Here’s what the purchase of Bitcoin worth $2.1B might mean

Bitcoin, in its bid, to continue rising, needs to find some support from its investors. The new all-time high registered a couple of days ago was the result of the consistent rally this month. And, when observed closely, you can see that the same rally also woke some previously dormant investors. This led to BTCs worth $2.1 billion running out of exchanges.

Bitcoin investors’ new move

Contrary to Ethereum investors’ behavior, Bitcoin is seeing more inflows from richer investors than retail. Addresses holding more than 100 BTC and the ones holding more than 10k BTC have been rising in numbers.

Bitcoin’s address distribution | Source: Glassnode – AMBCrypto

Most of these addresses have only appeared in the last 10 days, a period during which Bitcoin hit $65.9k and recorded a new all-time high.

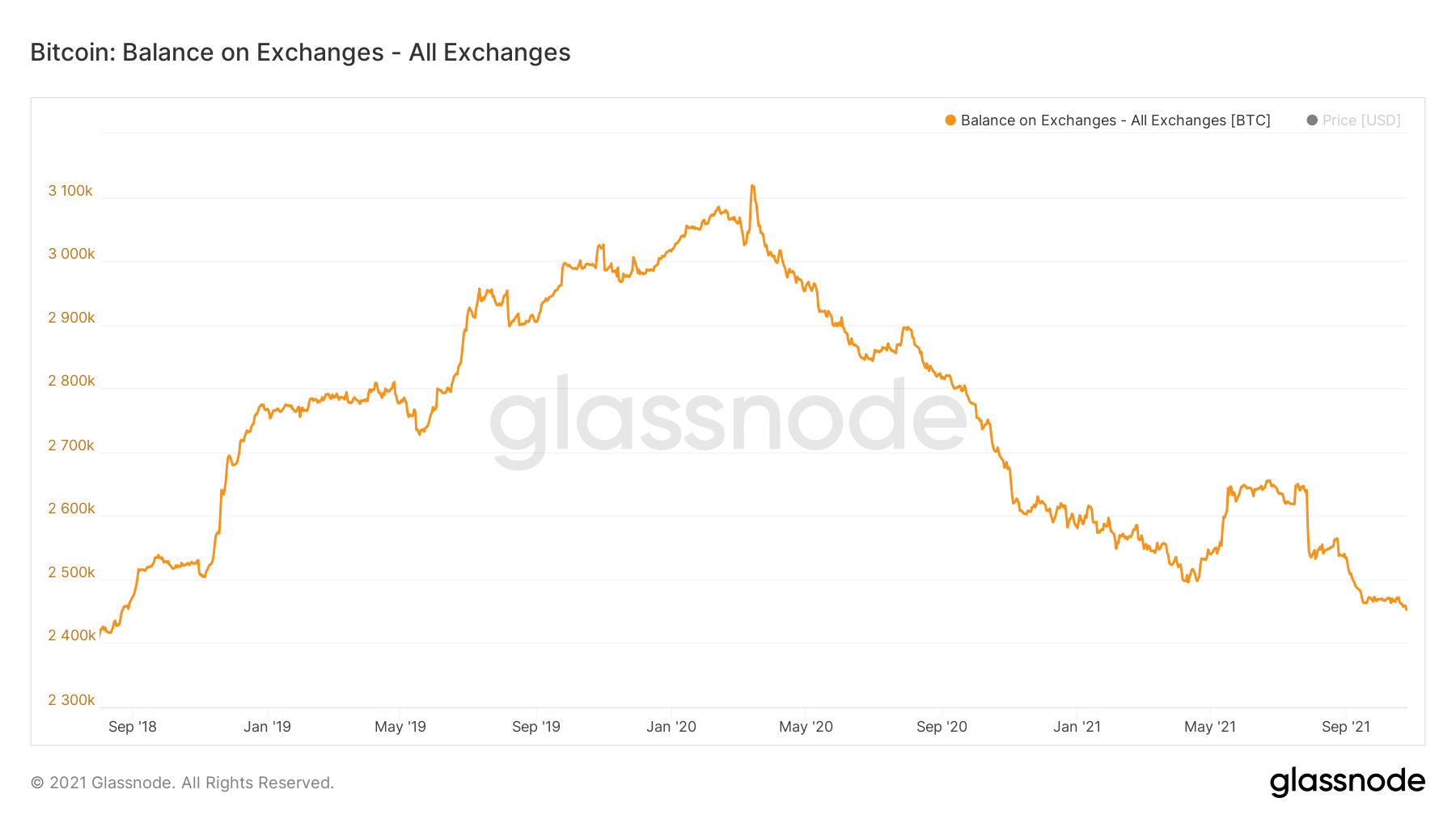

In fact, the accumulation has been so powerful that the balance on exchanges, in just 7 days, has dropped by 35k BTC. This suggests that more than $2.1 billion worth of BTC was purchased.

