How a drop in this Bitcoin metric can work in its favor

Yet another week followed by yet another incessant range-bound movement and seemingly tougher highs and lows for Bitcoin that sharply impacted the king coin’s social data. While there is no denying that several positive factors such as the increase in net growth users, whale holding, and accumulation by traders indicate a healthy long-term trajectory for BTC, the coin’s recent price movement has been rather haphazard.

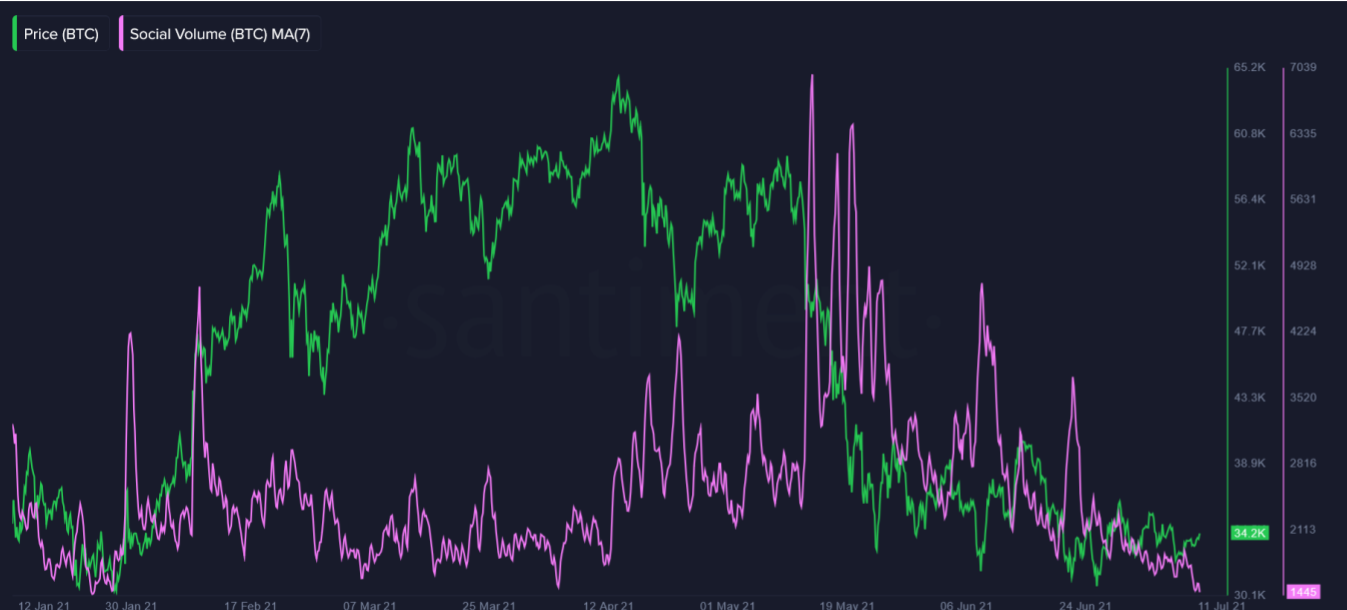

To start with, a recent Santiment report highlighted that the amount of daily Bitcoin mentions on crypto social media has plummeted greatly, with its 7-day moving average sinking to a half-year low as of July 11. Bitcoin’s social volumes had tested the January 2021 levels as trading volumes for the last week showed no significant spikes.

