How is this central bank policy making Bitcoin more attractive?

Panic has been evident across global markets and global banks for a while now, with central banks around the world escalating efforts to combat this by pledging to buy more bonds. However, such Yield Curve Control is expected to have far-reaching implications on Bitcoin’s price. While it incorporates inflation expectations and credit concerns, at the same time, it controls the market’s ability to express free-market pricing.

Ergo, market participants may look for other avenues to hedge risk and book higher returns, when compared to other asset classes.

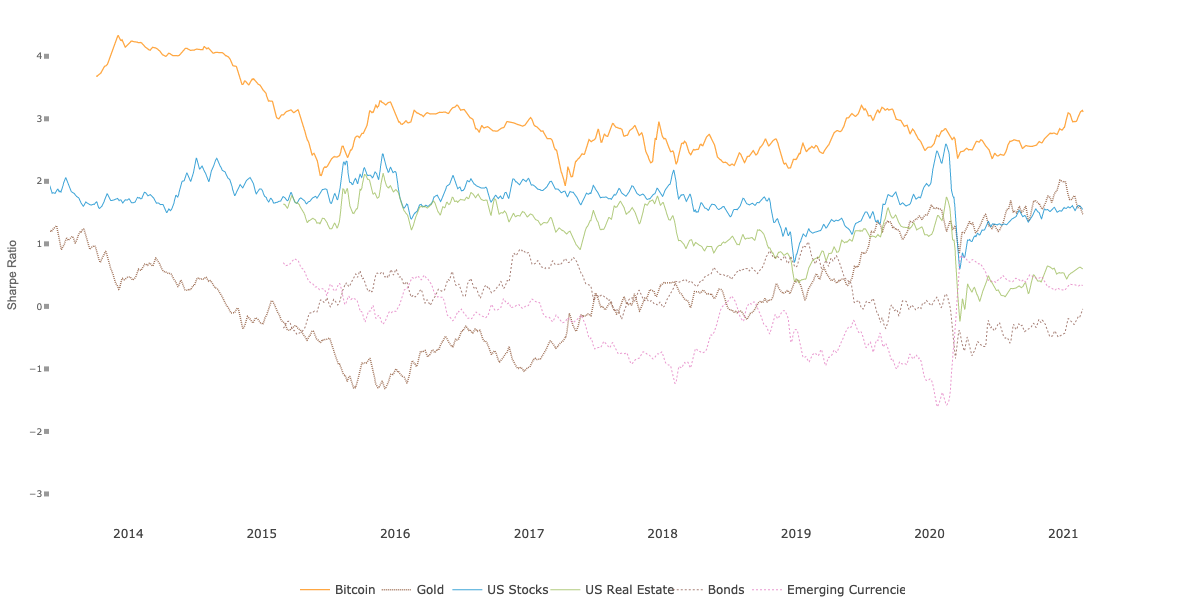

Source: Woobull Charts

Based on Bitcoin’s risk-adjusted returns chart from Willy Woo, BTC’s risk-adjusted returns are higher than that of other assets, including Gold, U.S Stocks, U.S Real Estate, Bonds, and Emerging Currencies. When central banks adopt the policy of controlling borrowing costs, open market participants are free to hedge their views to risk-adjusted borrowing costs.

Bitcoin is a lucrative choice for hedging risk in the current macroeconomic environment for retail traders. The other option with investors is the default insurance market, and that does not fare well in terms of RoI and risk-adjusted returns. Thus, it can be concluded that the investment options for hedging risk are limited for retail traders in the U.S since most options like CDS markets on the sovereign are limited to large institutions.

The only other way to offer higher returns is Bitcoin. By default, Bitcoin becomes a safe haven, a hedge against inflation and protection on sovereign credits. According to popular Bitcoin strategist Greg Foss and his Fulcrum Index, an index that calculates the cumulative value of CDS Insurance on a basket of G-20 Sovereign nations multiplied by their respective funded and unfunded obligations, the fair value of one Bitcoin right now is between $1,10,000 to $1,60,000, at a time when the crypto’s price is below $50,000.

Despite trading well below the estimated fair price based on the Fulcrum Index, there is scope for vertical growth in price due to factors that may trigger demand. YCC is expected to drive Bitcoin’s price higher by further highlighting Bitcoin as the ideal choice for the retail investor looking to hedge risk. Retail traders’ contributions to Bitcoin’s demand have dropped on top exchanges, but it may go through a revival and support Bitcoin’s price rally again.