How SushiSwap [SUSHI] managed to pull a Terra before it was cool

Once valued at $119 at its highest, Terra today has three zeroes after the decimal before a number appears. Trading at $0.0001902, LUNA has lost 100% of its value this month.

But not too far away within the DeFi section of the cryptocurrency list sits another token that did leave its investors hopeless, although it did not tank as terribly as LUNA.

SushiSwap’s Titanic

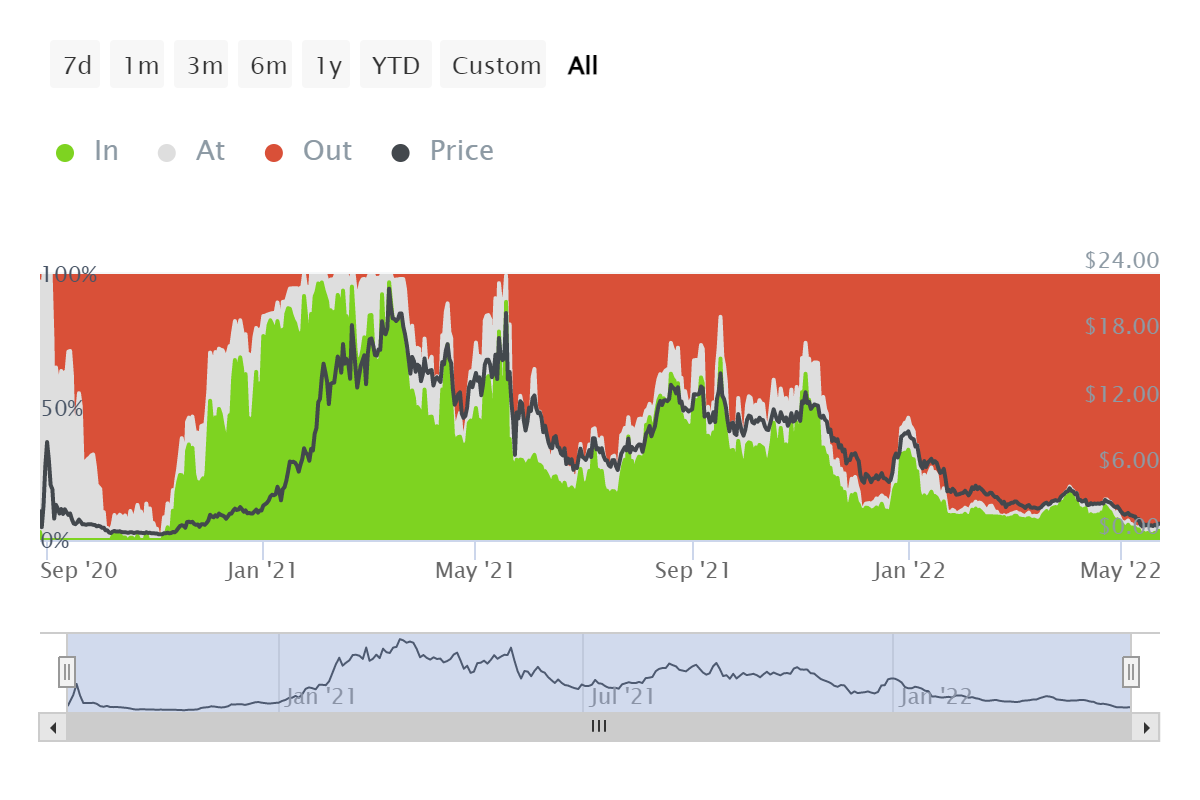

Back in May 2021, the DEX’s token SUSHI peaked at $23.93 before the bears took over, and the altcoin never found another opportunity to turn the tide around.

Thus, within a year, the coin went from its ATH to changing hands at $1.02 earlier this month. Marking a 95.24% decline, SUSHI investors are suffering losses higher than most of the existing coins.

SushiSwap price action | Source: TradingView – AMBCrypto

However so, SUSHI holders have surprisingly held on to some sliver of hope since, as per on-chain data, investors have not sold their holdings nor exited the network yet.

This is despite the fact that 94.66% of them are far from witnessing profits any time soon.

