Here’s why Bitcoin price won’t hit $40,000 or $50,000 anytime soon

The bitcoin price surge up to $40,000 was exponential and a sight to behold. The 2020 returns of BTC stand at a staggering 300% and the same can be seen with MicroStrategy’s stock price, which began Bitcoin investments in early August. Suffice to say, institutional investors who bought in before $20,000 are in massive profits even now. However, those that purchased BTC above $30,000 and haven’t taken profits are now hoping that BTC doesn’t collapse below their break-even and are expecting the price to revisit the $40,000 level. This particular revisit might not come soon, in fact, it looks like BTC will not be surging higher anytime soon, and here are a few reasons why.

Bitcoin’s cool off period

After every exponential rally, the buyer’s cool off causes the price to either retrace or go range-bound. At press time, BTC is in this phase, range-bound, devoid of major volatility. In this phase, BTC either consolidates into bullish/bearish patterns, awaiting a breakout. In Bitcoin’s case, it is a bullish pattern.

Depending on market conditions, this might continue up to mid-February or late March.

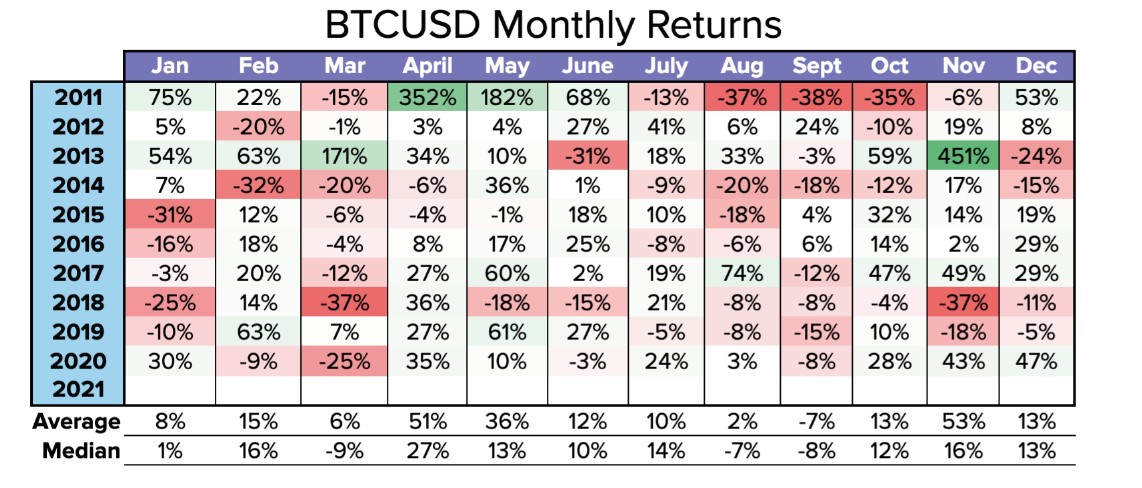

Overall Q1 returns for bitcoin are quite small as seen in a previous article. Hence, we can expect an undoing of February’s returns in March, bringing BTC back to where it started.

Bitcoin returns

Source: Kraken

Bitcoin’s monthly returns show that BTC has a relatively normal January and March. However, February is slightly more bullish so, BTC might hit its local top in February. Hence, going forward, we can expect the same trend to continue without ruling out the bearish possibility.

Bitcoin funding rate

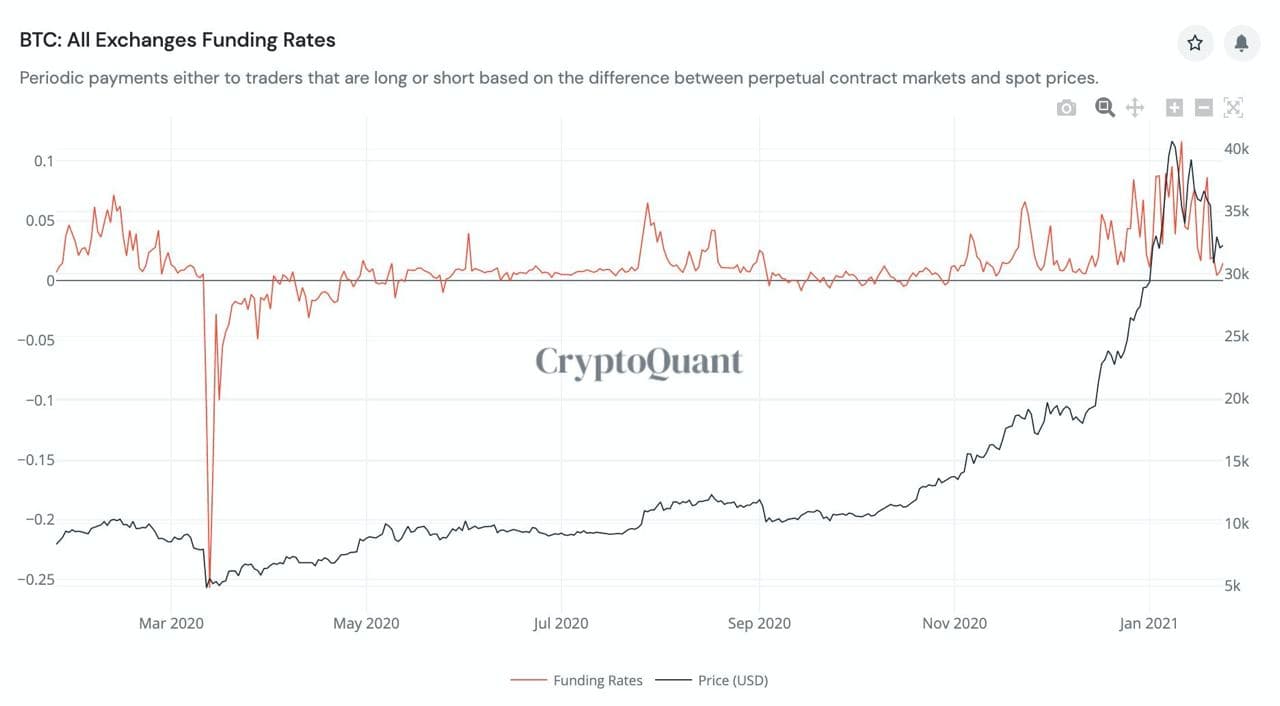

Source: CryptoQuant

Bitcoin funding rate shows what the market participants’ psychology is at the moment. If the funding rate is too high, then the market can be volatile, and similarly, a lower funding rate suggests that the market is cooling off. At press time, the BTC funding rate is near-zero suggesting exactly that.

Hence, going forward, BTC will remain range-bound with less volatility and fewer returns. Ideally, this is where long-term holders stop looking at the chart and accumulate more BTC in anticipation of a surge. Traders, on the other hand, can look to scalp the ranges and accumulate more BTC. The third option is to accumulate altcoins that have already started to see good returns. To sum up, BTC ranging to $40,000 is unlikely but not impossible, however, BTC hitting $50,000 anytime soon, or at least in the 1st quarter seems unlikely.