Holding ETH at a loss? You may want to read this before making your next trade

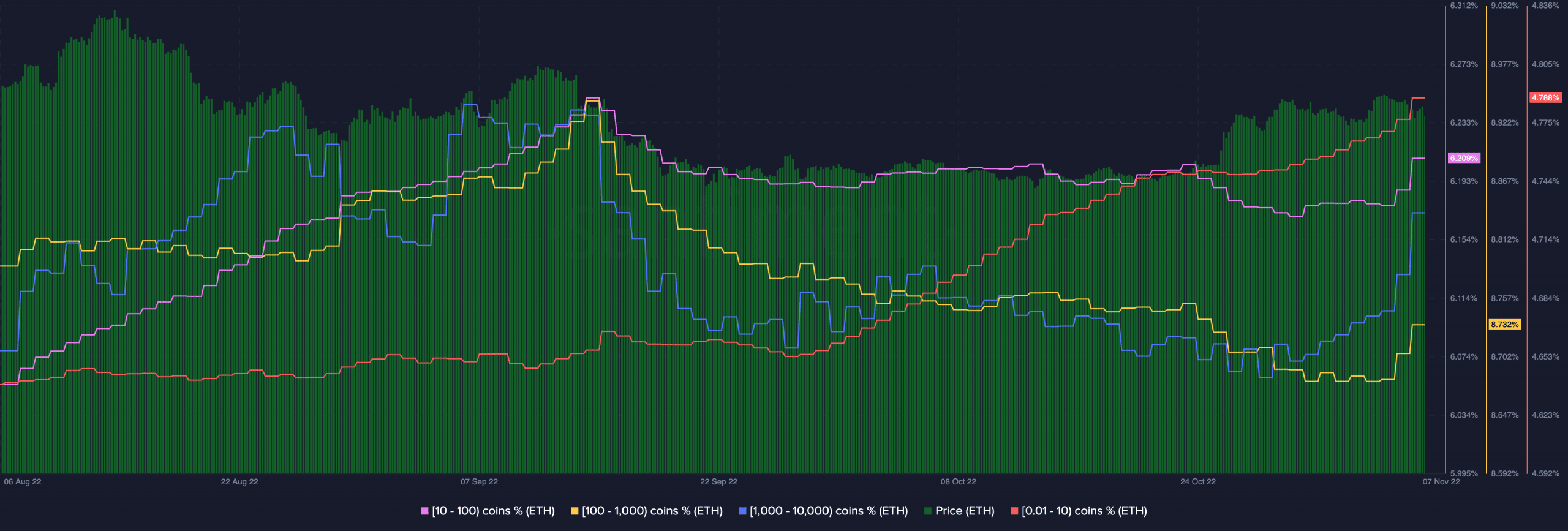

Since the end of October, all categories of Ethereum [ETH] holders embarked on a buy-the-dip spree, data from Santiment revealed. According to the on-chain analytics platform, the leading altcoin witnessed a surge in coin accumulation by small, medium, and large traders since late October.

Here’s AMBCrypto’s price prediction for Ethereum [ETH] for 2022-2023

Apart from founders’ addresses holding over 10 million ETH coins, all other cohorts of ETH investors increased their percentage holdings of ETH’s total supply.

According to Santiment, the growth in dip accumulation could be attributed to the general rally in the altcoins market in the past few weeks. This led investors to take “profits from altcoins” and “move back to blue chips.” A resulting impact of this was that it “could probably mean the end of the rally (for altcoins) for some time,” Santiment noted.

Commenting on where price might go next, Santiment took a cue from history books and opined,

“Historically speaking, we’ve seen a similar pattern in back September, they just bought the dip, and we dumped.”

What else do we see on-chain?