This led to the Bitcoin supply on exchanges falling to levels as low as those last seen in August 2018.

Bitcoin’s balance on exchanges | Source: Glassnode – AMBCrypto

However, even though it has mostly been accumulation, some long-term holders sold their holdings on 18 October 2021 and destroyed over 27.2 million coin days in the process.

This liquidation of long-time held coins also contributed to a rise in liveliness. This was a sign that long-term holders stopped accumulating. The indicator has since been stationary.

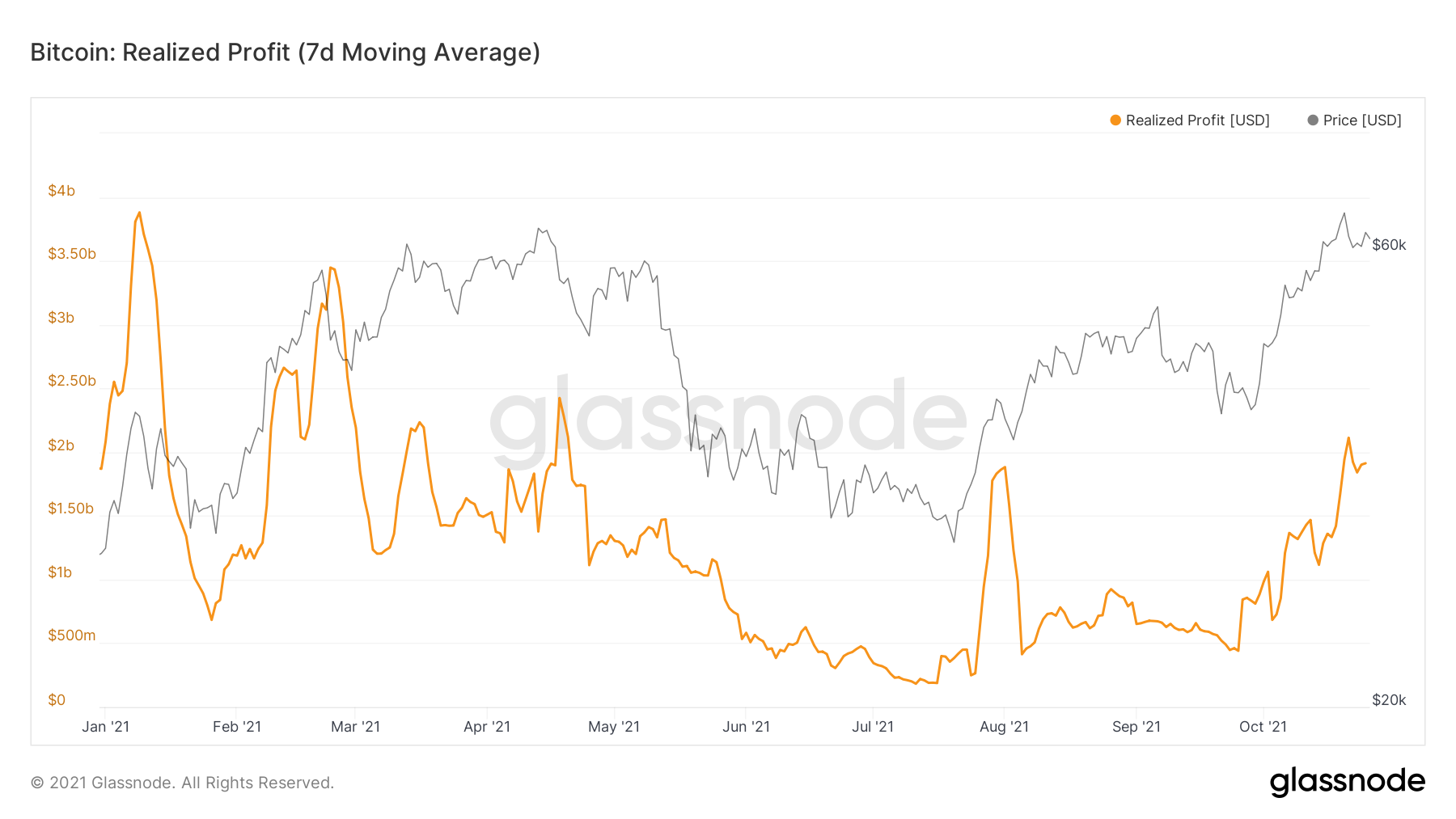

In any case, regardless of buying or selling, the fact is that all the coins have been in absolute profit this month. The realized profits haven’t been this high in 6 months.

