Here’s why institutional interest in Ethereum has hiked so rapidly

It is safe to say that Ethereum is no longer playing second fiddle to Bitcoin. While there might be a massive difference between their market capitalizations, the community engagement is almost similar, with Ethereum taking the center-stage sometimes too.

In light of growing institutional involvement and accredited investors showing interest in crypto-exposure, Ethereum is surely starting to ruffle a few feathers.

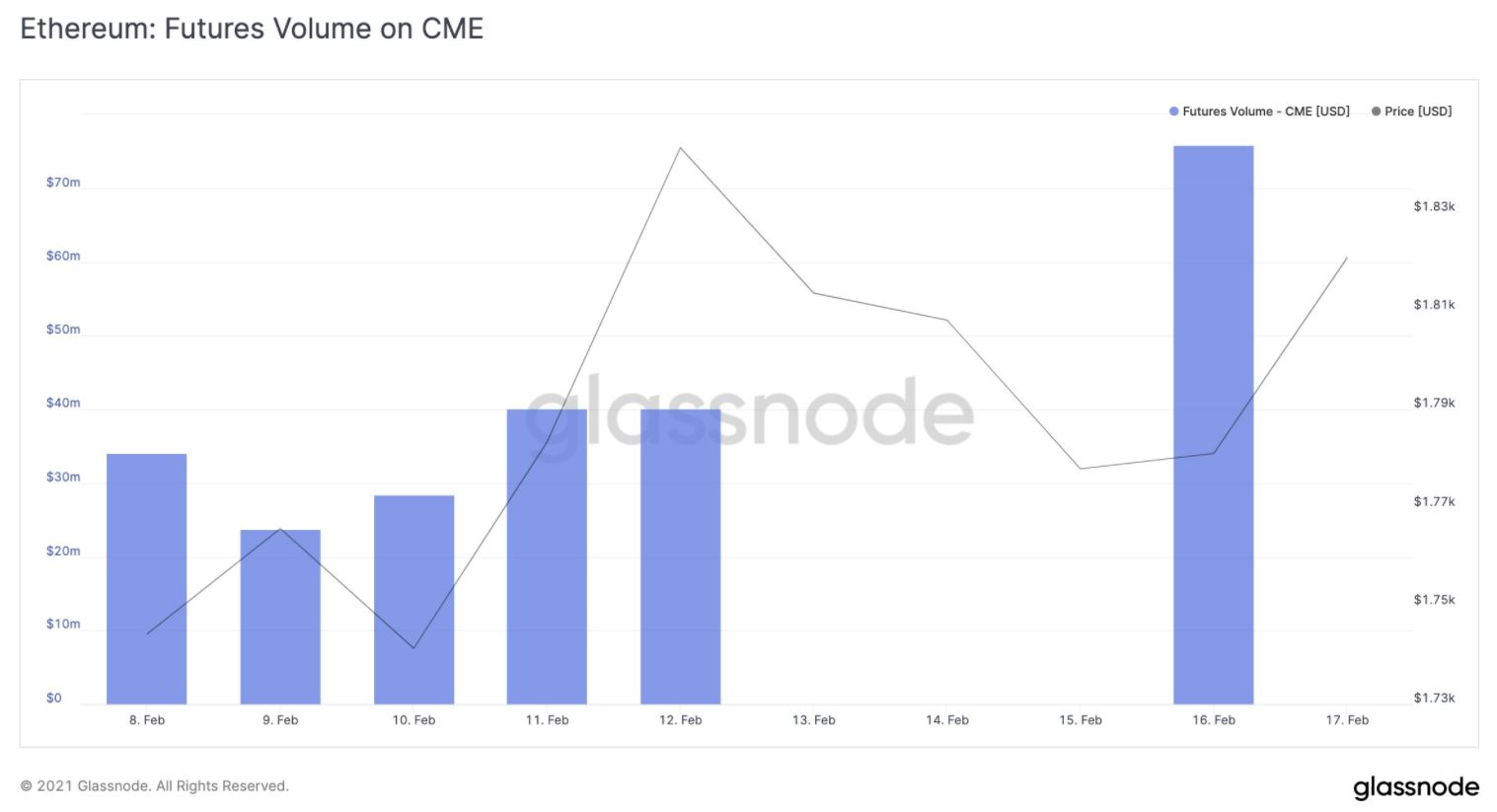

CME Ethereum Futures demand is high off the bat

In fact, the scale of the latest institutional demand for Ethereum can be observed by the activity registered by the newly launched ETH CME Futures.

