How Chainlink joining Crypto Climate Coalition DAO can trigger recovery

Chainlink, known to be a market leader in the blockchain oracle solution, became part of an alliance today which brings real-world implications of crypto into existence. While it has a great impact on the network on a developmental front, Chainlink’s investors might also benefit from this announcement.

Chainlink for the people

The Lemonade Foundation along with major crypto players including Chainlink, Avalanche, and others launched the Lemonade Crypto Climate Coalition as a DAO to provide weather insurance to subsistence farmers and livestock keepers.

Chainlink’s expertise in the field of economic fairness and transparency will allow it to be one of the leaders in the coalition to bring financial inclusion to farmers as well as protect their crops (their only livelihood) from the ruin that climate change brings.

We're proud to announce #Chainlink is now a member of the Lemonade Crypto Climate Coalition (L3C) DAO.

L3C will use Chainlink to power parametric insurance for subsistence farmers across Africa, enabling them to hedge against emerging climate risks. https://t.co/nwJfEciOXO

— Chainlink (@chainlink) March 22, 2022

Commenting on the same Chainlink co-founder Sergey Nazarov said,

“We plan to make the Chainlink team and platform available to L3C in an effort to protect the millions of farmers who depend on what they grow from the devastation of climate change.”

Chainlink’s foray into such projects is what drew investors towards it since the blockchain oracle solution is an entity with nearly no formidable competition in its field. While most other chains build on the prospect of providing a cheaper faster platform for smart contracts, Chainlink brings an entirely different suite of advantages with cross-chain applications.

However, despite its DeFi potential, investors haven’t been very warm towards the asset. A lot of this hesitation stems from the lack of appropriate ROI which has been negative for the third month straight.

Chainlink Return on Investment | Source: Coinmetrics – AMBCrypto

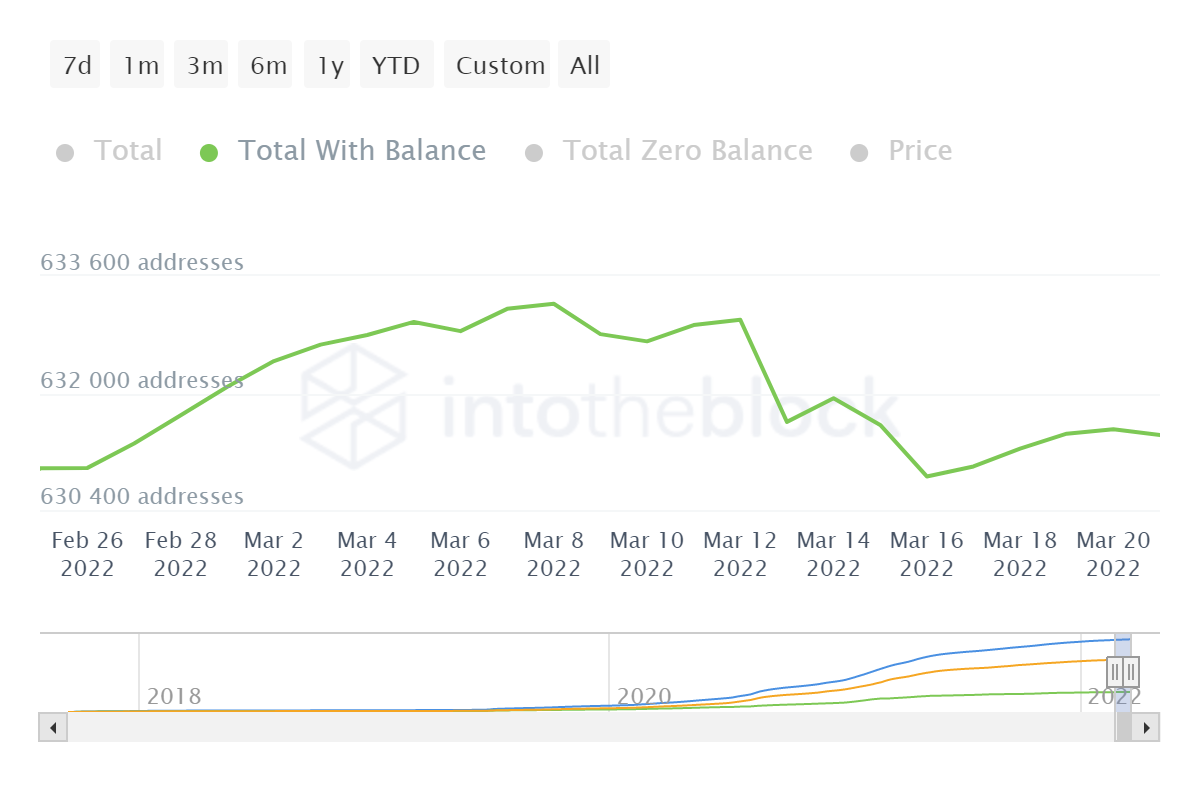

As a matter of fact, investors’ disappointment has pushed them beyond enduring losses and in the last 10 days, about 2,000 investors have exited the market.