Bitcoin’s realized profits | Source: Glassnode – AMBCrypto

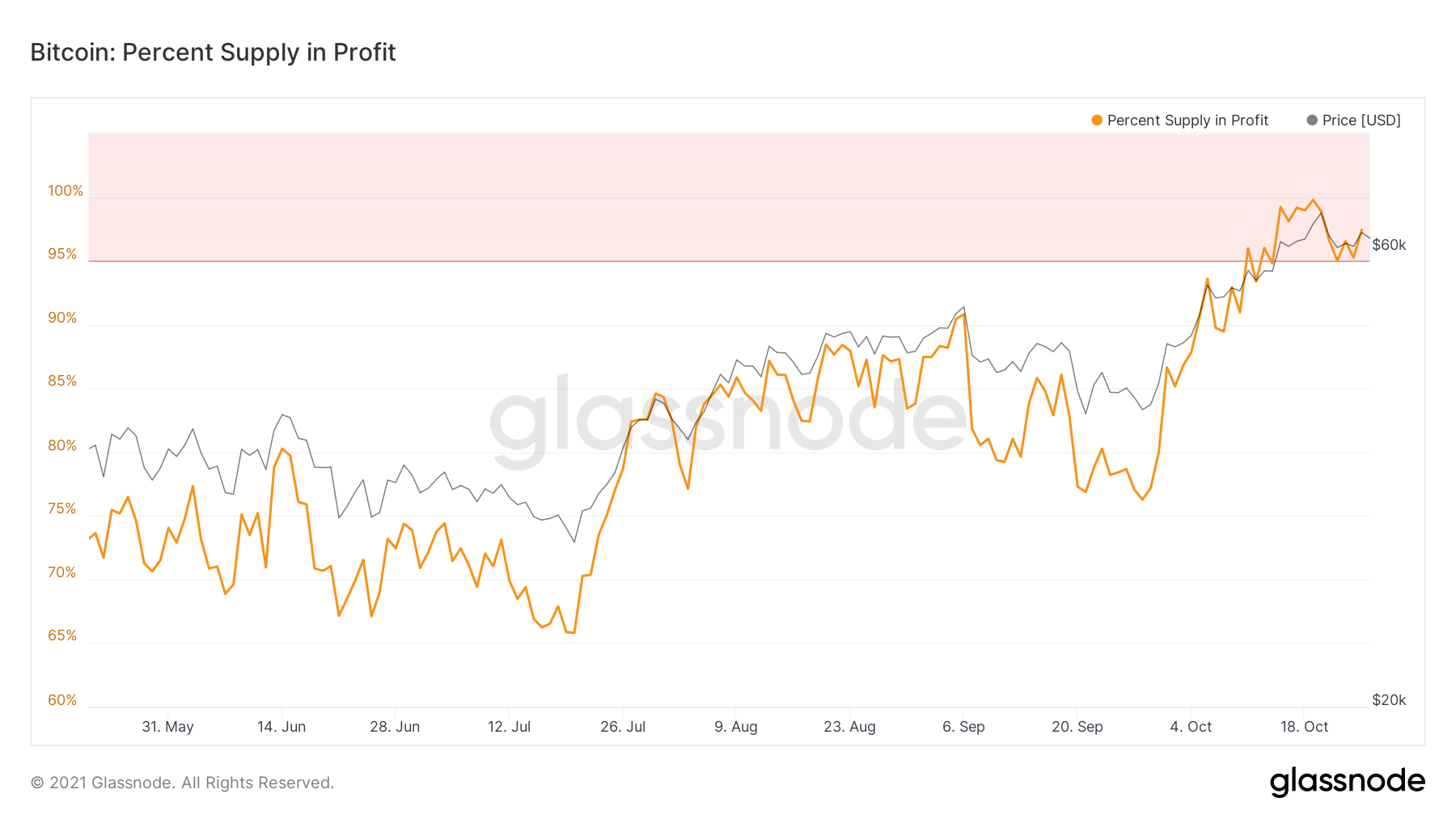

Although the fear of a price correction continues to loom over investors’ heads, looking at the percent of supply in profit, it is clear that more than 97% of all Bitcoin is in profit.

However, this also leads to the formation of a market top, post which there have mostly been bouts of price fall.

Bitcoin’s supply in profit | Source: Glassnode – AMBCrypto

Thus, all bullishness aside, investors must watch out for all possibilities before making any investment decisions.