Source: Sanbase

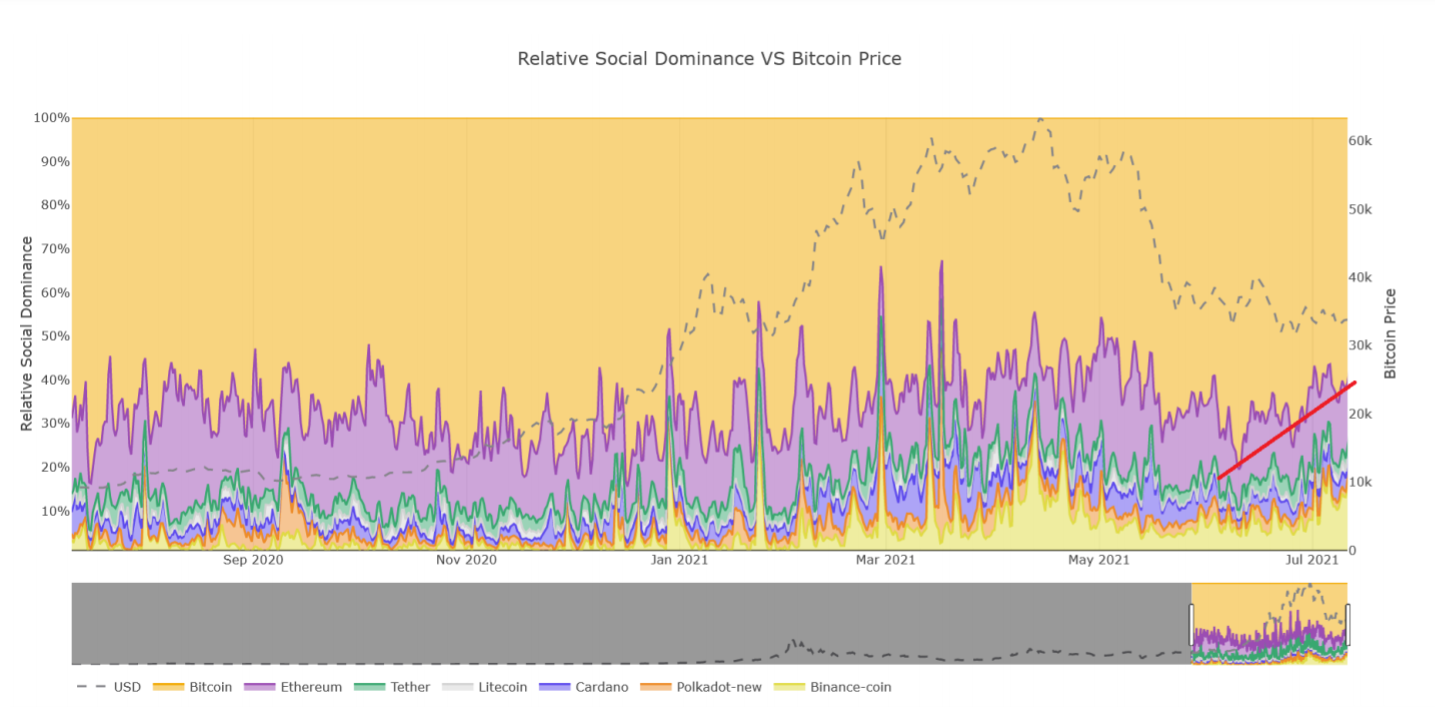

Further, Bitcoin’s relative social dominance was seen falling against other top-cap assets like Ethereum, Litecoin, Cardano, and Polkadot. The chart given below highlighted that retail apathy towards the top coin continued to build up, with Bitcoin’s social dominance (in orange) shrinking from 80.5% to 60.5% in the last 30 days.

Looking at this macro market picture, it would appear that Bitcoin is losing attention faster than expected. While the current buzz might all seem heavily negative, is it all that bad for Bitcoin? In one word, No.

Predominantly bearish market sentiment has been an old friend to cryptocurrencies. In fact, a report has previously underlined that extremely high social volume and bullish sentiment seem to coincide with looming price tops and short-term corrections, as the market becomes overconfident and too greedy for its own good. That’s not the case for Bitcoin currently, on the contrary, continued low levels of crowd chatter and a bearish bias may work in the king coin’s favor, signaling undervalued conditions and potential for short-term recovery.

Even though historical performance is not always indicative of future results, it is noteworthy that Bitcoin’s price recoveries in the last two years have coincided with a predominantly bearish sentiment. Keeping an eye out for Bitcoin’s social activity in the near future might better help understand where the market sentiment will weigh for the top coin.

