How DYDX may redeem itself after this latest update

- DYDX’s latest milestone may offer a ray of hope to investors anticipating more upside.

- Whales have been taking profit but prevailing demand limited the downside.

DeFi platform dYdX [DYDX] concluded June with a noteworthy announcement. The network is celebrating the successful rollout of its new public testnet, marking an important milestone.

Is your portfolio green? Check out the DYDX Profit Calculator

Like most decentralized networks, the public testnet launch marks the start of opportunities for participants. DYDX expects the development to pave the way for more growth opportunities ahead.

The development comes at an opportune time when the crypto market is recovering from 2022 woes. This means DYDX can take advantage of the higher probability of success when DeFi is recovering.

Will the DYDX token benefit from the public testnet launch?

The testnet will help gauge the level of utility, but it may not necessarily have a direct impact on DYDX’s price. However, the testnet launch marks a positive development for the network and might potentially fuel a bullish sentiment.

DYDX’s price chart looks a lot like most of the other top cryptocurrencies. This was because most of them have been moving in tandem with Bitcoin [BTC], hence the correlation. However, a closer look revealed that it bottomed out on 10 June, unlike most other coins which bottomed out in mid-June.

One DYDX token would set you back $1.94 at press time. The price represented a 42% upside from its lowest price point in June. Its MFI was already overbought while its RSI recently pushed above its mid-point. But can DYDX sustain more upside especially considering the latest milestone? Perhaps some of its on-chain metrics may offer some insights.

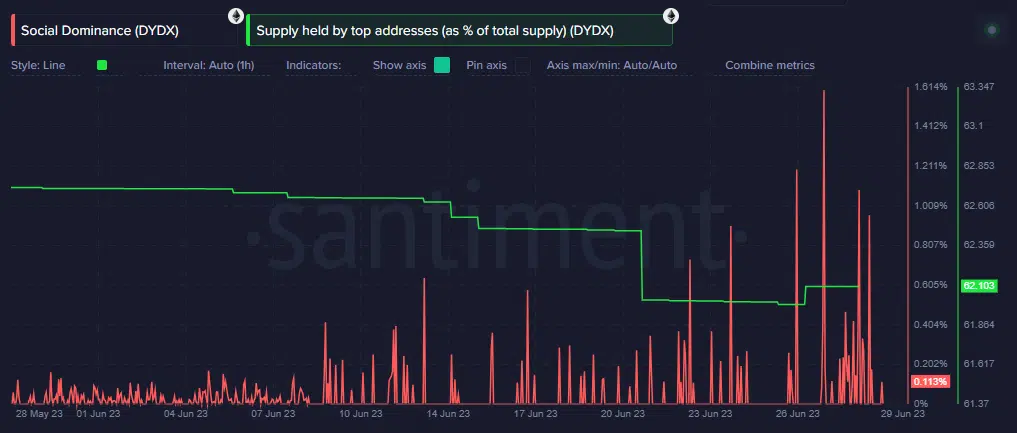

DYDX’s social dominance has been on the rise for the last few days. This means the token was receiving more attention from potential buyers. However, it is also worth noting that the supply held by top addresses fell in the last four weeks.

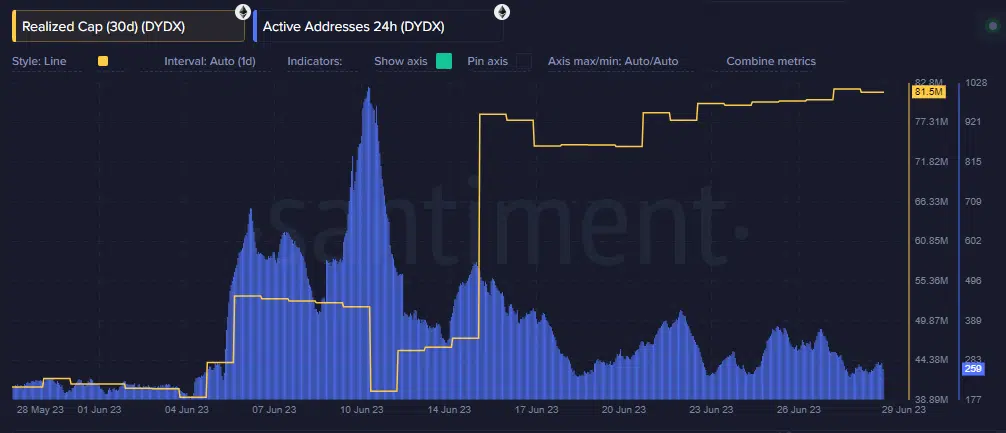

A lower supply held by top addresses confirmed that whales have been taking profits. The 30-day realized profit metric confirmed this considering that it is now at its highest level in the last four weeks.

Realized profits represent the actualized gains after a sale. DYDX traders should also keep in mind that active addresses peaked at the last pivot and have slowed down since then.

Read DYDX’s price prediction for 2023/2024

DYDX is still holding on to the gains it achieved since its June lows. This means it is likely to experience more upside especially if it manages to secure more investor confidence courtesy of the public testnet launch.