Chainlink investors exit the market | Source: Intotheblock – AMBCrypto

These addresses could have been part of the 16k addresses that have been aching from the market’s bearishness since May as these addresses bought their holdings around the ATH prices.

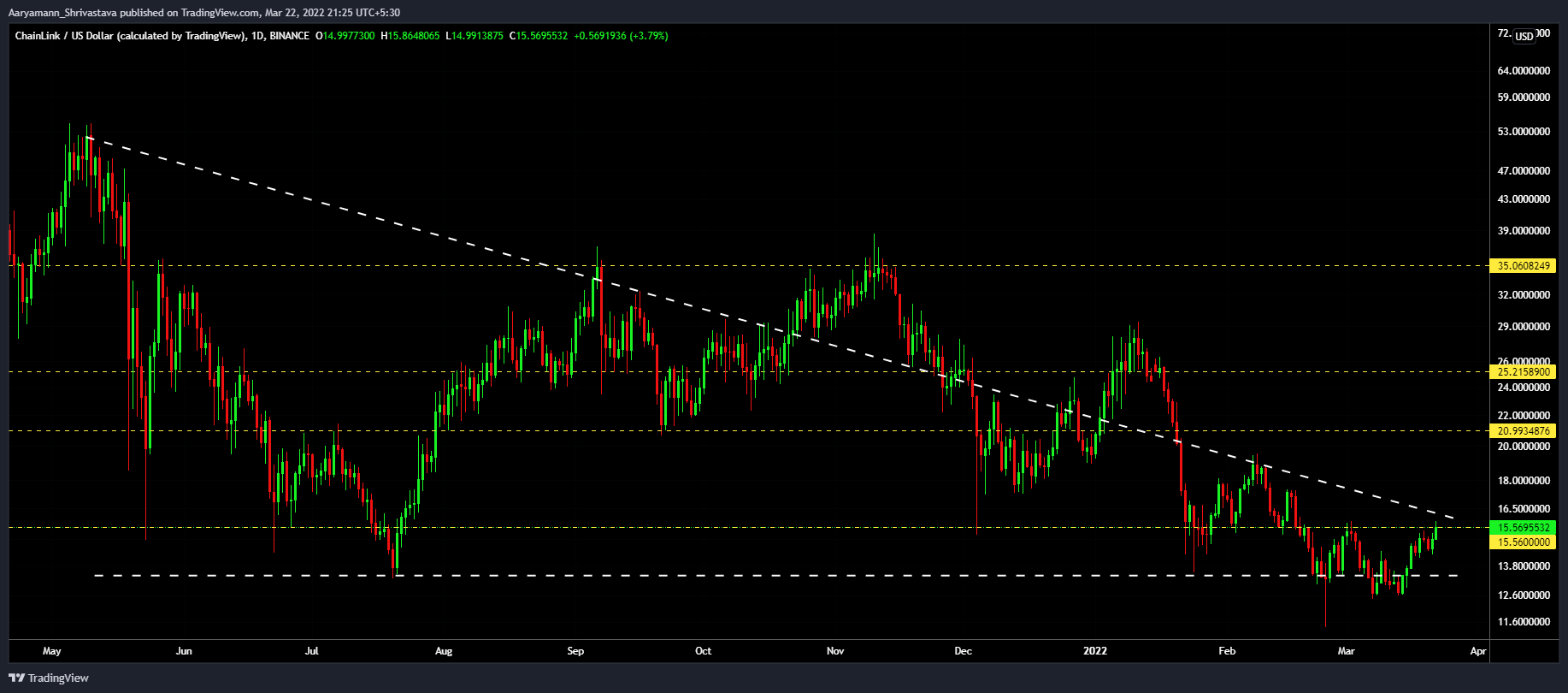

But going forward, this could change since LINK is on the brink of breaching its 10 month-long downtrend wedge. Today the price actions tested critical support of $15.56 as resistance and if the same is flipped into support, LINK would be one step closer to breaking out.

Chainlink price action | Source: TradingView – AMBCrypto

This would aid the market value of the asset which has been somehow kept above the 1.0 neutral level.

Chainlink MVRV ratio | Source: Coinmetrics – AMBCrypto