Here’s why despite a new ATH, Ethereum isn’t out of the woods

After recording yet another ATH on the charts, one well beyond $1,800, Ethereum currently has its eyes set on the $2,000-mark. While quite a few of its on-chain metrics are flashing positive signs, other noticeable concerns are creeping up as well. The culprit here, according to many, is a familiar foe (fee*).

Source: Coinstats

Ethereum registers high active addresses, large addresses

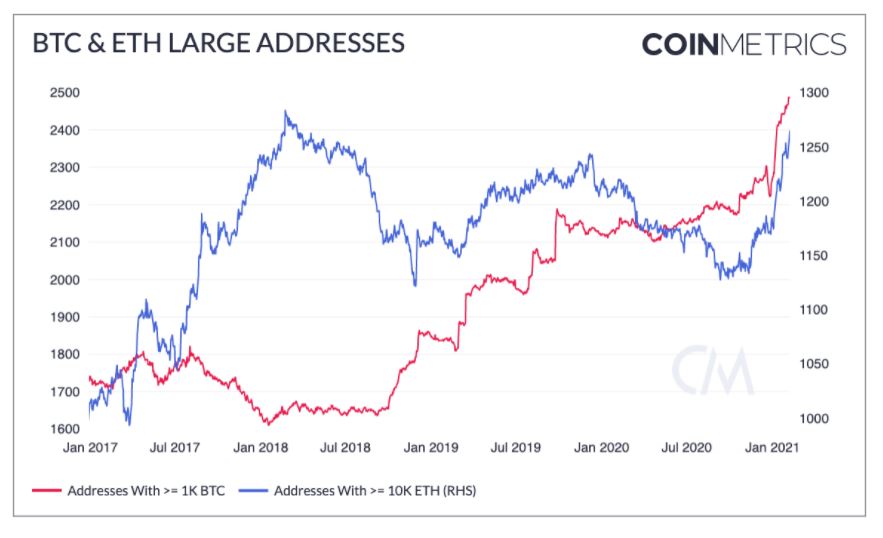

Ticking off some of its optimistic signs, according to CoinMetrics’ latest report, Ethereum has been noting an increase in active addresses since the summer of June 2020, with the active addresses averaging between 500k-600k since January 2021.

Additionally, it was also identified that addresses holding significant amounts of ETH have registered constructive growth, with the number of addresses holding at least 10k ETH improving too. Now, with the introduction of CME ETH Futures, the mood around Ether is even more hopeful, however, its massive transaction fees deserve a lot of scrutiny too.

How long can ETH maintain demand with such high fees?

That is the biggest issue for Ethereum right now. The high transaction fees are only due to the increasing demand for block space on its network. However, the fees are getting a little out of hand and climbing to new all-time highs too, even when compared to the highs registered during the DeFi season of August-September 2020.

According to the aforementioned report,

“The average ETH transaction fee reached $25.80, its highest level ever. The median transaction fee topped $14.32.”

For context, Ethereum miners earned $3.74 million in a single hour last Friday, amassing over $55 million on the same day; another ATH.

Small investors fear: Are other networks catching up?

A major concern associated with large fees is that the median value of the transaction is currently going up and it may lead to smaller investors getting priced out of the network. The same goes for developers as if DeFi devs identify a better scalable network, they may jump ship if Ethereum is not able to solve its fee-situation.

According to Ryan Selkis of Messari, EIP-1559 makes a compelling argument, but,

“It also ignores the reality that Ethereum’s scaling plans explicitly call for pushing transactions off of the expensive, gas-guzzling main chain and onto roll-up chains (or competitive layer 1s).”

Now, other competitive layers might be catching up already.

Some of the other primarily scalable layer 1 networks have completely outperformed Ethereum in 2021, networks including Cardano and other rising projects such as Polkadot and Avalanche. Here, it is important to note that the volume of activity witnessed by Ethereum is levels above these other projects, but their growing valuation suggests they have improving traction as well.

Ethereum might be on the clock to limit its transaction fees over the next few months, otherwise, these projects will only go on to gain even more traction.