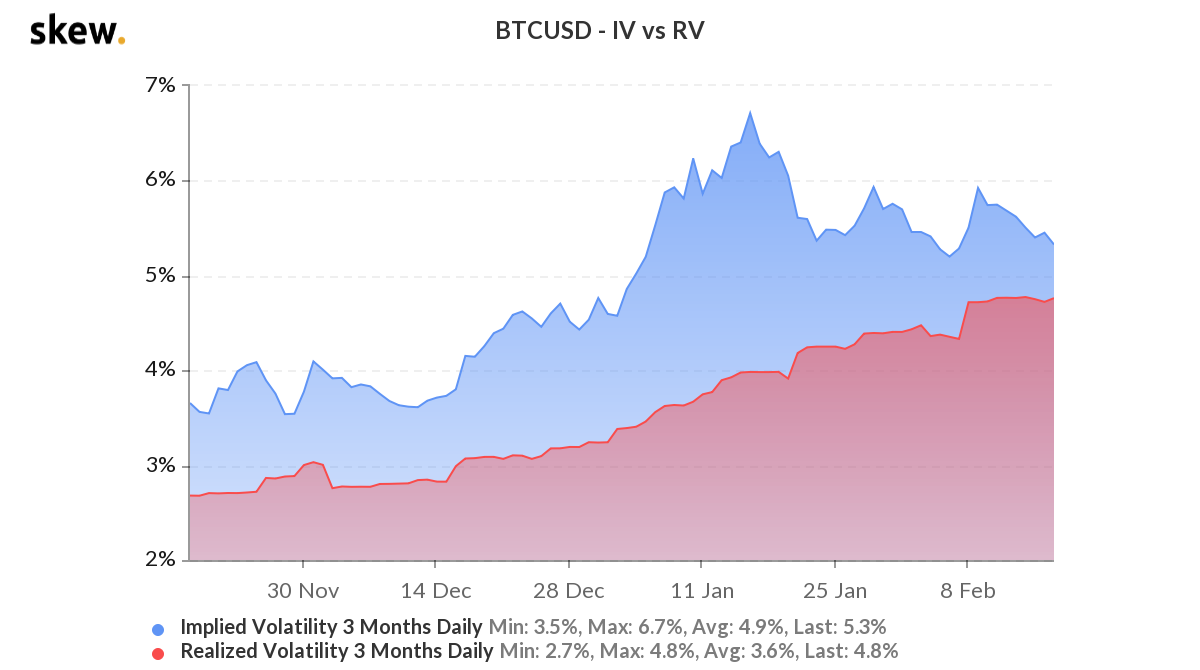

Since the beginning of November, Realized Volatility has risen on the chart at a steady pace. While the Implied Volatility charted a similar pattern too, since the turn of January, the same has underlined low volatility expectations despite the RV continuing to rise, exhibiting a move against expected volatility.

Now, though this is particularly positive for swing pricing, it also opens up the possibility of a sudden breakout downwards.

