How far can Maker prices retrace after losing $1300

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- MKR retreated from $1300 and eased back into the ascending channel.

- Key whale actions had countering effects at press time.

Maker’s [MKR] recent 27% recovery gains are at risk after faltering at $1300. The gains, fronted after rising from $1000 to $1300, were partly clawed back after MKR retraced to $1287 at press time.

Is your portfolio green? Check out the MKR Profit Calculator

Meanwhile, Bitcoin’s [BTC] extended consolidation of recent losses above $26.4k. If sellers crack $26.4k and push BTC to range lows, MKR could follow suit to extend losses. Here are key levels to consider in the short term.

Will the retracement extend?

The price rejection at $1300 forced MKR to breach below the range high of the ascending channel (orange).

At press time, the price reversal eased at the confluence area of the previous H12 bearish order block (OB) of $1235 – $1279 (cyan) and 50-EMA (Exponential Moving Average).

Extra BTC losses could tip MKR to retrace further to the mid-range, near $1230. An extended drop below the 50-EMA will signify a possible extension of losses to the mid-range. So, the mid-range and low-range could be key interest levels for bulls.

However, buyers could see a reprieve if MKR reclaims the range-high,>$1300, especially if BTC reclaims $27k. The recent high near $1360 will be the next target if the bulls manage such a fete.

Meanwhile, the capital inflows and buying pressure eased, as shown by the down sloping CMF and RSI.

Whales action influence

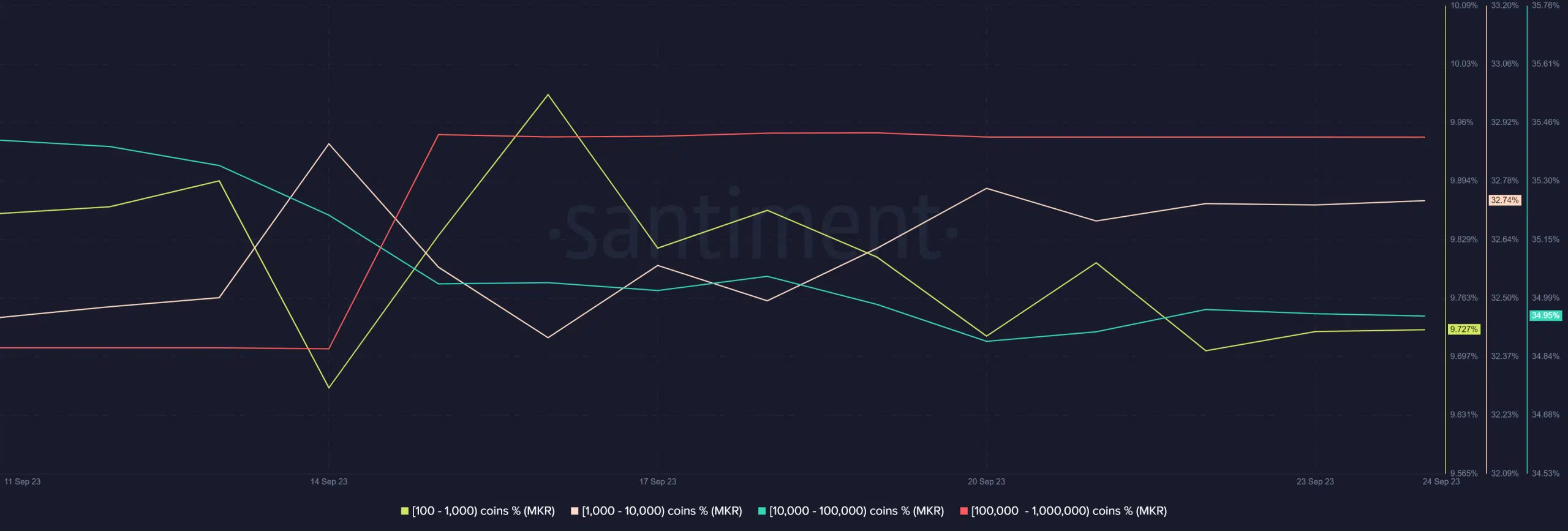

According to Santiment, two whale categories accumulated in the past two days before press time. The 10k – 100k MKR coins category, controlling >34% of supply, and 1k – 10k coins category, commanding >32%, were buying.

How much are 1,10,100 MKRs worth today?

But the category holding 100k – 1 million MKR coins has yet to buy nor offload since 20 September. So, the recent sell pressure was majorly driven by the 10k – 100k coin holder category.

In the derivatives segment, more short positions were wrecked across all timeframes in the past 24 hours before press time. It reinforces a bullish inclination in the Futures market and calls for close tracking of BTC price action for risk mitigation.