How is Uniswap coping with the crypto-market’s consolidation

The market today has been bearish, but it’s part of the macro consolidation witnessed by everyone. However, Uniswap has been on a different path, one which was hindered today. The DeFi protocol, after days, had a good thing going for it before the market halted its hike on the charts. As a result, many investors have now been hurt as well.

Uniswap stopped…

From rising.

Most of the market began consolidating just 2-3 days ago. This consolidation came only after marking a strong rally throughout the month. However, for Uniswap. this broader market consolidation was a curse in disguise as it only began climbing on 13 October after consolidating throughout the month.

For some reason, on 13-14 October, UNI appreciated by 12.6%, hitting a monthly high just 2 days later. The last time the market saw UNI touch $27 was back on 16 September. This little incident got investors so excited that it actually rejuvenated the stagnant movement of the altcoin on the chart.

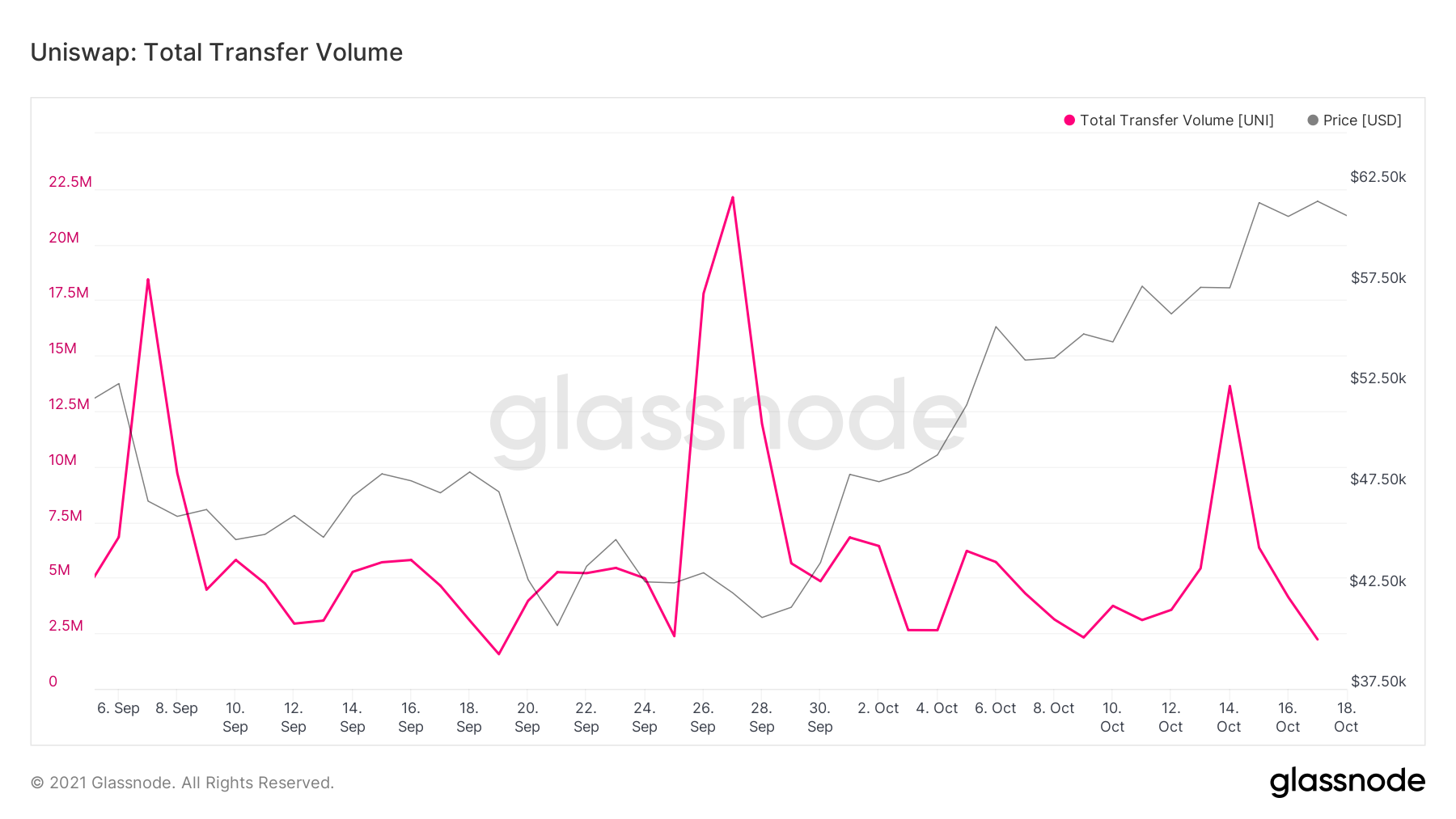

On that very day, Uniswap’s volumes spiked and peaked at $342 million. These volumes came at the hands of both sellers and investors and UNI could be once again seen changing hands as the velocity of the altcoin went up.

Uniswap transfer volumes | Source: Glassnode – AMBCrypto

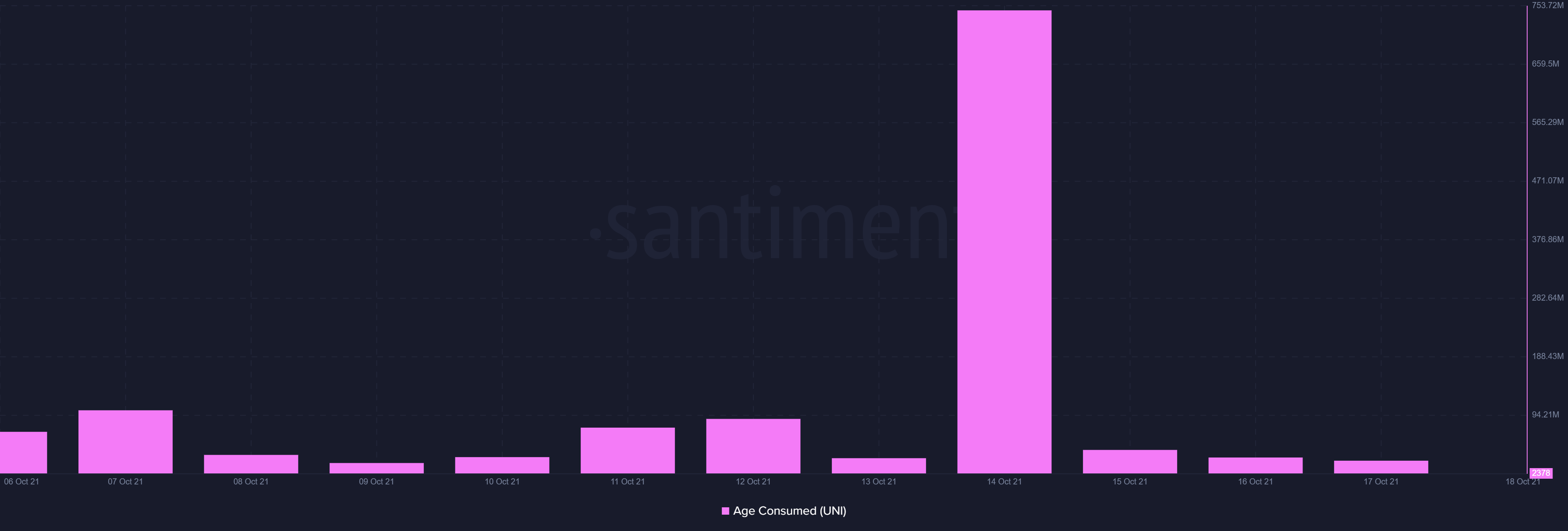

Similarly, even long-term holders took advantage of this opportunity.

