How are Ethereum Futures coping with the market-wide crash

The effect of the People’s Bank of China’s latest statement on crypto-services prohibition in mainland China was as expected. The crypto-market came tumbling down as Bitcoin fell by over 5% after the news and Ethereum lost more than 7% of its value in just two hours.

All was going well for the top altcoin before the market started bleeding, however. In fact, just recently, JPMorgan analysts presented how big investors are turning their heads towards ETH.

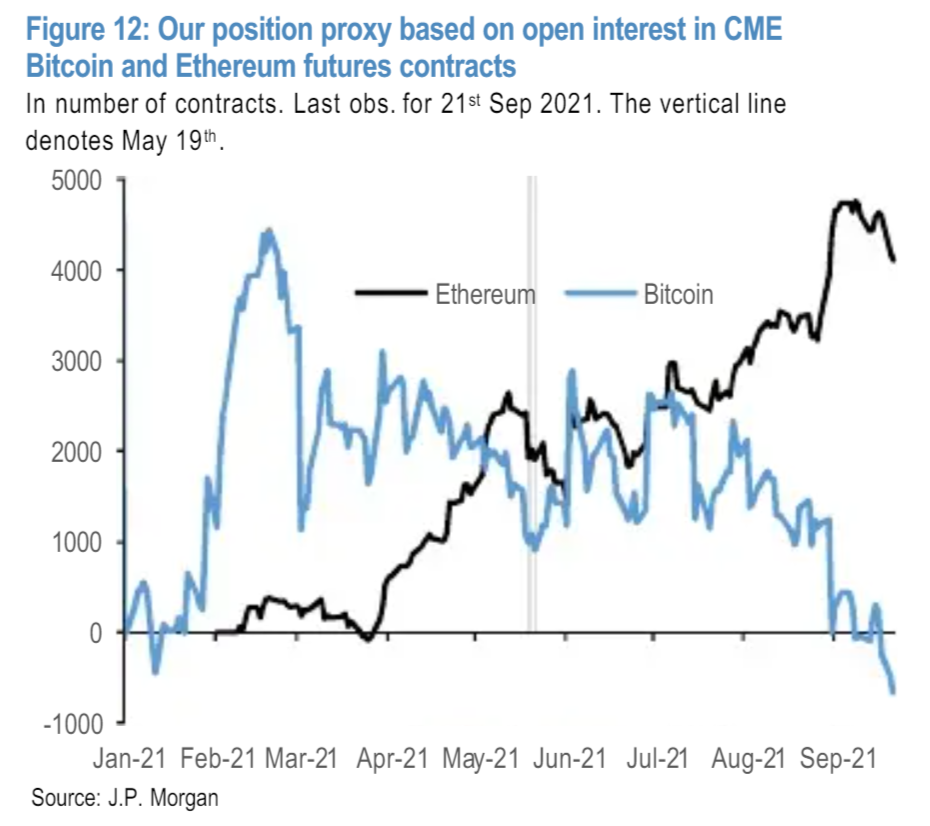

The report pointed out that of late, Bitcoin Futures have been seeing weak demand as BTC Futures traded below spot prices. On the contrary, Ethereum Futures premium rose 1%, highlighting a strong divergence in demand towards ETH.

Options market’s optimism

Institutional investors have been increasingly pivoting from Bitcoin to Ethereum since August as demand diverged towards the second-largest crypto by market capitalization.