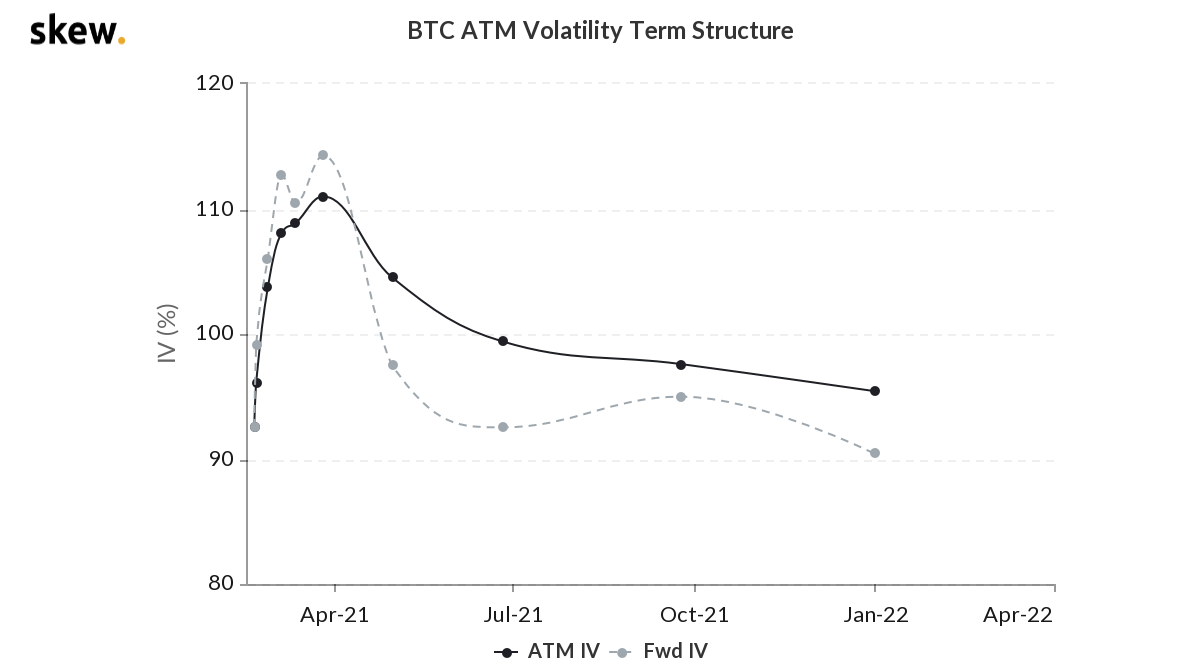

Further, Bitcoin’s ATM Volatility term structure also seemed to point towards a reduced volatility space for the rest of the year, suggesting a steady rise or steady decline from here onwards.

Is the collective trend positive though?

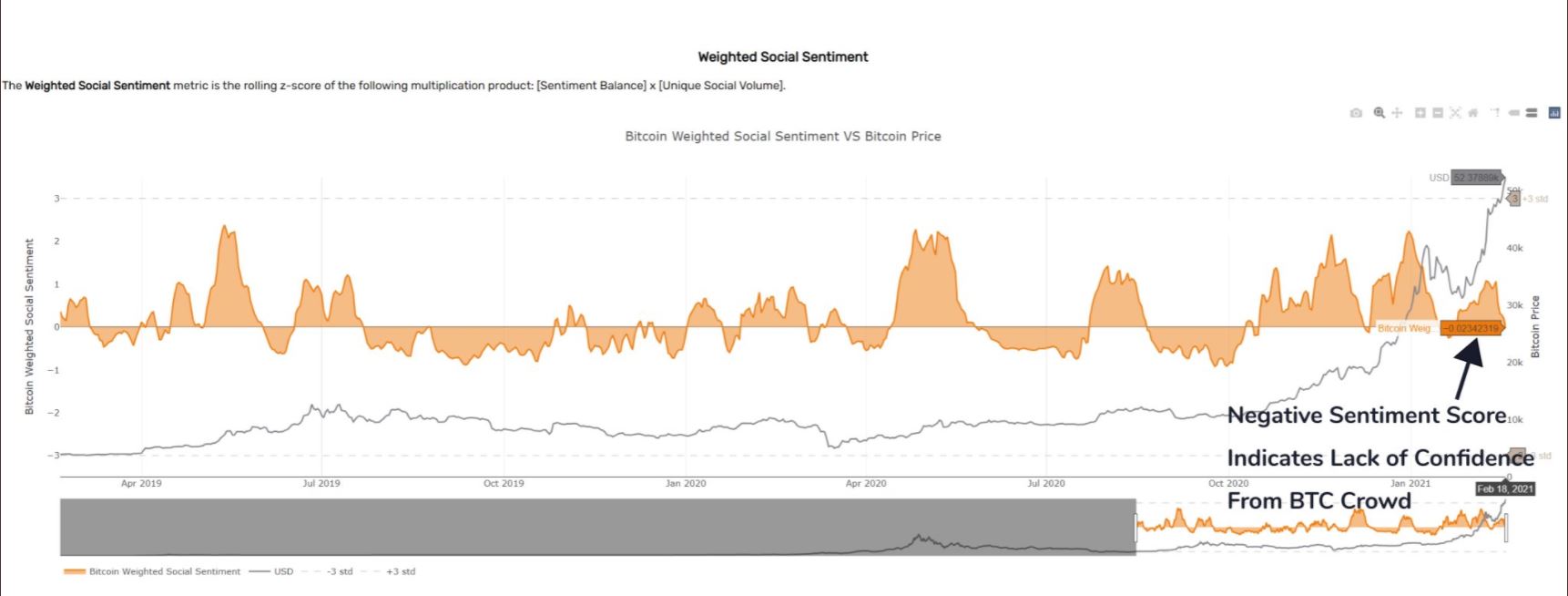

Here, it’s worth noting a contradictory metric too. According to Santiment, its weighted sentiment tracker for the world’s largest cryptocurrency has been rather negative following Bitcoin’s hike past $50,000. In fact, positive commentary slowed down while the social volume dropped too after BTC crossed the said level.

It is important to consider such developments with a pinch of salt, however, since many altcoin proponents may be responsible for less than positive commentary as well, alongside crypto-skeptics.