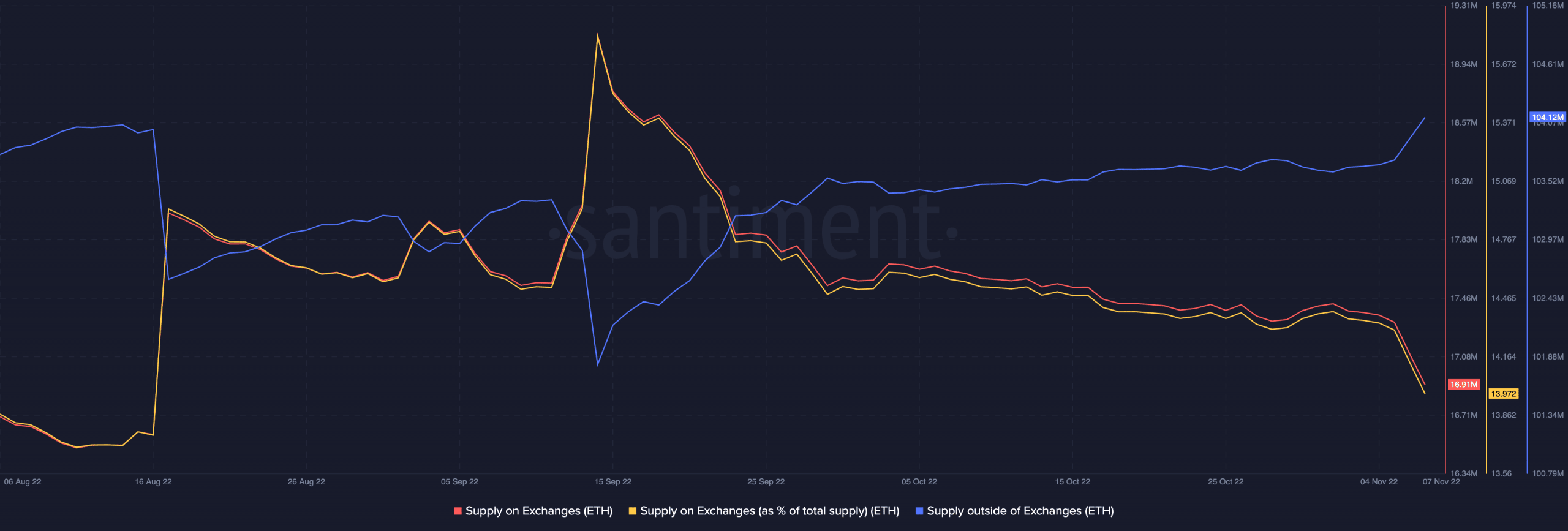

In spite of the consistent and painful decline in the alt’s price since 15 September, on-chain data revealed that selling pressure dropped significantly. While many harbored doubts about the success of the Ethereum Merge before and after the event, HODLers’ conviction remained fervent as fewer ETH coins got sent into exchanges since the Merge.

According to data from Santiment, ETH’s supply on exchanges has since dropped by 12%. This revealed that the percentage of ETH’s total supply on exchanges dropped from 15.82% to 13.97% within the period under review.

Conversely, the alt’s supply outside of exchanges has since rallied. Per Santiment, since the Merge, this number grew by 3%.

