How stablecoins helped Base’s TVL surge to $5.8 billion

- Base’s stablecoin supply crosses $2.3 billion.

- The platform maintains the third-largest TVL market share.

Since incorporating native minting of the stablecoin USDC, Base has witnessed a notable increase in its supply on the platform.

This development has had a positive impact on the stablecoin market cap within the platform’s ecosystem. Recent data indicates that the stablecoin market cap has experienced substantial growth.

The surge in market cap has, in turn, contributed to an increase in the Total Value Locked (TVL) on the platform.

Native USDC on Base cross $2 billion

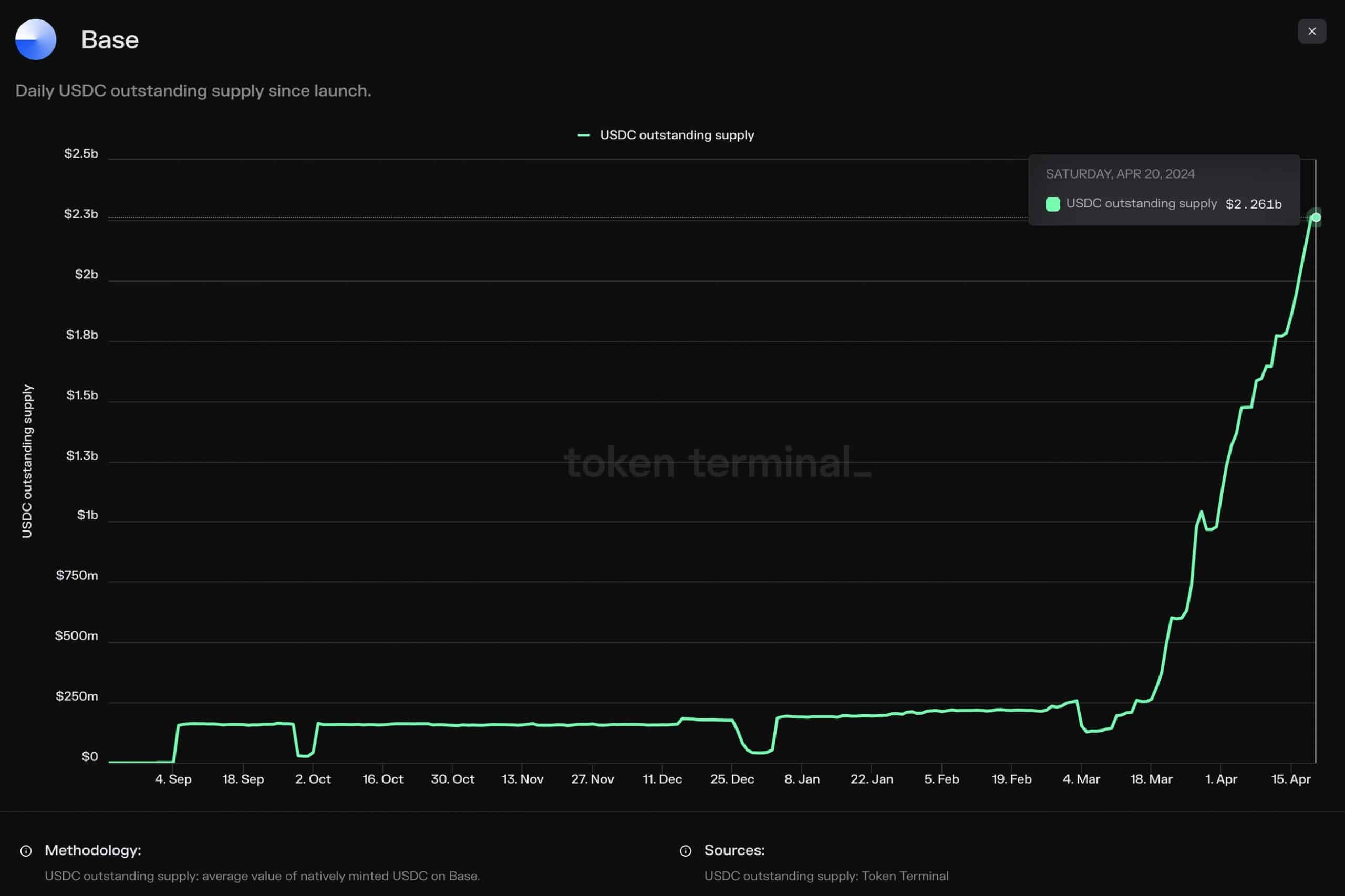

Recent data from Token Terminal highlights a substantial surge in the volume of USDC supply on Base following the platform’s adoption of native stablecoin minting.

The data reveals that the volume of USDC supply was now over $2.2 billion, marking a significant increase. Moreover, the chart indicates that the supply continues to grow steadily.

This notable uptick in supply draws attention to stablecoin market capitalization within the platform’s ecosystem.

How the Base stablecoin market capitalization and TVL has trended

AMBCrypto’s examination of the Base stablecoin market cap reveals a consistent upward trajectory, mirroring the rise in USDC supply.

At the time of this writing, the stablecoin market capitalization has surpassed $2.3 billion, marking a substantial increase over recent weeks.

This growth closely correlates with the surge in USDC supply, suggesting that USDC constitutes a significant portion of the stablecoin market cap on the platform.

Additionally, the Total Value Locked (TVL) showed a notable increase in recent weeks. Growthepie’s chart illustrates that this surge commenced around the same time as the rise in stablecoin market capitalization.

At the time of this writing, the TVL was over $5.8 billion. Both charts depict an upward trend, indicating the potential for further volume expansion in the days ahead.

How Base compares to other L2s

An analysis of Base’s Total Value Locked (TVL) and its comparison with other Layer 2 platforms indicates significant growth, elevating its position in the rankings.

According to data from L2 Beats, Base currently holds the third-largest TVL among Layer 2 platforms. With a TVL exceeding $5.8 billion, Base closely trails Blast, which boasts close to $7 billion in TVL.

The chart further illustrates that Base commands over 14% of the market share with its press time TVL. At the time of this analysis, Arbitrum leads the market with a commanding share of over 43%.