Here’s why the recent spot market dip is testing DeFi’s endurance

The crypto market is a volatile space, with the likes of Bitcoin leading the rally, rising by 103% sometimes and other times also crashing by almost 70%. But the crypto market is not limited to just the spot markets. With the emergence of Decentralized Finance (DeFi), the spot markets found an affiliate. Today that affiliation has led to a major fall in the DeFi space.

What happened today?

As the impending corrections arrived on September 7, many coins witnessed price falls in double digits. Today too, the market is mostly red, except for a few lucky coins. This took a toll on the entire spot market itself as market capitalization dwindled.

Since the September 7 crash, the crypto space lost about 15% of its market cap. Along with it, daily transaction volumes also fell by 50%, reaching $189 billion, down from $418 billion.

Total spot Market Cap | Source: TradingView – AMBCrypto

As a result, today, the DeFi Market cap is down by almost 8% from $135 billion. Since the September 7 crash, the DeFi market cap dipped by 13.72%. However, the last 4 days helped recover 11% of those losses.

Since the crash, volumes have also dropped as people have become cautious, leading to transaction volumes falling by $14 billion from $30 billion.

DeFi Market Cap | Source: TradingView – AMBCrypto

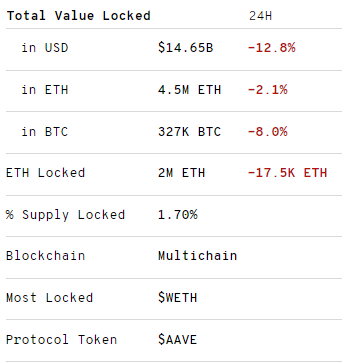

The biggest DeFi token also suffered because of this. Today AAVE lost about 12% of its TVL, along with that 2.1% ETH TVL came down and BTC lost about 8% as well. In addition to this, its price also fell by 25.2% this week.

AAVE’s TVL changes | Source: DeFi Pulse

Since DeFi is a newer space it still has a relatively smaller participation of only a 3.3 million user base. Whereas the spot market already has over 300 million users, which is why it makes sense that it’ll follow the spot market’s movement.

Crypto users as of 2021 | Source: Triple-A

However, with Cardano smart contracts here, the DeFi space could see a rise in participation and volumes as well. And if the rise is consistently strong, who knows, in the future, DeFi could become an independent system as well.