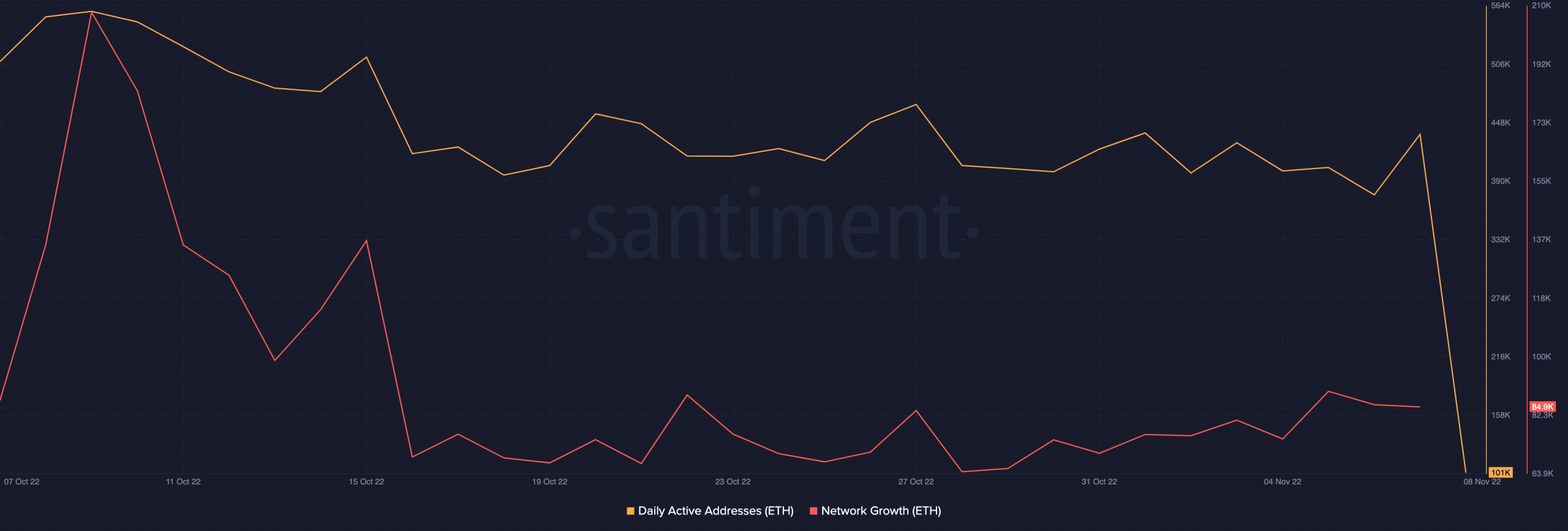

The count of unique addresses that traded ETH also witnessed a drop in October. Per Santiment, this dropped by 80%. Notably, in the last 24 hours, this decline was strangely steep as the count of daily active addresses on the ETH network fell from 436,000 to 101,000.

This coincided with an 8% decline in the alt’s price within the last 24 hours. According to CoinMarketCap, trading volume was up by 55% within the same period showing that sellers ravaged the ETH market. Thus, explaining the steep decline in daily active addresses.

In addition, the daily count of new addresses on ETH network also dropped by 60%, data from Santiment showed.

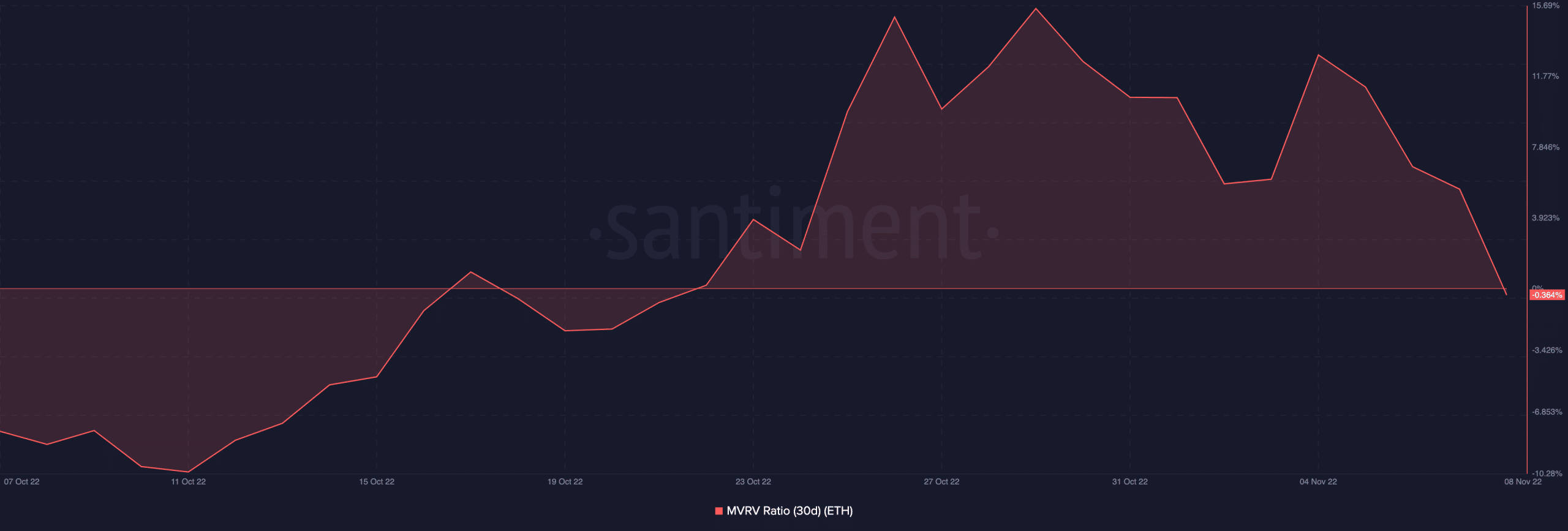

Regarding ETH’s profitability on a 30-day moving average, most holders currently held the altcoin at a loss. Its 30-day Market Value to Realized Value (MVRV) ratio posted a negative -0.364%.

Hence, investors buying the deep would have to HODL for a little while longer before they can turn any profits on their investments.