Here’s what Apple’s trajectory reveals about the future growth of BTC

The top cryptocurrency Bitcoin and all its correlated assets in the market have been facing considerable volatility since the market crash in May last year. And, its effects have been especially evident over the past few months. After reaching an all-time high of over $69,000 in mid-November, the digital asset was creating lows around $33,000 by the end of January. BTC had fallen 41% since its November ATH and was trading at $40,693 at press time, having lost 7.4% of its valuation in just the past day.

Effects of Network Adoption

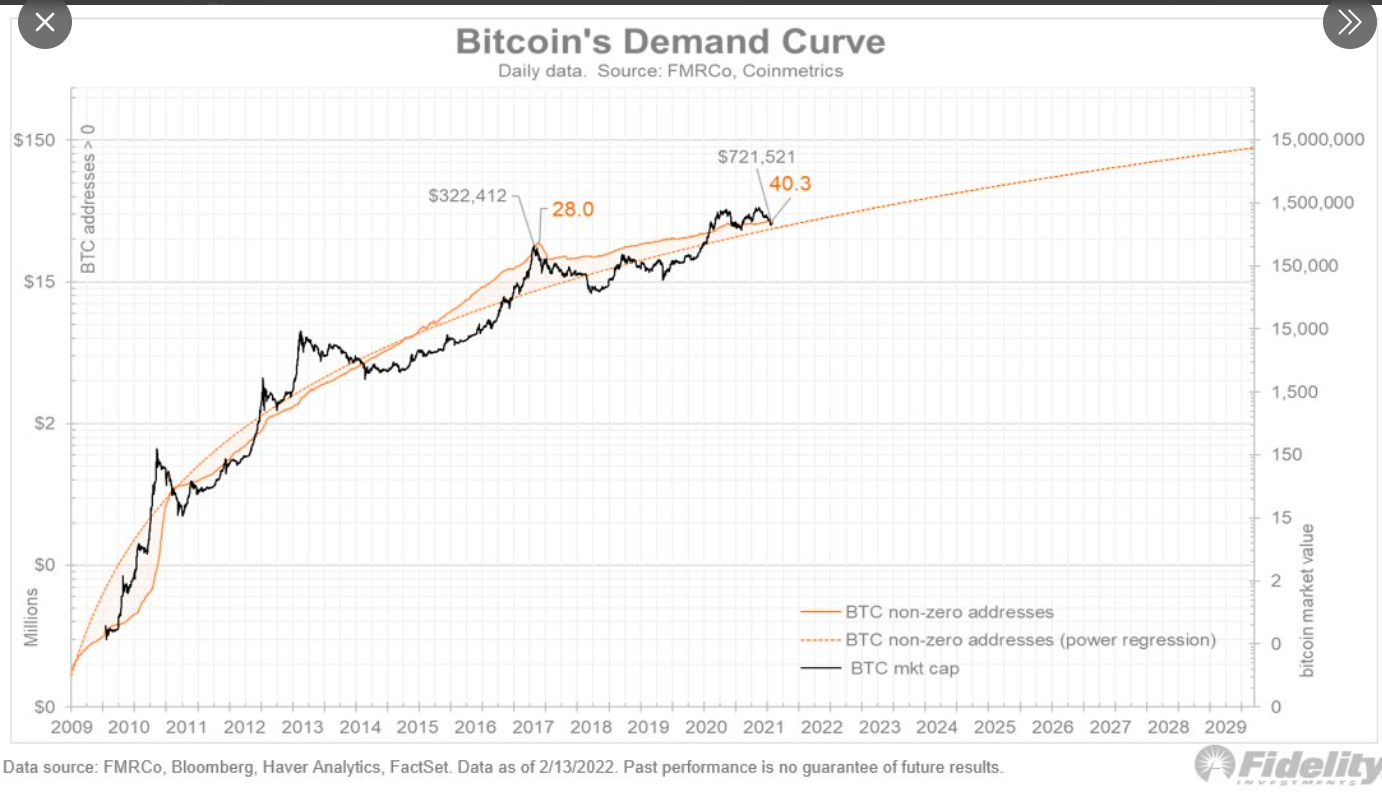

However, asset manager Fidelity’s Head of Macro Jurrien Timmer believes that the concern about Bitcoin’s price performance ‘is mostly noise’, and what really matters is Bitcoin’s network effects. Taking to Twitter, the exec claimed that the virtual asset’s demand curve portrayed the real picture of Bitcoin’s growth, as active and non-zero addresses have been on a constant upward trajectory, regardless of its market capitalization.

Interestingly, Timmer also noted that Bitcoin’s s-curve, which measures adoption, has often been compared to that of the early internet and mobile phone users. In fact, the growth of technology giant Apple can also provide a reasonable idea of Bitcoin’s future growth.

