How the ‘Great Wall of FUD’ was a buying opportunity for Bitcoin investors

China bans Bitcoin (BTC) — again, again, and again. In fact, this exact piece of news has been floating around forever. Needless to say, there have been a few direct repercussions pre and post the news.

For instance, the larger cryptocurrency market took a hit. Now, how is this ban different from previous bans? Or did it really affect the institutional investors this time around?

Well, the simple answer is ‘NO’ since investors have instead been buying the dip on the back of China’s latest FUD. Simply put, investors see China’s ban as a buying opportunity:

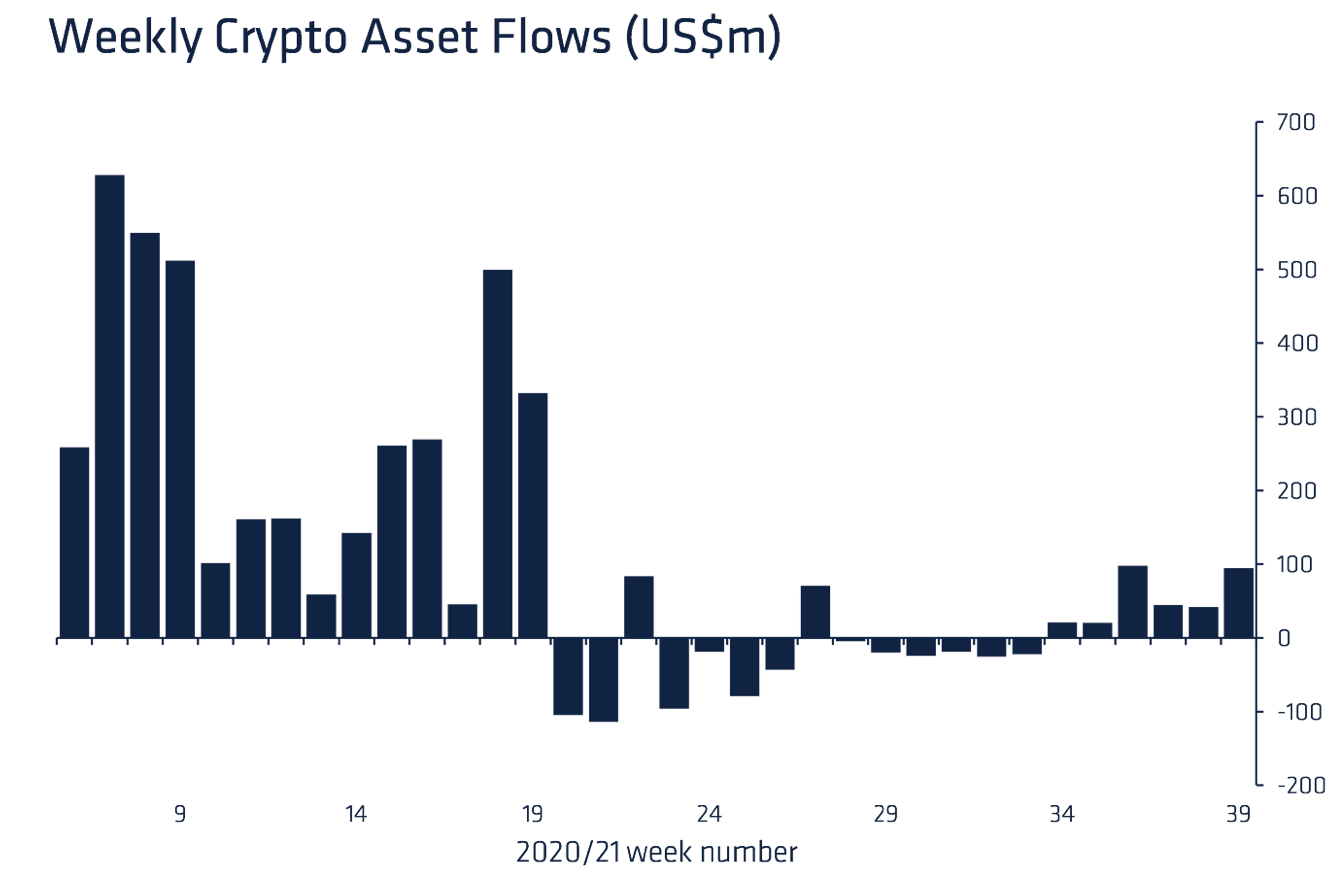

Cryptocurrency investment products saw inflows of $95M last week, with total inflows of $320M over the last six weeks, according to digital assets fund manager CoinShares.

This marked an increase of 126% in weekly inflows.

Source: CoinShares

What do the aforementioned stats mean? According to CoinShares’ James Butterfill,

“The continued inflows suggest the recent headwinds for digital assets, such as the widened China ban, were seen as buying opportunities for investors.”

Individual cryptos recorded positive stats as well.

Bitcoin led with inflows of $50M, with the figures among the largest of the market’s cryptocurrency investments. This certainly helped the crypto recover by 234% week-over-week inflows, when compared to the previous two quarters.

The timing here is interesting, especially since as covered previously, BTC has seen outflows over 13 of the last 17 weeks.

Source: CoinShares

Ethereum, the market’s biggest altcoin, saw inflows totaling $29M last week.

“Sentiment has remained relatively buoyant for Ethereum as the amount staked to Eth2.0 progresses. By our estimates, 6.6% of Ethereum is staked to Eth2.0, with growth in staking essential for investor sentiment, as investors see it as a potential environmentally alternative to other proof-of-stake digital assets.”

Additionally, other altcoins like Solana, Cardano, and Polkadot also saw small inflows of $3.9M, $2.6M, and $2.4M, respectively. Solana and Polkadot continue to see “outsized inflows” representing 4.5% and 3.2% of assets under management (AUM), Butterfill wrote.

Zooming out a bit, news about the harshest China cryptocurrency crackdown initially crashed the market. However, Bitcoin managed to recover over the weekend. Just as it did before.

Fundstrat’s Will McEvoy too shared a similar narrative. One of his tweets read,

China #Bitcoin "bans" have been great buying opportunities@fundstrat @fs_insight pic.twitter.com/wGvr6FDFv0

— Will McEvoy (@will__mcevoy) September 24, 2021