Here’s why the market will be the ultimate decision-maker for Bitcoin’s future

“I think Bitcoin is the first real global money of integrity” according to Okcoin CEO Hong Fang.

In a recent interview, she said if “Bitcoin can succeed at the monetary level of achieving a decentralized and censorship-resistant network of money,” there’s hope for other projects as well. She added,

“That includes a lot of layer one attempt and various projects that people are trying.”

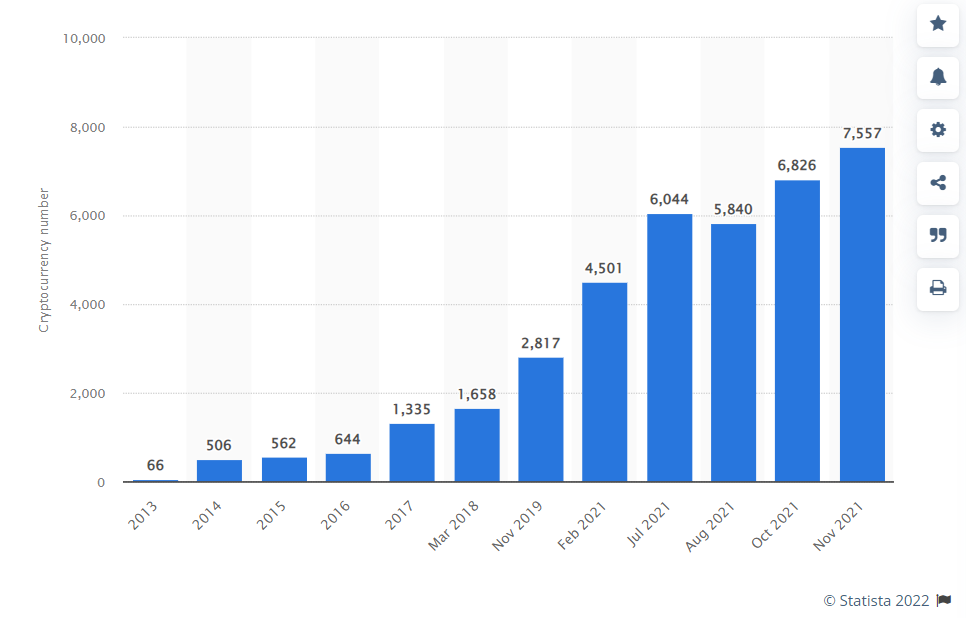

It is noteworthy that the market consisted of over 7000 crypto tokens as of last year when the market surpassed a cumulative market cap of $3 trillion.

Meanwhile, the recent crypto market’s downward spin has kept many investors worried as BTC has lost close to 20% of its value in the last two weeks. When the cumulative market cap now hovers close to $2 trillion.

However, Fang commented that she is excited about the Taproot upgrade as people are now building both on top of Bitcoin and next to it. It is worth noting that Taproot was the last major Bitcoin upgrade in around four years. The soft fork is expected to enhance Bitcoin’s smart contract capabilities while bringing in more privacy on the network. However, with regard to the future of projects, Fang said,

“Ultimately the market will tell.”

Further noting that Bitcoin will continue to grow but it’s still too early for people to realize its value.

That being said, Blockstream chief Adam Back is suggesting Layer 2 solutions after the Taproot upgrade. He said,

“Of course, there’s a lot of very rapid innovation in applications built on top of Lightning, in a lightning protocol, in a Liquid protocol, so in layer-2 and in the application layer. So, I think there’s a lot of use cases on top in terms of smart contracts and transactions. “

Further adding that Layer 2 “provides a different kind of section of transactional capacity optimized for use cases.”

In a previous conversation with AMBCrypto, Stacks Founder Muneeb Ali had also said that applications like Stacks “open up a world of possibilities for making Bitcoin a more productive asset.”

In terms of performance, Bloomberg noted in its 6 January report based on MicroStrategy’s overview of returns of different assets versus BTC, that,

“A total of 212 companies out of the 500 that make up the broad S&P 500 index, did perform better than Bitcoin on a 12-month basis.”