SushiSwap investors | Source: Intotheblock – AMBCrypto

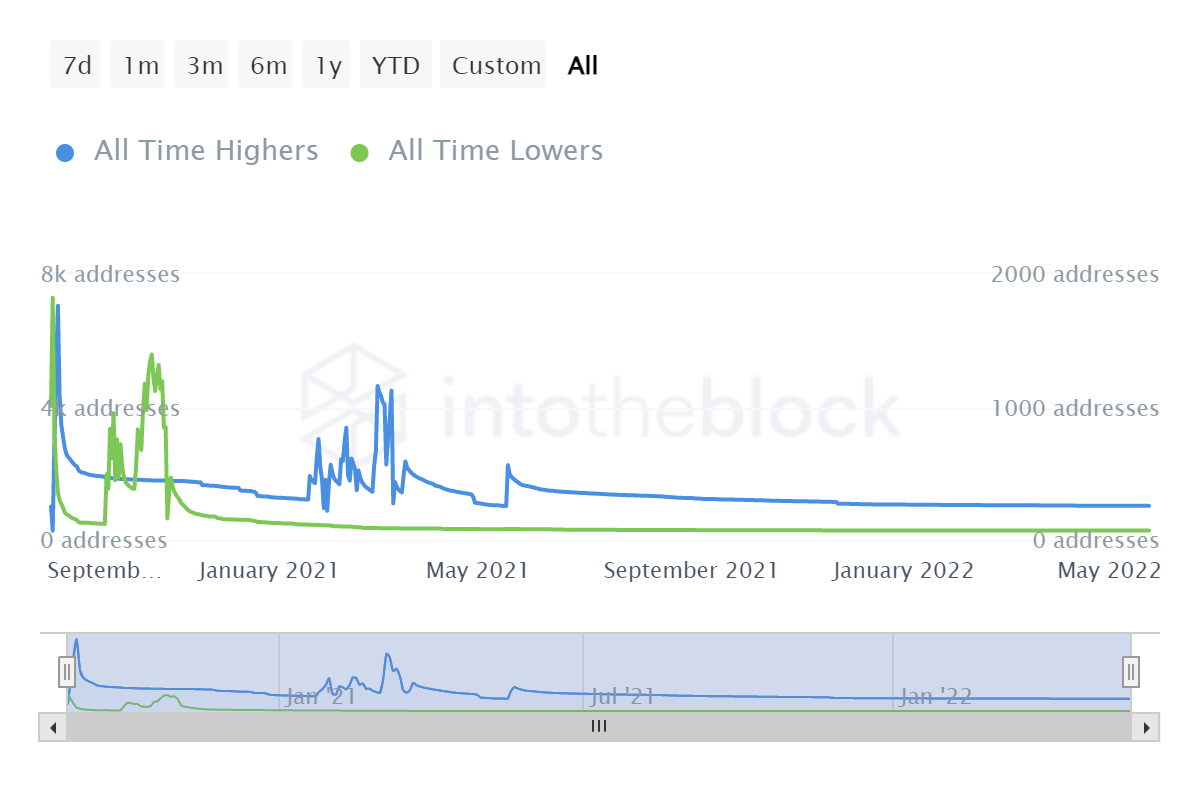

Of these 84k addresses, 1.03k addresses are those poor investors who bought during the hype at the time when SUSHI was trading at its highest. Their holdings are at a solid 95% loss and might never turn into profits again.

SushiSwap holders who bought around ATH prices | Source: Intotheblock – AMBCrypto