According to Glassnode, the daily trading volume climbed to a total of $75.8 million on 16 February, almost doubling from the volumes registered on the 12th, which was around $40 million.

There were other prominent indicators as well. In a recent interview, Meltem Demirors of CoinShares suggested that towards the beginning of February, Ethereum investment products registered 80% total inflows, worth about $175 million, with such institutional interest never seen before.

A similar narrative was also put forward by Coinbase’s annual review of 2020. In the same, the crypto-exchange suggested that a growing number of its institutional clients are taking a position in Ether, with these particular clients having predominantly bought Bitcoin in 2020.

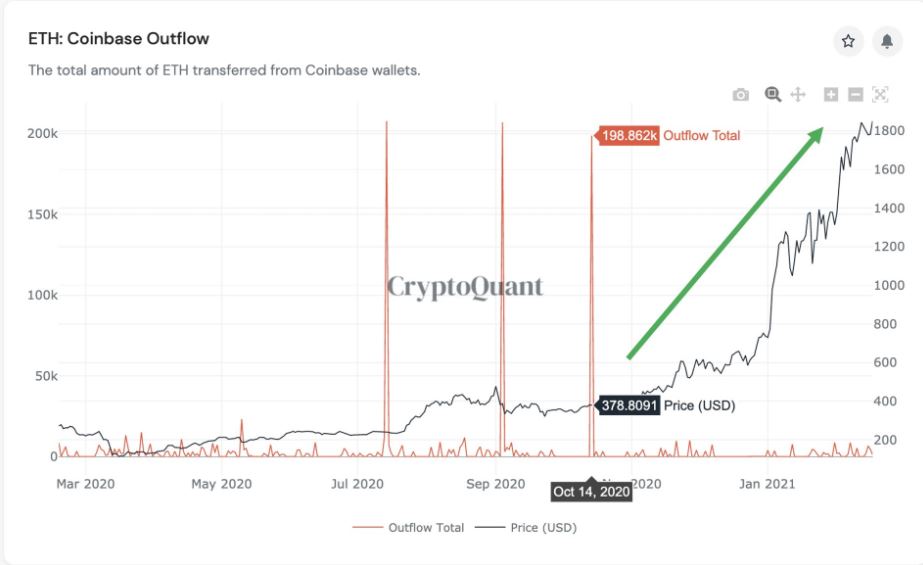

ETH continues to fall on exchange wallets

Ki-Young Ju, CEO of CryptoQuant, recently shed some light on three massive ETH outflows witnessed last year. He speculated that these might be OTC deals for institutional investors, similar to Coinbase outflows. Young Ju might not be far from being accurate.

Over time, the amount of Ethereum held on exchanges has rapidly fallen, indicative of the same hodling sentiment common with Bitcoin.

Thank you, Bitcoin?

If the institutional demand for Bitcoin is considered, it took almost a year before accredited investors were considering it seriously. There was a lack of solid interest in the initial months, but for Ethereum, the growth has been significant right off the bat.

The timing has been extremely important. From a floor price of $77 in March 2020, Ethereum is currently valued at over $19,00 in less than a year. The crypto-asset experienced a more dominant bullish rally than in 2017, and now crypto-exposure is much more amiable than before. Finally, Ethereum has also improved its stock with the successful launch of ETH 2.0 phase zero and the prominent rise of DeFi over the past year.

Source: Coinstats

However, Bitcoin deserves a lot of credit here too. Until accredited investors were comfortable with Bitcoin, there was little chance of them moving into Ethereum. From a practical aspect, Bitcoin led the charge for institutional exposure and now, organizations are looking at the next most valuable digital asset, i.e Ethereum.