Here’s why the new ‘Uniswap of Cardano’ may not be a threat just yet

The Ethereum killer narrative has been around for a long time. Now, with the gas fee still high on the Ethereum blockchain after the London upgrade, concerns around the use of the Ethereum blockchain have been rising. But it wasn’t only impacting Ethereum’s image, as Defi infrastructures like Uniswap felt the brunt of it too.

Amid such concerns, certain players turned to Cardano as an alternative, amid the increasing fees and slower transactions resulting from increased users. Recently, the announcement of ADAX coming up with Cardano-tailored Defi solutions acting as a Uniswap killer was like a wake-up call.

Notably, this censorship-resistant Defi platform on the Cardano Ecosystem looks pretty similar to Uniswap in terms of functionality. So, what will be the implications of such increasing market competition on the alt’s price?

Uniswap network needs backup

Like most alts, Uniswap has rallied pretty well in the last month. It rose from under $15, to $26 at press time. However, UNI saw a lot more consolidation in the last two weeks than the larger market. Additionally, it has made lower lows.

There was also a notable rise in tokens consumed, which indicated the movement of old coins. In light of the competition in the market, this could’ve been a sign of dormant tokens moving with the intention of pushing up prices. Clearly, that didn’t work, with prices still consolidating.

Source: Santiment

Further, a spike in transaction volumes at the time of writing meant that activity on the network was rising, which was a good sign amid consolidating prices. While all this looked good, the active addresses saw a steady decline over the last week.

Uniswap holds its ground firm

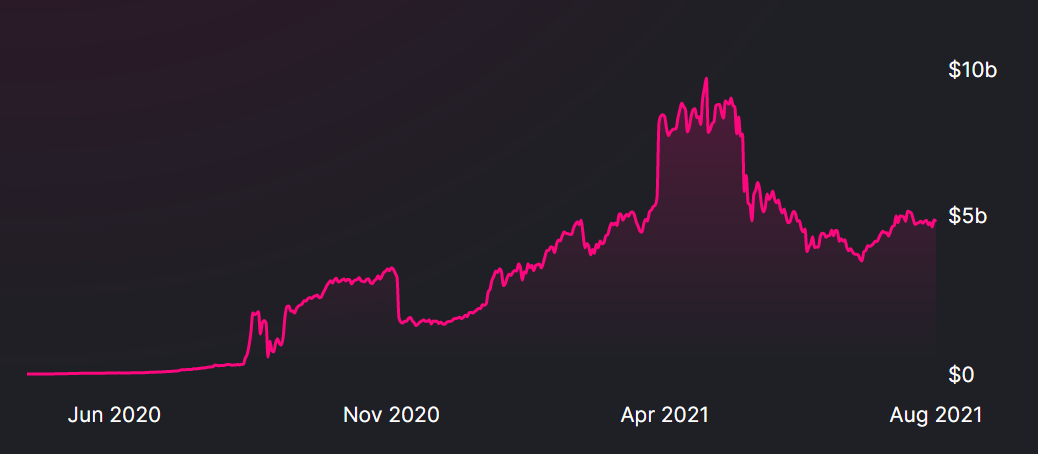

The good news however was the steady increase in total value locked in, which saw a spike in just one day. TVL rankings however weren’t too bright, with Uniswap on the tenth spot and Uniswap v3 on a close 15th spot. Interestingly, Uniswap v3 has seen a constant uptrend in TVL which is indicative of Uniswap’s dominance in the market.

Uniswap v3 TVL; Source: Defillama

While Uniswap does need to constantly upgrade in terms of network strength and activity, it need not worry about its market position, at least in the short term.