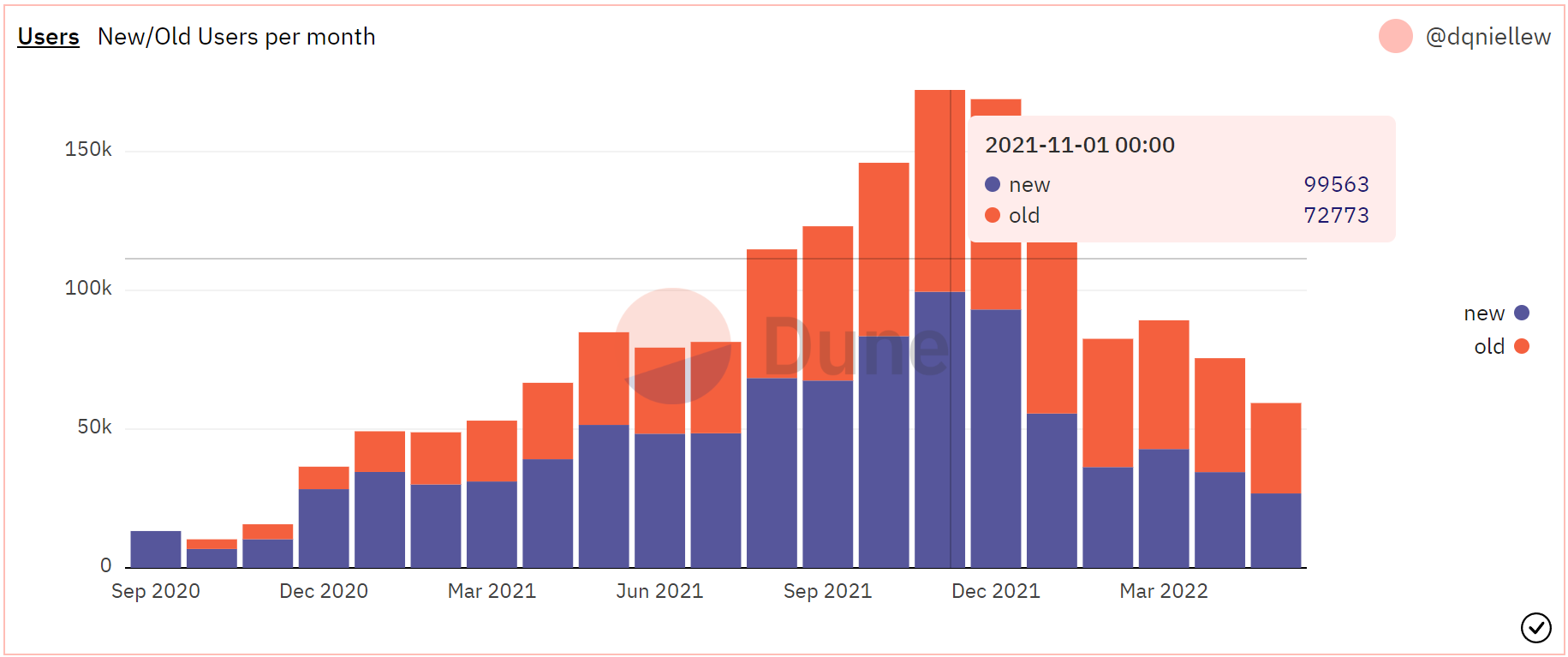

But it’s not just the spot market that’s noting a decline. Being a DEX SushiSwap has been observing a fall in participation as well as usage.

At its best, the Decentralized exchange registered almost 100k new users in a month in November 2021. The figure has since dropped significantly.

This month SushiSwap only marked 26.8k new users, and only 32.5k old users were still active in May 2022. Combined, these users represent about half of the just the new users SushiSwap had back in November.

SushiSwap monthly users | Source: Dune – AMBCrypto

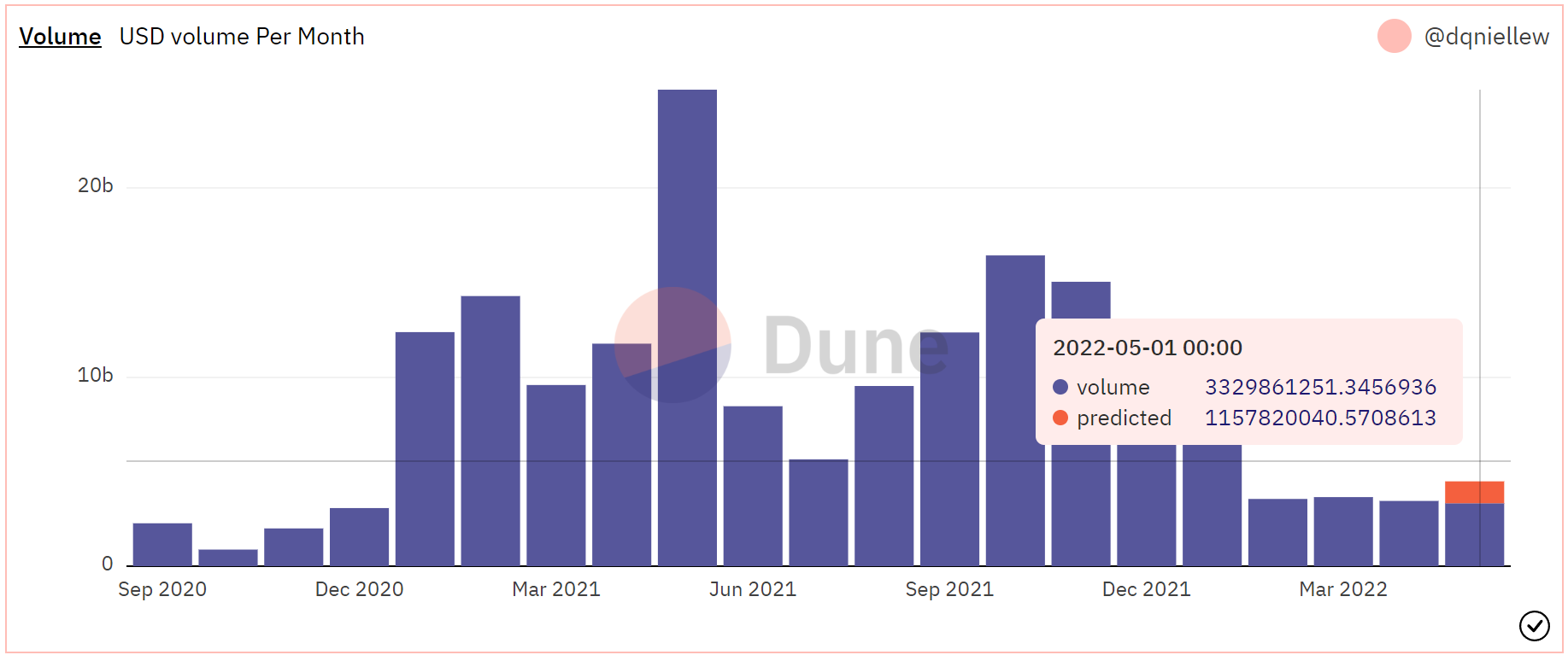

Even so, the volatility observed in the market in the last few weeks certainly triggered a lot of investors to move their holdings around, be it for the better or worse.

Consequently, SushiSwap has already observed assets worth $3.32 billion being transacted on the DEX this month and is expected to draw in another $1.15 billion in volume before the end of the month.

SushiSwap monthly transaction volume | Source: Dune – AMBCrypto

Given the uncertainty surrounding the crypto market, even DEXes can’t be expected to perform well month-on-month, which is the case with SushiSwap.

But when a recovery is triggered, investor activity will increase as well.