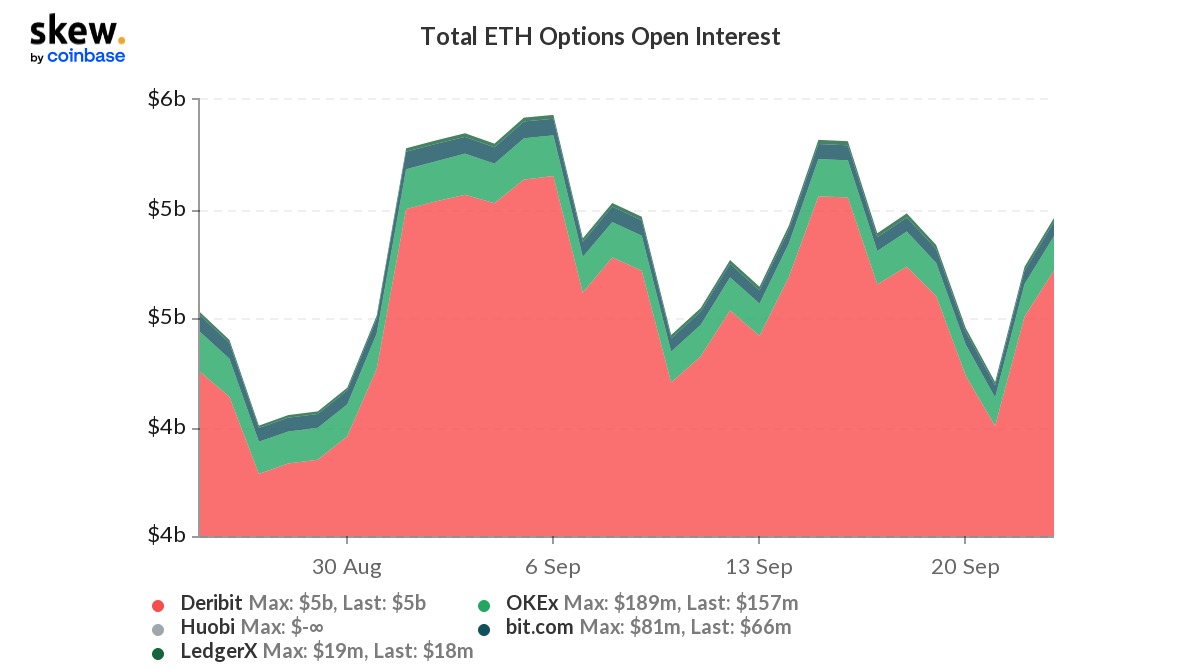

After the latest plunge in Open Interest on 18 September, Ethereum saw a V-shaped recovery which instilled confidence in the market.

The report also noted that the return to backwardation in September for BTC was a negative signal, one pointing to weak demand for Bitcoin by institutional investors.

Backwardation refers to a downward sloping Futures curve where front-month contracts trade at a higher price than far-maturity contracts. Contango, in simple terms, is a situation where the Futures price of a commodity is higher than the expected spot price of the contract at maturity.

Ethereum Futures remained in contango and if anything, this contango steepened in September towards a 7% annualized pace (on a 21-day rolling average basis). This pointed to a much healthier demand for Ethereum v. Bitcoin by institutional investors.

This strong divergence in demand was also evident in the CME Futures position proxy, as seen below.

Further, a strong interest in out-of-the-money (OTM) was spotted early this month. In spite of prices falling at the time of writing, calls dominated at the ETH $5,000 level for the end of year (December 31) contracts. There were over 100k call options that were open at this strike and expiry.

Additionally, the mid-long-term bullish outlook that the market had could also be spotted in the 68.9k call options that were open for $10k.

Nonetheless, with the price falling at press time, there were some unmissable signs that suggested ETH may tumble before it runs again.

ETH may tumble before a run

While institutionally the demand for ETH seemed to make the altcoin’s narrative bullish, a recent drop in Ethereum’s Implied Volatility was a worrying factor.

This meant that the market’s forecast of a likely upward movement had dwindled. Another worrying trend was no visible spike in ETH’s Options trading volume. Further, its Put/Call ratio saw a divergence with OI increasing and volume going down.

However, on the day of a key Options expiry (September 24), as the news of China’s latest crackdown on crypto floated, there was a change in sentiment. This could have implications for the spot and consequently, the Options market.

So, could investors and institutions once again turn to the top coin amid high volatility and price falls? Well, for this, we’d have to wait and watch the market dip unfold.