IMF calls for implementing ‘global standards for crypto-assets’

As the popularity and the reach of cryptocurrencies grow worldwide, the International Monetary Fund (IMF) has stepped in to ease the situation. It has come up with some policies that would help authorities in emerging markets and developing economies ensure financial stability.

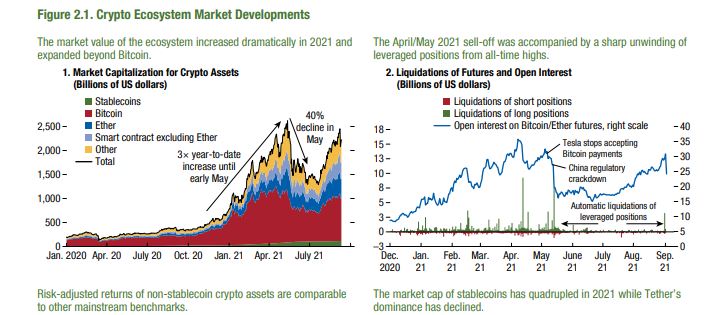

A document shared by the IMF – ‘The Crypto Ecosystem and Financial Stability Challenges’ – noted the efficiency of this technology to perform cross-border payments very quickly and at low costs. It also looked at the dramatic rise in the value of crypto-markets, even though the price of most digital assets has been stumbling since May 2021.

As per the organization, the reasons mentioned for this drastic hike in interest were the potential for high returns, low transaction costs, speed, and anti-money laundering standards.

Meanwhile, the rise in market capitalization was attributed to the increasing interest of investors in stablecoins, smart contracts, and decentralized finance (DeFi).

Source: IMF

IMF’s crypto-policy recommendations

Amid this cycle of price boom and crash, the IMF advised policymakers around the world to “balance enabling financial innovation and reinforcing competition.” It outlined policy recommendations related to three main areas –

- Regulation, supervision, and monitoring of the crypto ecosystem

- Stablecoin specific risks

- Managing the macro-financial risks in emerging markets and developing economies

Apart from the implementation of global standards for crypto-assets, regulators need to control the risks of these assets, especially “in areas of systematic importance.” While regulators must address data gaps and monitor the crypto-ecosystem for better policy decisions, communication between national regulators is key, the document added.

According to the IMF, to counter financial stability challenges,

“Policymakers should implement global standards for crypto-assets and enhance their ability to monitor the crypto ecosystem by addressing data gaps. Emerging markets faced with cryptoization risks should strengthen macroeconomic policies and consider the benefits of issuing central bank digital currencies.”

Meanwhile, CBDC issuance may help nations. Alas, regulators have also been advised to proportionate regulation. De-dollarization policies were also recommended to help governments tackle micro-financial risks.

The IMF remains optimistic about the potential crypto has to change the financial infrastructure. Thus, it has offered policies that could protect nations and at the same time, not stifle crypto.