How ‘creeping’ cryptocurrency exposure affects direct and indirect investment

Low-risk takers largely portion their portfolios around debt and low-risk equity investments. These conservative investors also keep their distance from volatile asset classes like crypto. Additionally, green investors stick to Environmental, Social, and Governance (ESG) compliant investments.

However, a recent research found that at least 52 public companies covered by MSCI ESG have exposure to cryptocurrencies, as of September 2021. This essentially meant that retail and institutional investors might have more exposure to “cryptocurrency risk” than they may be aware of or have anticipated.

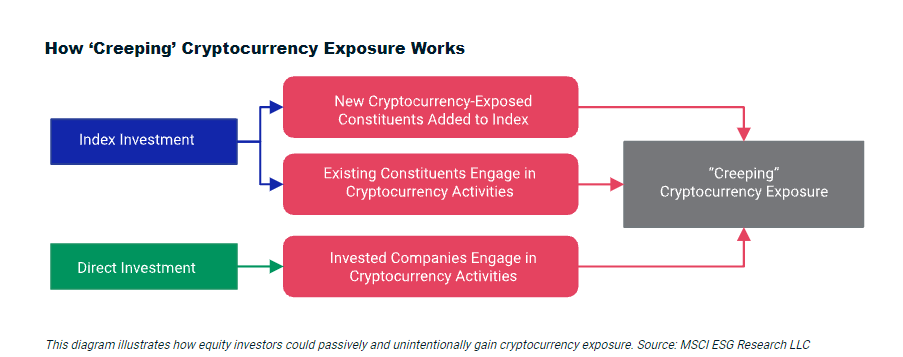

This can be viewed in the context of “creeping” cryptocurrency exposure, which the report explained, impacts both direct and indirect investments. Essentially, this happens by gaining exposure to investments in companies or indices that include Bitcoin exposure.

Another report by Gartner found that 85% of investors considered ESG factors in their investments in 2020.

Therefore, this majority segment might be affected by the potential or existing ESG risks in crypto. The report stated that crypto exposure has environmental risks like carbon footprint and e-waste, social risks around transaction disputes, and Governance risks like cybersecurity and anti-money-laundering policies.

MSCI also stated in a recent podcast that companies with high exposure to crypto represent about $7.1 trillion in market capitalization, or around 6.6% of the market cap through “creeping exposure.”

Which are these companies?

The research pointed out that the companies range from the “pure-play companies like Coinbase and Online Coin Exchange to component manufacturers like Nvidia.” It added,

“There are also companies like Facebook that have no revenue from coins, but are exploring ways to monetize the system.”

Apart from this, companies like MicroStrategy, Tesla, Galaxy Digital, and Square have significant exposure to Bitcoin, among the largest public companies. Additionally, with approval to funds like Volt ETF, there seem to be more “indirect” exposure options.

Meanwhile, in another update, environment advocates are opposing Bitcoin mining in power plants based in New York. On the back of climate crisis and energy outages, New York Policy advocate for Earthjustice called for slashing mining company permit. A decision to renew the company’s permit in question- Greenidge, is pending before the New York State Department of Environmental Conservation (DEC).