Huobi Token’s [HT] key metrics to help you sail through crypto winter

Huobi Token’s [HT] 86% increase in the last seven days seems to have taken another turn, thanks to some revelation by Justin Sun.

According to the Poloniex CEO, he might be the biggest HT holder as Huobi Global finalizes a new ownership transfer. The controversial figure said this statement in a recent interview with Bloomberg.

Sun had initially declared that he was not taking over at the exchange but only acting in an advisory role. However, recent activities from the Huobi exchange might indicate that the Tron [TRX] founder had secured a stake in the company.

Here’s AMBCrypto’s Price Prediction for Huobi Token for 2022-2024

This was because Wu Blockhain revealed that about 74 million HT were transferred into a wallet belonging to Sun. Hence, creating rumors of a private handover.

74 million HT of Huobi’s two official wallets have been transferred to two new addresses on October 13, and the first transactions were from Justin Sun’s poloniex. The HT officially held by Huobi may be part of the acquisition of Huobi Exchange and has been handed over to Sun. https://t.co/O3SexjA8io

— Wu Blockchain (@WuBlockchain) October 14, 2022

The Etherscan receipt showed that Huobi sent the tokens worth $583.86 million into the “Poloniex 4” wallet. However, it did not seem like HT was concerned about slowing down its surge.

At press time, CoinMarketCap showed that HT was 13.85% up from the previous day’s price. While it decreased earlier to $7.39, it regained its bullish drive, trading at $7.87, at the time of this writing.

Of highs and lows

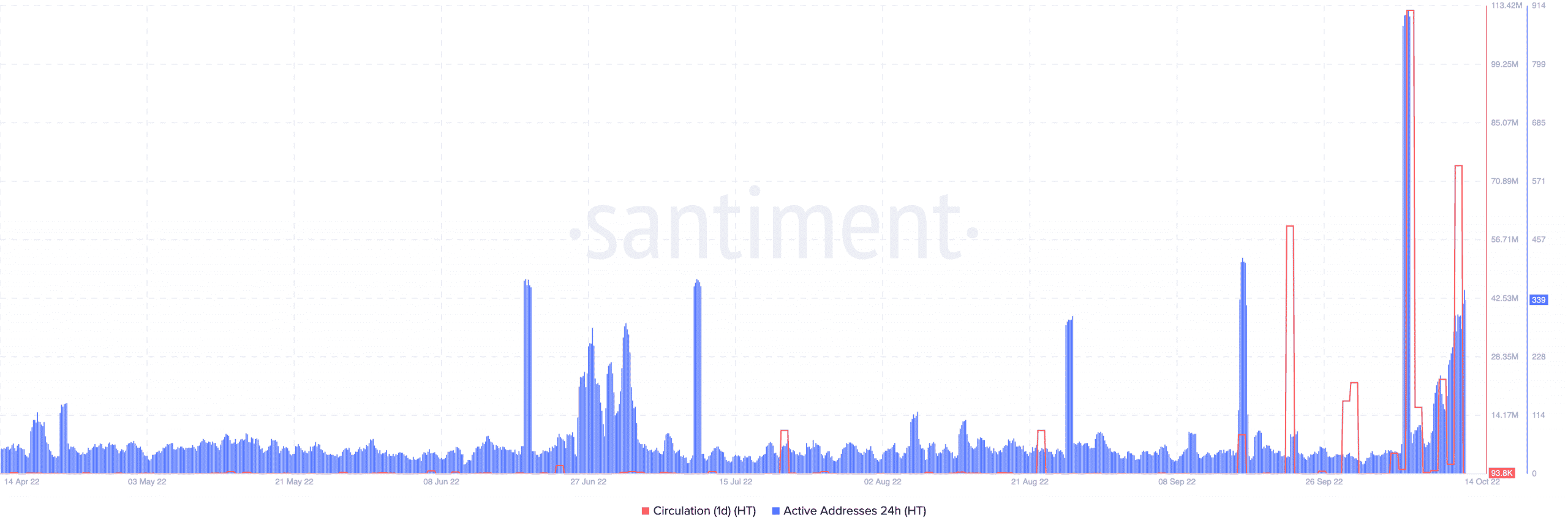

Although there had been a continuous uptick in some aspects, a few others experienced lows. According to Santiment, the HT one-day circulation which rallied to 74.23 million on 13 October had dwindled.

The on-chain analytic platform revealed that the circulation, at press time, was a mere 93,800.

Conversely, the HT 24-hour active addresses had not stopped increasing. At press time, it was up to 339. This translates to the fact that despite some ease in trading, HT was still a token of interest in the crypto market.

In addition, the reflection of the active addresses may suggest that some parts of the crypto community trust Sun’s judgment. On the exchange part, active deposits seemed to have decreased. Santiment noted that HT deposits on exchanges as of this writing were six.