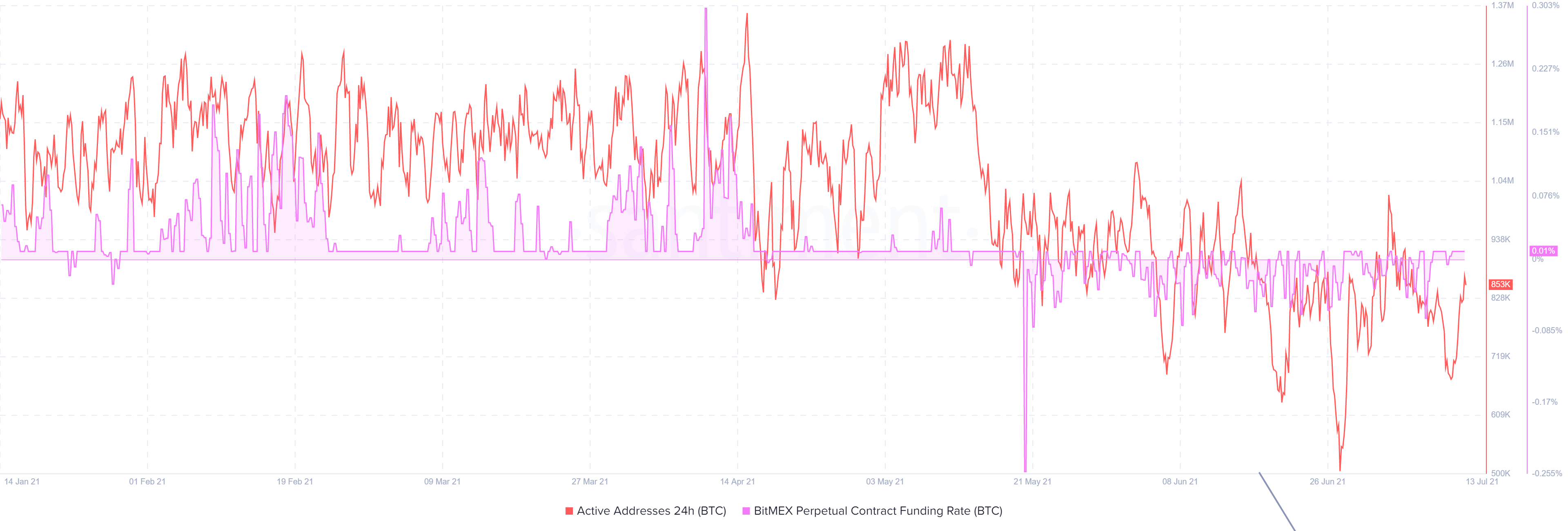

The general bearish tone for the top coin same can’t be seen across Bitcoin’s futures traders. Bitcoin’s funding rate hovered at 0.01% on both BitMEX and Binance (and 0.0076% on Huobi), suggesting more indecision in the derivatives market than a general bearish consensus. Active addresses that noted a sharp dip towards the beginning of this month, saw a steady recovery and stood at 853k at press time.

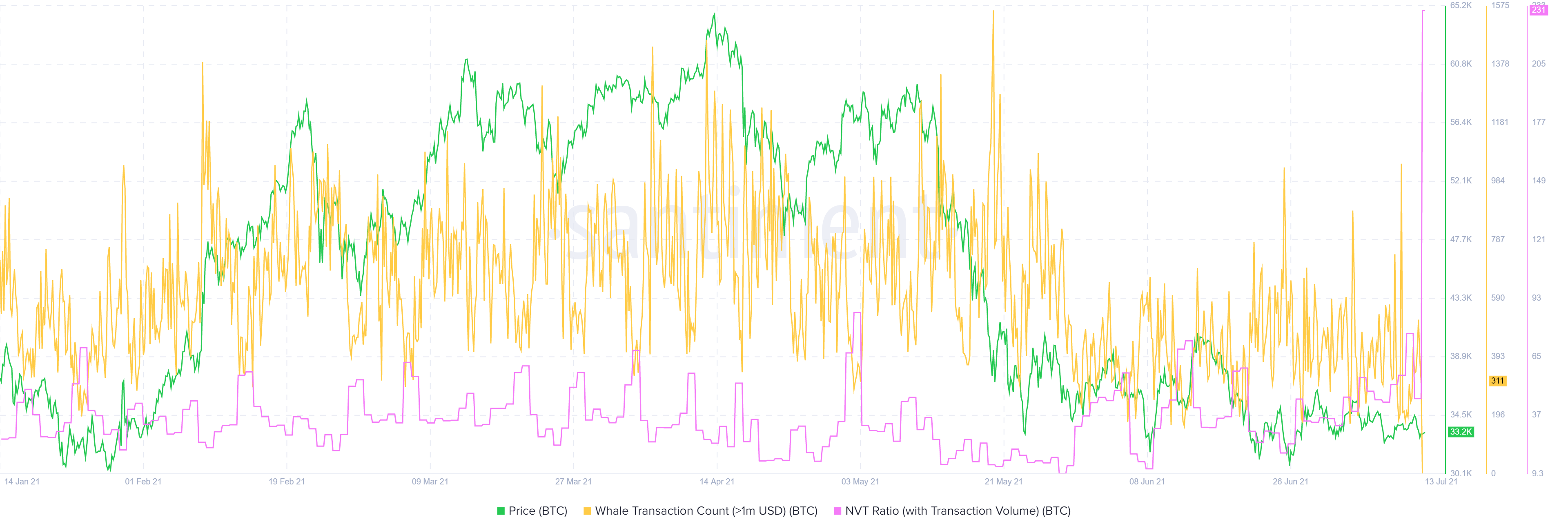

That being said, Bitcoin’s NVT ratio with transaction volumes reached early May levels signaling towards better adoption and higher network value for the asset which can prove to be a good sign for it in the short run. Additionally, whale transactions saw a major peak on July 10 pointing towards some healthy activity in the space.