These holders didn’t necessarily sell their UNI, but definitely moved their holdings. As a result, the previously idle coins changed addresses, consuming 746 million days in the process.

Uniswap age consumed | Source: Santiment – AMBCrypto

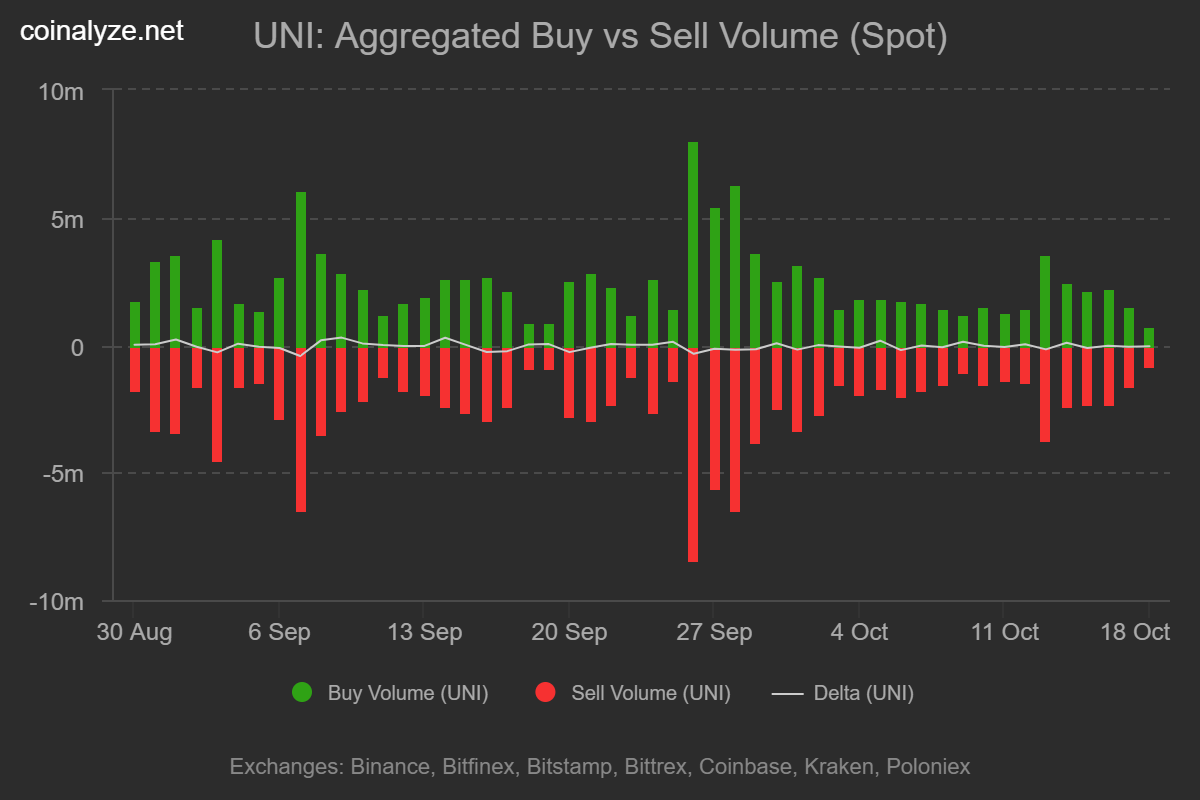

Even so, as much UNI was sold, it was bought back by other investors as well since supply on exchanges remained unchanged and buy/sell orders remained in balance.

Uniswap buy-sell volumes | Source: Coinalyze – AMBCrypto

Unfortunately for UNI’s traders and investors though, all of this was short-lived as the aforementioned soon returned to their older lower levels.

How so? Well, UNI depreciated on the back of Bitcoin‘s rally coming to a halt. In fact, at press time, it was again down by over 5% on the daily charts.