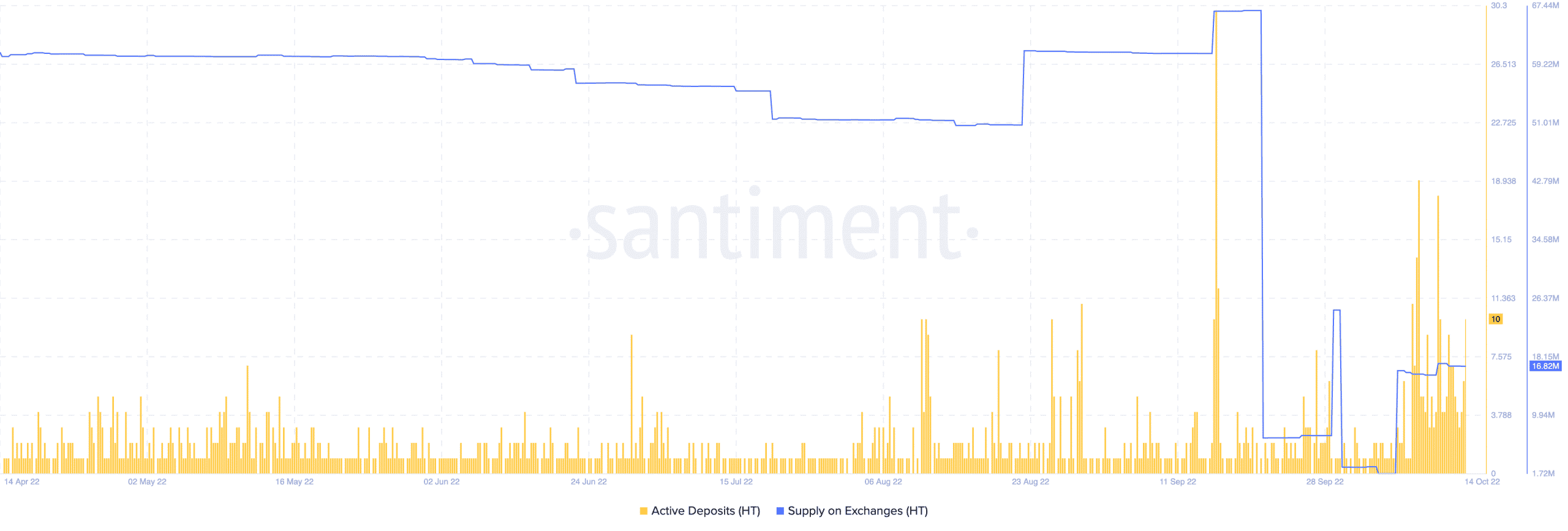

However, it was likely that HT investors could be considering selling their holdings in non-custodial wallets. The exchange supply revealed this.

According to Santiment data, HT supply on exchanges had risen to 16.82 million.

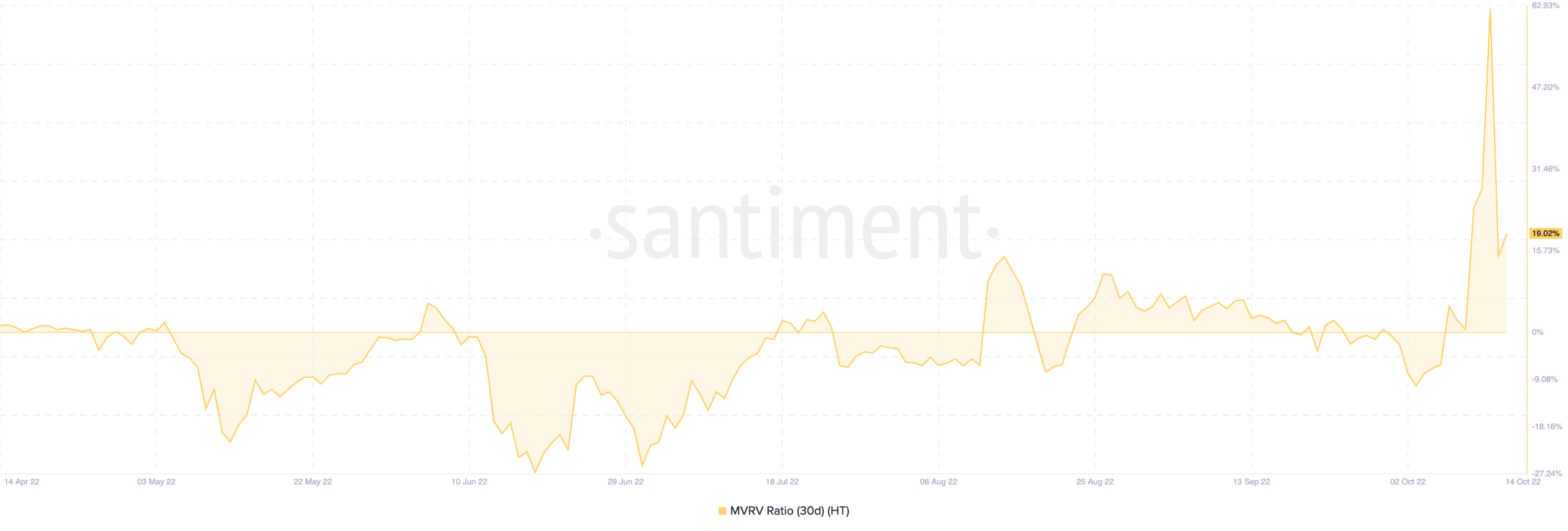

Meanwhile, it did not seem like HT investors would lose that much if the token price slightly decreased.

According to the thirty-day Market Value to Realized Value (MVRV) ratio, investors who held the token since the start of October would still be in profit. Despite a decline to 19.02%, the MVRV showed that more gains could be on the way.