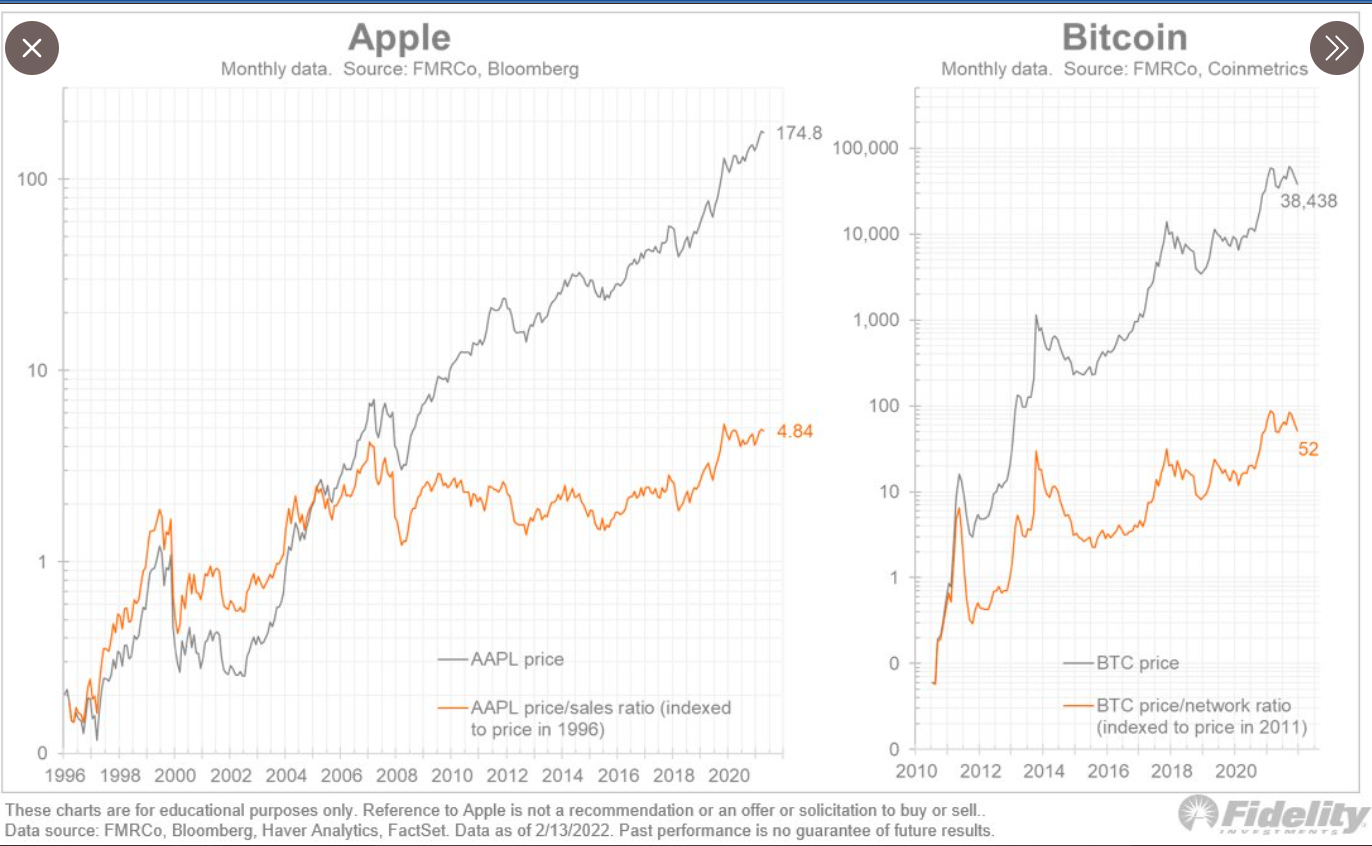

Drawing out an S-curve for Apple based on its growth over the past three decades and applying the Metcalfe law, which says that the value of a telecommunications network is square of the number of connected users in the system, Timmer pointed out that Apple’s network has increased 53x since 1996, while it’s market value, has increased 1699x. He added,

“If Apple’s increase in market value should have been roughly the square of its growth in sales, then we get an expected growth rate of 2855x for Apple’s market value. At 1699x, it’s in the ballpark.”

Apples to Oranges

Similarly, the exec noted that Bitcoin’s valuation has increased 867x since 2011, while its price has increased 640,633x. Hence, according to Metcalfe’s law, squaring 867 would give the value of 751,111, which ‘is roughly in line with the 640,633x.’

According to Timmer, Bitcoin and Apple ‘follow a similar path as dictated by their network growth’, and a similar overall long-term growth path can be derived from measuring the historical S-curves of mobile phone subscriptions and internet adoption.

This is not the first time that Timmer has derived an asset’s value from its network effects, as he had argued earlier that one of the reasons Ethereum was falling behind Bitcoin was because it didn’t have both scarcity and rising adoption playing in its favor.

And, he is not the only analyst believing so. Investment bank Wells Fargo in its recent report had claimed that Bitcoin was entering a hyper adoption mode akin to what the early internet had experienced in the mid-90s, which placed it in an ‘early, but not too early investment stage.’