Here’s why a full recovery for AAVE could take time despite bullish divergence

The new year has been relatively better for altcoins which have been doing well against the broader market sentiment. AAVE in particular has seen accelerated growth. The Defi money market platform has come up with a more concrete plan for 2022 focused on usability, aiming to push on-chain activity.

AAVE, after revealing plans to launch a new mobile wallet for users and further expansion to Curve Finance and SushiSwap for better scaling, had already upped the scales in the new year. Supporting the increased on-chain activity, AAVE had a decent start to 2022 as the price gained almost 14% in the first three days. But with the larger market crash, the Defi token too lost ground and slipped below the crucial $225 support.

Price needs some push

AAVE, at the time of writing, was one of the few tokens in the market with high gains in the short term. But with the larger rally weakening AAVE’s price trajectory, it looked like the alt would need some support. For the most part of December, AAVE’s parabolic recovery reassured the market of a solid rally. However, the plans of the same were hindered after the over 30% fall starting 4 January.

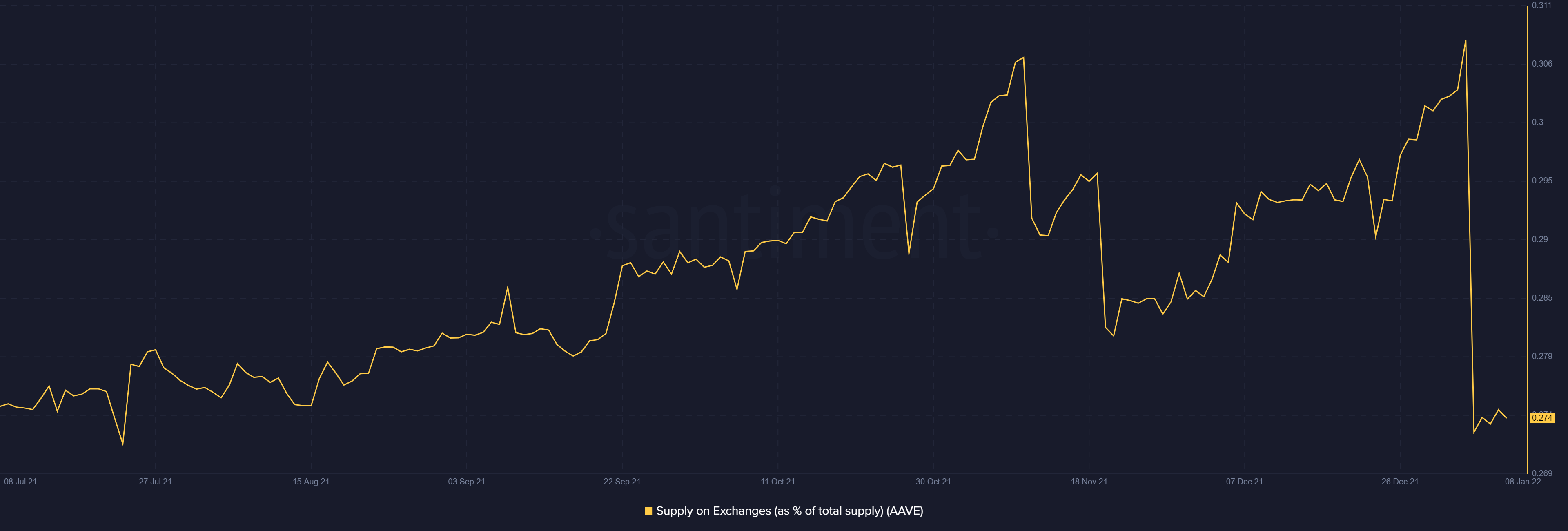

That said, with waning retail euphoria, as AAVE’s trade volumes fell, it seemed like the altcoin needed retail push for a rally ahead. In fact, a considerable amount of coins left exchanges on 3 January which fueled the supply shock narrative for the coin aiding a bullish narrative.

Network growth is on point

A few days back, Aave launched its permissioned lending and liquidity service Aave Arc to help institutions participate in regulation-compliant Defi as over 30 institutions were on-board and set to join in. So, with efforts from the protocol strengthening to stir institutional interest, the same could aid AAVE’s growth TVL. However, the total value locked in AAVE has fallen since the October high of around $19 billion and stood at $12.92 billion at press time.

Price-wise, while a minor recovery seemed underway, as on a four-hour chart AAVE saw minor pumps on 8 January. But the larger trend was still downward as around 80% HODLers were losing money at the current price level as per Global In and Out of Money.

The coin’s correlation to BTC was still at all-time lows while volatility was constant at the higher levels. The negative correlation with Bitcoin aided AAVE’s recent rallies as BTC consolidated but the same couldn’t push AAVE above the crucial $225 resistance.

Further, as new address balances saw an over 4.40% fall, skepticism in the market from new players surfaced. Notably, network growth had finally picked up while active addresses were still maintained at the older levels. This could be a good sign for AAVE’s recovery.

For now, however, with the price rally weakening and AAVE’s long and short-term MVRVs still in the negative zone, the key signs of reversal were still missing-in-action. A strong push from the retail side alongside price recovery could confirm AAVE’s breakout in the near term.